How WHAS Explains Netflix’s Dominance (But The Stock Is Still Overpriced)

It was the year 2010 and I had just moved to Atlanta. After shopping for furniture at IKEA, I checked the mail to find a red Netflix (NASDAQ:NFLX) envelope. It was a movie that I had put on my Netflix queue, but was not in the mood for that evening. I decided to check out the Netflix website to see what I could watch on streaming. Unfortunately, the selection was very limited.

Video Length: 00:07:41

I decided on Arrested Development. I was a "cord-cutter" and I had never seen the show before. For the prior 8 years, I watched virtually no television. This was partly because I wasn't willing to pay for cable and partly because I never liked the idea of "scheduling a time" to watch a TV show.

In 2010, the vast majority of people subscribed to Netflix for the DVD plans. I was one of the few who subscribed almost solely for streaming. I saw the DVDs as an added benefit, but really just wanted to be able to watch something instantly when I felt like it. If only the selection would grow, I thought, this would be perfect.

That day was 5 years ago, but it feels like an eternity in Netflix time. The DVD rental company with a small streaming side business is now a major television and movie studio that successfully competes with some of the biggest names in the entertainment industry. It has produced several hits including House of Cards and Orange is the New Black. It has revived older franchises such as Arrested Development and Trailer Park Boys. It has gone from 15 million subscribers in Q2 2010 to over 65 million subscribers today.

I continue to be a loyal Netflix customer. The content library has grown over the years. Most impressively, however, has been Netflix's original programming. I've been a particularly big fan some of its recent comedic exclusives such as Bojack Horseman and The Unbreakable Kimmy Schmidt. If there's one show that exemplifies Netflix's sudden dominance, however, it's Wet Hot American Summer.

Wet Hot American Summer: First Day of Camp

To describe Wet Hot American Summer (we'll call it WHAS from now on) to someone unfamiliar with it is a difficult task. On the surface, the show is a comedy about a youth summer camp in 1981 that takes place in rural Maine. It is both a parody of summer camp movies, as well as a parody of other 80's films that follow a particular formula where a scrappy group of protagonists overcome adversity and succeed against all odds.

It's a relatively obscure film that was released in 2001 and was considered a box office bomb. It generated less than $300,000 in revenues in spite of sporting a few well known stars such as Frasier's David Hyde Pierce, Janeane Garofalo, Paul Rudd, and Molly Shannon. It's also now known as being a launching vehicle for several actors more well known in 2015 than 2001, such as Amy Poehler, Elizabeth Banks, Bradley Cooper, and even voice actor, H. Jon Benjamin (who you may know as Archer, Bob from Bob's Burgers, and / or the guy from those Coke Zero commercials.)

WHAS is a film that drew rather polarizing reactions. It has a 32% score on Rotten Tomatoes, including a 1-star review by Roger Ebert. Most people will either love it or hate it. It's possible that you may find yourself confused by it at first, only to find it growing on you over time. In which case, you'll eventually join the group that loves it. By its very nature, however, it was a movie designed to appeal to a small niche audience.

How do you describe the humor of WHAS to someone who doesn't get it? I'm not sure there is an easy way. If you've ever had a group of close friends and you've spent considerable time around each other, you eventually develop your own group culture. This culture may include things like inside jokes that make sense to the group, but not to anyone else.

The nature of many "inside jokes" is that they start from an off-hand comment that is moderately amusing at first. Through the power of repetition, the joke becomes funnier over time. It's almost the opposite of what we think of as "conventional comedy," which typically includes jokes that immediately smack us right in the face, but the impact wears off over time. WHAS feels a bit like an inside joke.

WHAS is also an absurdist comedy. It features comically improbable events that are then explained by even more comically improbable events. In fact, part of what makes WHAS so interesting is that it's not like anything else out there. It's a strange brand of comedy that also gets better with repeated viewings.

So how did an obscure "cult classic" with a limited potential audience end up getting a TV deal to produce a prequel? That's where things get interesting and can only be explained by Netflix's biggest competitive advantage: data.

Netflix: Domination by Data

Netflix has many advantages that allow it to achieve success where other TV studios cannot. Before we jump back into WHAS, let's examine two other recent launches: Bojack Horseman and The Unbreakable Kimmy Schmidt.

Bojack Horseman is cartoon comedy about a horse that starred in an early 1990s Full House-like sitcom called Horsin' Around. His career has fallen apart since then and he's trying to revive his career John- Travolta-after-Pulp-Fiction style with a role in a biopic of Secretariat. It stars Will Arnett of Arrested Development fame as the title character. It may be one of the most innovative comedies of the past 20 years. It's been a success, but it's difficult to imagine any major TV studio taking a chance on this type of show.

Meanwhile, the story of how Netflix obtained another recent comedy, The Unbreakable Kimmy Schmidt, is a sordid tale of the problems of network TV economics. The show, written and produced by Tina Fey of 30 Rock and Saturday Night Live fame, was initially created for NBC (NASDAQ:CMCSA). NBC execs decided to drop the show based on concerns about the time of year it would be released and that it had no complementary shows to launch with. Imagine if NBC had dropped Seinfeld or Friends for a similar reason.

Netflix is able to take what other networks toss into the trash heap and turn it into gold. There are countless examples of this, but what makes Wet Hot American Summer unique here is that it's not even the type of project that the most daring of TV execs would have ever considered. Why would anyone think that a box office flop from 14 years ago, that still remains relatively obscure, could be a money maker?

Only Netflix could dream of such an idea. And the reason that Netflix dreamed that idea likely has a lot to do with the data it is able to gather on millions of viewers that no other TV studio out there has access to. NBC, ABC, and FOX have to rely on Nielsen data, surveys, and advertiser perceptions. Even HBO, which has its own streaming service, really only has limited data. They might know that you really like Game of Thrones or enjoy watching old episodes of Deadwood, but they know very little about your viewing habits of old sitcoms and movies from the 00's.

Wet Hot American Summer: First Day of Camp is the ultimate example of an entertainment product that couldn't exist without Netflix and its massive data advantage. It's unlikely that without that data, anyone would've ever truly understood that the film's small but intensely dedicated fans could fuel an entire TV series.

This certainly isn't the only example of NFLX using data to uncover little known truths about the consumer entertainment market. I've already alluded to the two most classic examples with the revival of Arrested Development and Trailer Park Boys. Arrested Development was a critically-acclaimed comedy from the 00's that just wasn't well designed for the staggered out scheduling of network TV. It was cancelled in 2006 after only three seasons, but saw a massive surge in popularity after Netflix bought the rights to stream it.

Trailer Park Boys started out as a low budget Canadian show about a group of characters at a Nova Scotian trailer park. It was one of the first TV shows to utilize a mockumentary style (later championed by The Office). Netflix picked up on its immense popularity through streaming and paid to have two new seasons of the show made, and also picked up two movies.

Whether you like WHAS like me or you hate it like Roger Ebert, it's difficult to deny that it showcases why Netflix will only continue to grow as a TV and film studio. There's no other entertainment company in the world that can use data like Netflix.

Netflix as an Investment

As this is an investment site and I'm a value investor, I would be remiss if I did not explain whether Netflix is a good investment or not. From a business strategy perspective, I view NFLX as one of the best businesses in the world. From a quality of entertainment perspective, it's only true competitors are AMC (NYSE:AMC) and HBO (NYSE:TWC). In a sense, it is even world's ahead of even those two companies.

Data is valuable. There are very few companies on Earth that can use data as Netflix does. It has access to data that HBO, AMC, NBC, ABC , FOX and every other television content creator can only dream of! Moreover, Netflix does not squander the data; it has an ability to know exactly what to produce. That's what makes Netflix an ultra-premium company with a defensible moat. Indeed, I suspect that in the next 5 years, NFLX will have a moat as wide as Disney (NYSE:DIS).

As a company, there are few concerns that NFLX will continue to perform impressively and grow rapidly. As an investment, it's not so clear.

There are two major issues:

(1) Weak free cash flow growth,

(2) Extremely high valuation

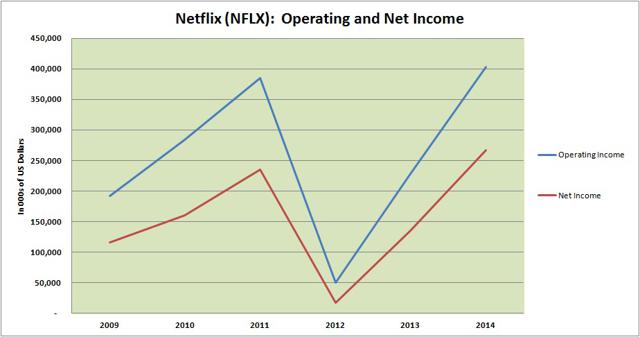

Before jumping into the free cash flow issue, let's look at the positive. Netflix has improved its Income Statement significantly in the past few years, with Operating Income and Net Income both increasing at a rapid rate. Net Income had fallen to $17 million in FY 2012, but in FY 2014, it was back up to $267 million.

Click on picture to enlarge

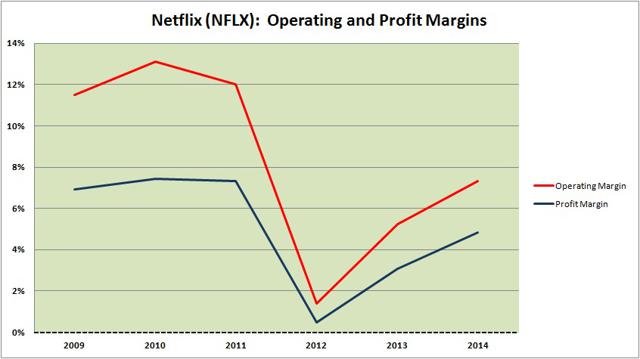

Margins have improved as well. NFLX's operating margin improved from 1.4% in 2012 to 7.3% in 2014. That's still well below the levels they saw in 2010 and 2011, when operating margin was 13.1% and 12.0% respectively. Nevertheless, its clear NFLX is seeing improvement.

Click on picture to enlarge

Indeed, revenue growth has been just as critical of a factor behind NFLX's improving Net Income as the margins. Moreover, it's likely that NFLX's margins will continue to expand as they grow subscriptions and are able to churn out more of their own exclusive content.

Based on this info, NFLX looks like an excellent company, albeit one selling at a pretty high multiple. At the time I authored this article, NFLX's share price was $122 nd its split-adjusted EPS for FY 2014 was a mere 63 cents per share. That means it's trailing P/E multiple based on 2014 results was about 194. Even with rapid growth in revenues and improvement on the margin front, that seems patently absurd! The stock price has fallen a bit over the past few weeks, but it still seems to sell at a rather elevated valuation.

Even in the best of circumstances, NFLX's 100+ P/E ratio would be cause for alarm for NFLX investors. However, I'd argue that it's even worse than it seems. That's because the free cash flow picture is nowhere near as pretty as the income picture.

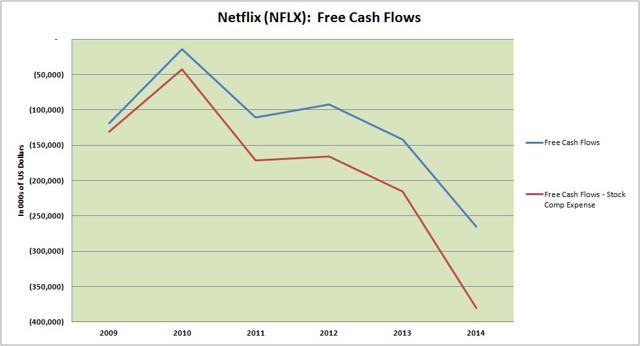

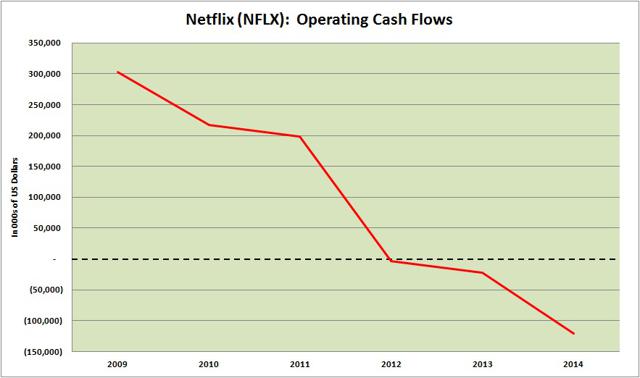

From a free cash flow perspective, NFLX has been bleeding boat loads of cash for years. In 2010, the company was near break-even on free cash flows, only losing $14 million. By 2014, it was generating negative free cash flows of $265 million.

Click on picture to enlarge

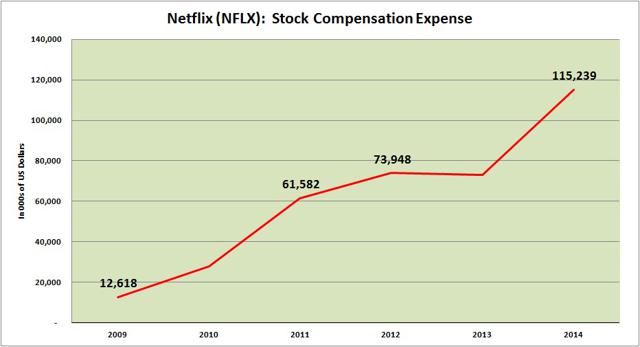

It's worth noting that these figures only get worse if we factor in stock compensation expense into cash flows. Stock comp has increased from $12.6 million in 2009 to $115 million in 2014. This is an unhealthy trend we're seeing at a lot of Silicon Valley based tech companies right now.

Click on picture to enlarge

To further drive home this point, we should note that it's not merely free cash flows that are suffering. Operating cash flows are nose-diving, as well, once we exclude working capital changes from the equation. Operating cash flows were a healthy $302 million in 2009 and have fallen every year since then. In 2014, operating cash flows were negative $121 million.

Click on picture to enlarge

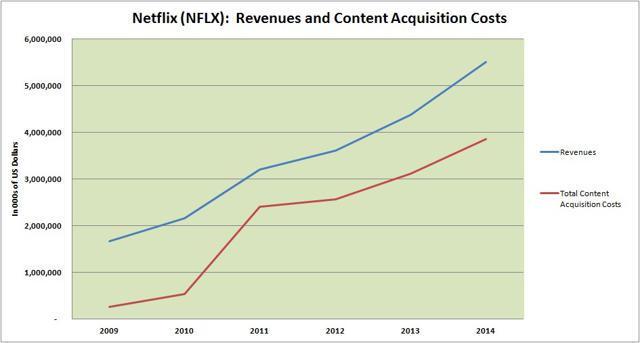

Both the plunge in free cash flows and operating cash flows is driven primarily by content acquisition costs. Content acquisition has increased from $530 million in 2010 to $3.85 billion in 2014. The more NFLX increases its revenues, the more it increases content acquisition costs.

Click on picture to enlarge

From a purely business perspective, this isn't necessarily a bad thing. NFLX relies on economies of scale to make its streaming business model work. By increasing its content, it further solidifies its advantage over competitors and increases the size of its moat.

From a financial perspective, however, it has its drawbacks. The strategy makes business sense, but it also exposes the reason why NFLX's stock is severely overvalued. NFLX has to continue acquiring content to stay competitive and that keeps margins in check. Of course, this is also the reason why NFLX has gone into the business of creating its own content, as management has been smart enough to realize that the monopoly over created content is extraordinarily valuable.

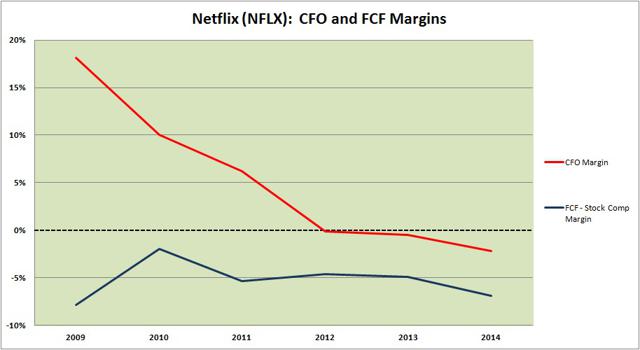

Before moving on, let's take a quick look at cash flow margins. Here we can see that NFLX is taking cash loss of about 7% revenues right now.

Click on picture to enlarge

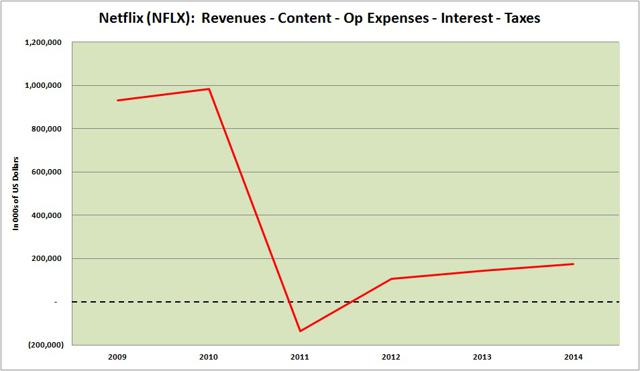

Finally, I have one more chart to share. This is a bit of an odd one. There is a major gap between NFLX's cash flows and NFLX's income. That gap is mostly explained by content acquisition. I wanted to create one custom measure that may or may not have any value. This chart is a bit complex by I'll break it down. It examines revenues and then subtracts all operating expenses, taxes, and interest. Then, it also subtracts the content acquisition costs. It's a flawed metric because I'm not sure how much of the "Cost of Revenues" is coming from content amortization, but thought it would prove interesting at least. Here were the results.

Click on picture to enlarge

Using this metric, NFLX bottomed in 2011 and has seen gradually improvement since then.

Valuation

With all, let's try to come up with a valuation for NFLX. This is hardly a simple exercise given the disparate cash flow and income figures. Given Netflix's original content, highly valuable data, and wide moat in the streaming market, we also must give the stock a premium valuation multiple.

In order to value NFLX, I created a simple model and experimented around greatly with the inputs. I assumed that NFLX could double its revenues in the next 5 years while also eventually improving its profit margins back to 12%.

Using these assumptions, my range of valuations shifted significantly based on other attributes such as early year free cash flows, long-term growth assumptions, etc. The more conservative valuations put NFLX at a mere $12. In these scenarios, we're assuming that NFLX continues having negative free cash flows for the next 5 years before finally shifting into the black. This might seem unrealistic, except that it's really difficult to predict how long NFLX will continue to need to be cash flow negative in order to stay ahead on content.

In the more bullish scenarios, I'm coming up with valuations for NFLX in the $40 - $60 range. In these scenarios, I'm assuming that NFLX can continue growing revenues at greater than 15% for the next 8 - 10 years before leveling off to around 5%. I also assume that at the end of the 10 year horizon, NFLX can generate 14% free cash flow margins. Is this extraordinarily aggressive? Maybe, but it is not outside the realm of possibility.

However, the important point to note here is that it's almost impossible to come up with a stock price over $100 without an almost insane amount of growth and margin expansion over the next decade. NFLX is a truly great company with a wide moat and massive potential. The assumptions required to get to a $100 - $120 stock price, though, are almost out of this world.

As an example, I expanded the revenue growth to 30% in the next 3 years, 25% in the 3 years after that, and 20% for 4 years beyond that before leveling off at a terminal growth rate of 5%. I expanded the free cash flow margins to 15%. I still only came up with a valuation of $107. There's nothing that seems remotely realistic about this valuation to me, either. In order for NFLX to continue growing revenues that dramatically it would have to raise prices significantly, which would essentially open the door for competition.

Given all these scenarios, I view the most probable valuation for NFLX to be in the $20 - $30 range, making it extraordinarily overvalued. You can make a good case that NFLX deserves an even more premium valuation than that due to its massive data advantage, but even then, paying more than $40 or $50 for the company seems insanely aggressive.

Conclusions

I can confidently assert that NFLX is one of the best companies in America. Wet Hot American Summer, more than any other piece of content, showcases how NFLX has perfected the use of data to drive content creation. Its large and growing international subscriber base also gives it a big moat against competition, allowing it to gobble up more content to further solidify its advantage.

Yet, even with all the plusses, the stock is wildly overvalued. NFLX would have to either grow revenues at an extraordinary clip (30%+) over the next decade or it would have to widen its profit and cash flow margins into the 20% range. While not totally outside the realm of possibility, both scenarios seem very unlikely.

NFLX is a great company, but the stock is probably worth $20 - 30. We would need to see a major correction before I became interested in the stock again.

Great article - I'm glad I persevered through the movie review portion! I do worry about Netflix along the lines of Blockbuster having once been a hot item - who knows what new technology could arise that would bump it to the curb.