Human Nature Is Prone To Self-Harm In Financial Bubbles

Twenty-four years ago, I was studying to become a financial analyst while working at a stock brokerage. Equity markets and animal spirits were soaring; the Nasdaq doubled in 1999 alone. Nortel was Canada’s pride and joy, accounting for over a third of Canada’s TSX stock index. In September 2000, Nortel was trading at C$124 a share; two years later, it was trading at 47 cents. And that was just one of many such examples.

In the stock brokerage, we were not taught how to value assets; investment firm training tends to focus on creating and selling investment products, not worrying about their risk-reward prospects. As a financial analyst, I learned about discounted cash flows and how to calculate a company’s present value and compare that with the market price of its shares and debt.

It was then that I noticed a problem. Almost all the most historically informative valuation calculations produced fundamental value numbers miles below the market prices in 2000, and they made no mathematical sense.

When I pointed this out to those around me, including the certified financial analysts (CFAs and MBAs) who worked on the ‘advisory’ team at the head office, they told me that those measurements were old school and irrelevant in a ‘new economy’ that was being transformed by the internet and technology. It was a forceful argument when confidently delivered by those decades older than me, but I wasn’t convinced. Why study to be a financial analyst if fundamental measurements no longer mattered?

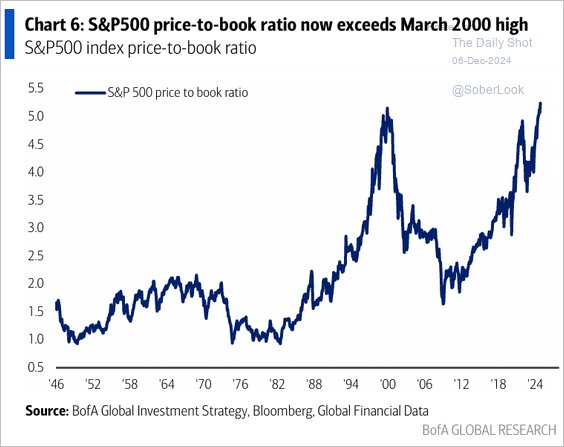

Case in point: a company’s book value is theoretically the amount of money it would pay its shareholders if it were liquidated and paid off all its liabilities. In the spring of 2000, the average S&P 500 company traded 5 times its book value (shown below since 1946, courtesy of The Daily Shot).

The long-standing historical rule of thumb was that a price of 1x book value was reasonable, and a price to book of less than one has traditionally signalled a bargain. Five times? That was just unprecedented. Nowhere in the CFA textbooks did it even contemplate such extreme market pricing.

Price to book was just one metric—price to sales, price to earnings, market cap to Gross Domestic Product, dividend yield, equity risk premium, and on and on—and they were all at illogical levels. Few people knew, and even fewer cared.

It turns out it wasn’t a permanently high new world. As the masses went all in and then some, the bubble finally burst into a three-year drubbing that saw tech stocks tumble 80% and ‘conservative’ dividend-paying shares halve. It then took many years of holding and hoping to grow back losses.

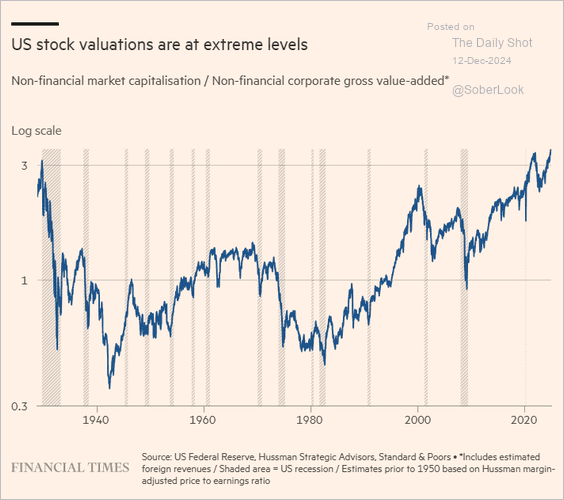

Today, we are back at 2000-era valuation levels for the third time in the last century (market cap to corporate gross value-added multiple shown below since 1929). Once more, conventional wisdom is asserting that valuations no longer matter. I recall a similar sentiment in 2007, and I remain less convinced today than ever.

As John Hussman points out in the Financial Times this week, in the last century, valuations have seemed least reliable precisely when they were most extreme and prescient, see Forgotten history reveals new eras but same bubbles:

The only way valuations could reach the heights of 1929, 2000 and today was for the market to advance triumphantly through every lesser extreme. Yet peaks such as today’s speak volumes about future returns. A security is nothing but a claim on a future set of cash flows that will be delivered to investors over time.

Regardless of short-term outcomes, the higher the price investors pay for a given set of future cash flows, the lower the long-term return they can expect. A reliable valuation measure is simply shorthand for such an analysis.

Similar to its predecessors, this speculative episode has been accompanied by exuberant sentiment about innovationled growth, perpetual expansion in profits and a tendency among investors to root expectations about economic and investment prospects in optimism.

As The Business Week observed in 1929: “This illusion is summed up in the phrase ‘the new era’. The phrase itself is not new. Every period of speculation rediscovers it.”

The latest new era is only part of an endless cycle. Extremes such as the present have been extraordinarily rare in history, and provide investors with the opportunity to examine their exposure and tolerance for risk. At such moments, it may be helpful to exchange extraordinary optimism for a calculator.

Human nature is prone to self-harm in financial bubbles. In 2000, the baby boomers were 35 to 54 years old and primarily still working. Today, they have the highest stock market exposure ever and are aged 60 to 78. Financial recovery time will not be their friend. Fear of capital losses should trump fear of missing out on fleeting gains.

More By This Author:

Market Snakes Follow LaddersCash Crunch Set To Intensify In 2025

Caught Between Rising Unemployment And A High Cost Of Living