How To Profit From The Rise In Gas Prices

If the price of a gallon of gas by you has jumped close to 50 cents in just a few weeks, then you’ll be happy to know there’s a simple way to profit that any investor can take advantage of. In this article, Tim Plaehn shares his strategy to realize quick share price gains by making these smart investments.

Refiners comprise the subsector of the energy sector with the potential to increase profits from higher gasoline and other fuels prices. A refining company generates gross profit on the difference between what it pays for crude oil and the wholesale prices of the fuels it produces. Owning and operating refineries can be a tough business. Both sides of the refining coin – the cost of raw materials and the prices of sold products – are driven by the market price action. There are a large number of factors that determine the price of crude a refinery purchases and how much it receives for refined products. Factors include sources and types of crude, local market pricing for fuels and government environmental regulations.

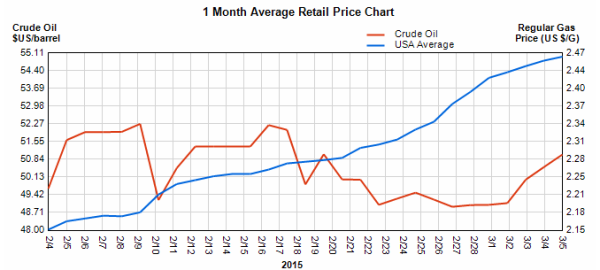

Over the last few weeks, as fuel prices have gone up, the gross profit margins for refiners have been exploding. I track a refining crack spread using the Energy Information Agency spot prices for WTI crude, and the New York Harbor prices for gasoline and low-sulphur diesel. The crack spread shows the gross margin per barrel of oil based on these market conditions. Over the last month, the crack spread has doubled, with the price of crude remaining low and wholesale fuels prices moving higher. Factors causing the increase in fuels include the iron workers strike at a dozen of the country’s largest refineries and an extended shutdown at one of California’s largest refineries (owned by Exxon Mobil) caused by a fire. As a result, refining companies are going to generate very large profits in the first quarter of 2015 and possibly the following quarters.

I cover dividend stocks, so from the refining sector here are a few that could reward investors with larger or extra dividends as well as share price increases when Q1 results are announced in late April. There are both corporate and MLP refining companies and here are a few that should put some nice cash distributions into your brokerage account:

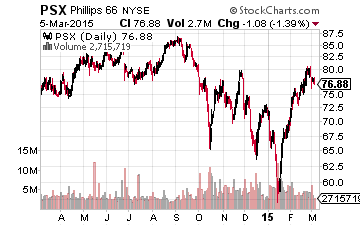

Phillips 66 (NYSE:PSX) yields 2.6%, very much in line with the other large cap refining companies. However, several of its peers have announced 40% dividend increases in the last few months. PSX has not increased its dividend since May 2014. A big dividend hike could result in a large share price gain.

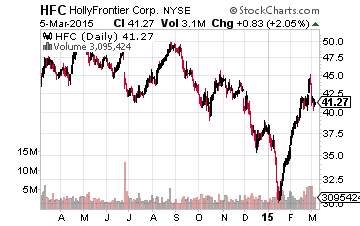

HollyFrontier Corp (NYSE:HFC) pays a regular $0.32 per share quarterly dividend, which puts the current yield at 3.1%. When profits are good, HFC will also pay a special dividend along with the regular quarterly payout. In 2013, four extra $0.50 special dividends were paid and three of the same amount were paid in 2014. HollyFrontier pays nice cash when profits are good.

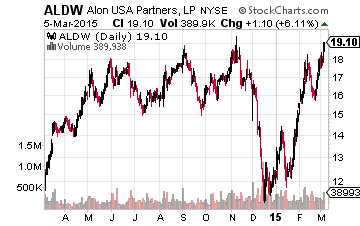

Refining MLPs (sometimes called downstream sector MLPs) all own just one or two refineries and have variable distribution payout policies. This means the quarterly distribution per share can vary significantly from quarter to quarter. These MLPs will pay out 100% of net cash generated during the quarter as distributions. Here are two that should pay out big for the 2015 first quarter:

Alon USA Partners LP (NYSE:ALDW) owns a refinery in Big Springs, Texas. Quarterly distributions over the last year ranged from $0.13 per unit up to $1.02. The total $2.54 in trailing twelve months distributions would be a 13% yield on the current unit price.

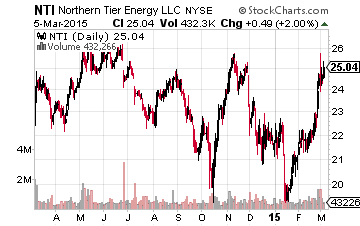

Northern Tier Energy LP (NYSE:NTI) owns and operates a refinery in a suburb of Minneapolis and owns mini-marts throughout Minnesota and Wisconsin. The $2.79 in trailing distributions gives an indicated yield of 11%.

With the MLPs, since the distributions vary, the unit prices are quite volatile. Some unit price vs. energy price study will show multi-month patterns that can be exploited for very attractive profits.

more