Hutchison China MediTech IPO: Consider A Modest Allocation

Hutchison China MediTech Limited (Pending:HCM) expects to raise $86 million in its upcoming IPO. Based in Hong Kong, Hutchison China MediTech is a biopharmaceutical that focuses on the discovery, development and commercialization of therapies for immunological and oncology diseases.

We previewed HCM last week on our IPO Insights platform.

HCM will offer 6.1 million shares at an expected price of $16.33.

HCM filed for the IPO on October 16, 2015.

Lead Underwriters: BofA Merrill Lynch and Deutsche Bank Securities

Underwriters: Cannacord Genuity, CSLA Limited, Panmure Gordon Limited, and Stifel Nicolaus & Co.

Business Summary: Biopharmaceutical Developing Treatments for Cancer and Immunological Diseases

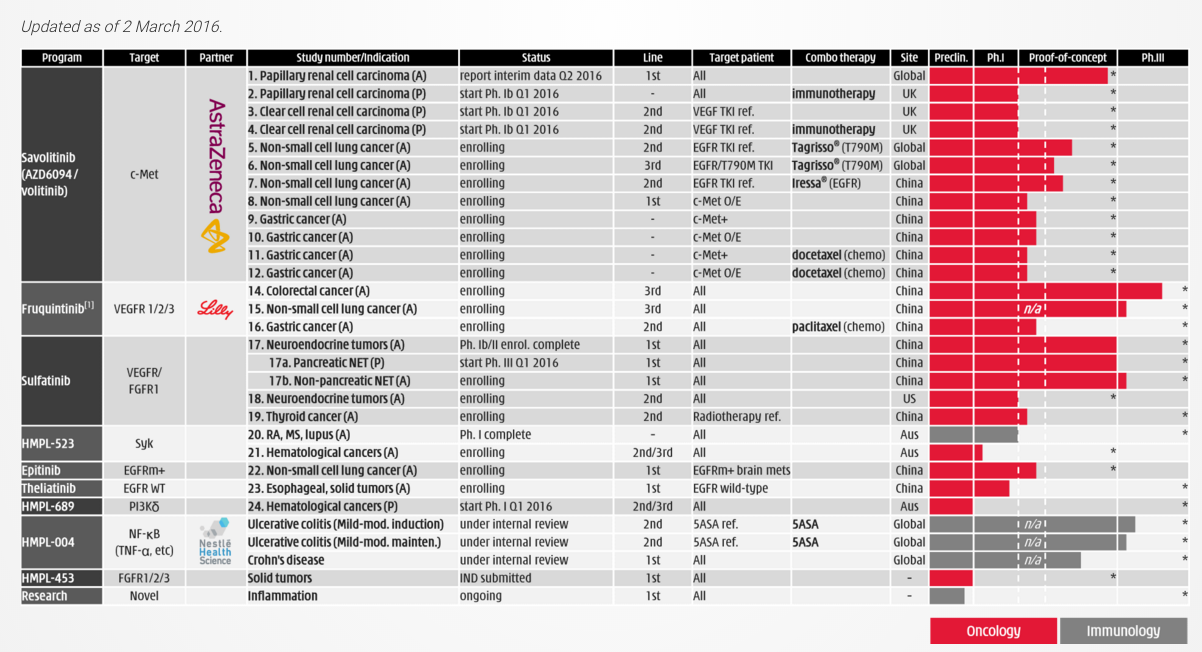

(Click on image to enlarge)

(Source)

Hutchison China MediTech Limited engages in the research, development, manufacture, and commercialization of pharmaceuticals and other health-related consumer products mainly in the People's Republic of China. It operates through three segments: Drug Research and Development, China Healthcare, and Consumer Products.

Hutchison China MediTech manufactures, distributes, and sells over-the-counter, prescription, and health supplements products under the Shang Yao and Bai Yun Shan brands, and it provides drug research and development services. In addition, the company offers traditional Chinese medicine products in the cold and flu and cardiovascular areas.

Hutchison China MediTech has several drug candidates in development (see above), including HMPL-004 that is in Phase III clinical trials for ulcerative colitis and Crohn's disease; Fruquintinib, which is in Phase III clinical trial for the treatment of colorectal, and gastric cancers; and Sulfatinib, a Phase 1b clinical trial product for neuroendocrine tumors. The company also has Theliatinib, which is in Phase I clinical trial product for the treatment of solid tumors; AZD6094 that is in Phase 1b clinical trial for treating non-small cell lung and gastric cancer; HMPL-523 and HMPL-689, which are preclinical stage products for the treatment of hematological cancers; and HMPL-453 that is in preclinical stage for the treatment of solid tumors.

Its consumer products division manufactures and sells natural and organic food items, beverages, baby and beauty care products.

Hutchison China MediTech Limited has strategic collaborations with multinational pharmaceutical and healthcare companies, including Nestle Health Science SA, Janssen Pharmaceuticals, Eli Lilly (NYSE:LLY), and AstraZeneca (NYSE:AZN). Hutchison China MediTech was founded in 2000, has approximately 475 employees and operates as a subsidiary of Hutchison Healthcare Holdings Limited.

The company intends to use the proceeds of this IPO for further funding of clinical trials.

Executive Management Overview

CEO and Executive Director Christian Hogg has served the company since 2000. Prior to joining Hutchison China MediTech, Mr. Hogg held senior positions at Proctor & Gamble. He received a Bachelor's degree in Civil Engineering from the University of Edinburgh and an MBA from the University of Tennessee.

Chief Financial Officer and Executive Director Johnny Cheng has served in his position since 2008. His previous experience includes positions at Bristol Myers Squibb, Price Waterhouse, KPMG, and Nestle China. Mr. Cheng received a Bachelor of Economics, Accounting Major from the University of Adelaide and is a member of the Institute of Chartered Accountants in Australia.

Potential Competition: Eli Lilly, AstraZeneca and Genetech

The biotechnology and pharmaceutical industry is highly competitive. Hutchison China MediTech faces competition from a variety of enterprise level companies including Genetech, maker of Avastin, Eli Lilly, which makes Cyramza, and AstraZeneca, maker of Iressa, among others.

Financial Highlights: Top, Bottom Line Growth

Hutchison China MediTech provided the following figures from its financial documents for the year ended December 31:

|

2015 |

2014 |

|

|

Total Revenue |

$178,203,000 |

$87,329,000 |

|

Net Income |

$10,427,000 |

($4,086,000) |

As of Dec. 31, 2015:

|

Assets |

$229,754,000 |

|

Total Liabilities |

$127,477,000 |

|

Stockholders' Equity |

$83,356,000 |

Conclusion: Consider A Modest Allocation

Healthcare deals EDIT and BGNE performed well in February (albeit supported by heavy insider buying). We like HCM's focus on high profile treatments and impressive partnerships - although we hesitate about Chinese exposure. Additional risks include significant indebtedness and need for significant additional funding post-IPO.

Stay tuned as this deal develops.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.