How To Find Top Momentum Stocks In Healthcare

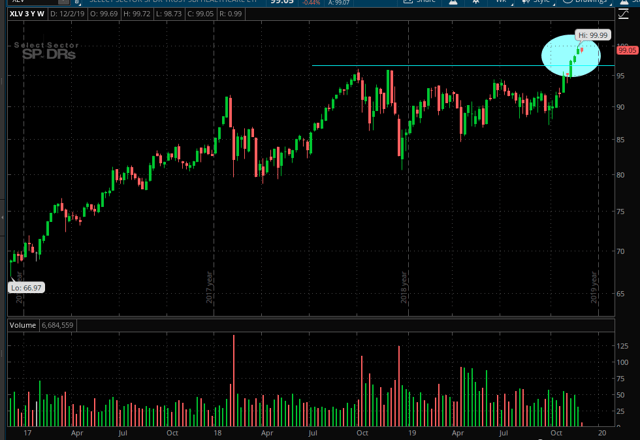

The healthcare sector seems to be waking up over the past several weeks. Political uncertainty has been hurting healthcare stocks throughout the past year, but this uncertainty seems to be dissipating as the Presidential election approaches, which is being a major tailwind for the healthcare sector in terms of performance.

(Click on image to enlarge)

Source: TOS

Prices don't rise in a straight line for too long, and many names in the healthcare sector have delivered big gains in a short period of time. In this context, some kind of pullback or sideways consolidation should come as no surprise at all. However, the outlook for healthcare stocks over the middle term, meaning several months and years, is looking strong.

The following paragraphs will be presenting a quantitative strategy focused on companies with strong momentum in the healthcare sector, both in terms of fundamental momentum and price behavior.

The strategy has both its strengths and weaknesses, and it many times gravitates towards companies with above-average volatility. Nevertheless, it makes sense to look for buying opportunities among high-momentum healthcare stocks in the current environment.

The Importance Of Momentum

Momentum is the tendency for assets that are performing well in the recent past to continue performing well in the middle term and vice-versa. There is plenty of statistical evidence showing that investors can obtain superior returns by capitalizing on the momentum factor.

Even Professor Eugene Fama himself, the father of the efficient-market hypothesis, has said that momentum is "the biggest embarrassment to the theory". According to the research data, momentum can produce market-beating returns across different assets, countries, and time frames.

Momentum stocks tend to be volatile and risky, and returns are also hard to predict in the short term. In fact, this particular momentum strategy has underperformed the benchmark by a considerable margin in the past year.

Personally, I wouldn't buy a stock solely because it's showing strong momentum. Factors such as competitive strength, the management team, financial quality, and valuation can make the investment thesis broader and more complete.

Nevertheless, the hard data shows that investing in high-momentum stocks tends to produce superior returns over the long term, and screening for companies with superior momentum in a promising sector can be a great strategy to identify interesting opportunities for further research.

Measuring Momentum

The Stocks on Fire system is a quantitative algorithm that ranks stocks in a particular universe based on a combination of two main factors: fundamental momentum and price momentum.

Fundamental momentum evaluates how earnings and sales expectations are evolving for the company. The performance of a stock does not depend on the fundamentals alone, but the fundamentals in comparison to expectations can have a much more powerful impact on returns. For this reason, the strategy is looking for companies that are performing better than expected and driving increased expectations about future performance.

This factor is basically a combination of five different variables:

- The percentage increase in earnings expectations for the current quarter.

- The percentage increase in earnings expectations for the current year.

- The percentage increase in earnings expectations for next year.

- The percentage increase in sales expectations for the current year.

- The percentage increase in sales expectations for next year.

The price performance component in the ranking system measures price changes over the past 4 quarters. This factor is looking for stocks that are consistently outperforming the market over recent time periods, as measured by variables such as:

- Return over the past 3 months

- Return over 3 months 3 months ago

- Return over 3 months 6 months ago

- Return over 3 months 9 months ago

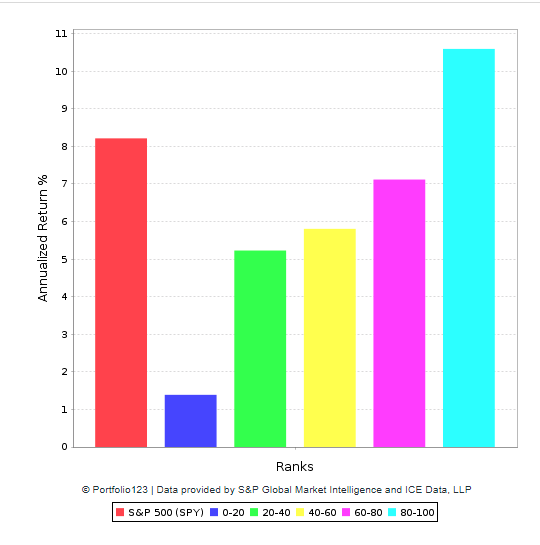

Looking at the long-term backtested data, there is a direct correlation between the Stocks on Fire ranking and annualized returns. Companies in the top quintile, meaning those with a Stocks on Fire ranking above 80, tend to materially outperform the market.

Data from S&P Global via Portfolio123

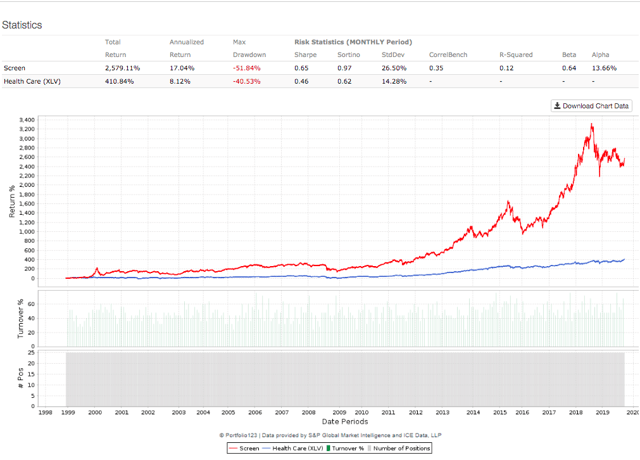

The following backtest considers only companies with a market capitalization above $250 million to guarantee a minimum size for inclusion in the portfolio. After that, the strategy selects the 25 stocks with the highest Stocks on Fire ranking in the healthcare sector.

The benchmark is the Health Care Select Sector SPDR ETF (XLV). The portfolio is updated every month, and trading expenses are assumed to be 0.2% per transaction.

The long-term performance numbers are quite impressive. Since January 1999, the strategy has gained 2579.11% versus a cumulative gain of 410.84% for XLV. In annual terms, the momentum strategy has gained 17.04% per year versus 8.12% for the benchmark. Alpha amounts to 13.66% for the strategy.

(Click on image to enlarge)

Data from S&P Global via Portfolio123

Looking at the long-term return numbers is of utmost importance, but we also need to keep in mind that these numbers don't always tell the whole story. Short-term performance can be very different, and the quantitative strategy has, in fact, underperformed the benchmark by a wide margin in the past year: the strategy declined -4.73%, while the benchmark gained 8.4% over that period.

| Strategy | XLV | |

| Annualized | 17.04% | 8.12% |

| One-Month | 5.67% | 5.37% |

| One-Year | -4.73% | 8.40% |

| Three-Year | 96.54% | 51.80% |

| Five-Year | 134.15% | 54.84% |

| Total | 2579.11% | 410.84% |

| Sharpe Ratio | 0.65 | 0.46 |

| Sortino Ratio | 0.97 | 0.62 |

| Max Drawdown | -51.84% | -40.53% |

| Standard Deviation | 26.50% | 14.28% |

| Correlation | 0.35 | - |

| R-Squared | 0.12 | - |

| Beta | 0.64 | - |

| Alpha (annualized) | 13.66% | - |

This is to be expected. Even the best strategies, meaning the ones with the best performance over multiple years, go through periods of underperformance from time to time. No strategy can outperform in each and every year, and the periods of underperformance can be quite painful.

The strategy also gravitates toward relatively small and volatile stocks, since many times those kinds of stocks are the ones that exhibit superior momentum. Investors sourcing for ideas from this strategy may want to pay special attention to the stock's valuation levels and the degree of stability in the company's financial performance.

Importantly, momentum cuts both ways. The stocks that deliver the biggest gains on the way up are many times the ones that suffer the biggest losses on the way down. Momentum stocks generally carry higher downside risk than other kinds of investments.

If we look at risk metrics such as standard deviation and drawdown, it's easy to see that the strategy is far more volatile than the benchmark. The strategy more than compensates for such risk with superior returns, and risk-adjusted return metrics such as Sharpe and Sortino ratios are clearly superior. However, we still need to acknowledge that momentum investing is only suitable for investors with elevated risk tolerance.

The strategy is concentrated in only one factor - momentum - and in a single sector - healthcare - so it clearly lacks diversification. This strategy is not intended as a list of recommendations, but rather as a source of ideas for further research.

Without further prologue, the table below shows the 25 stocks currently selected by the quantitative algorithm. Data in the table also includes the Stocks on Fire algorithm ranking for the companies considered and market capitalization value in millions.

| Ticker | Company Name | Rank | MktCap |

| ACAD | Acadia Pharmaceuticals Inc. | 97.79 | $6,954 |

| ADUS | Addus HomeCare Corp. | 97.11 | $1,450 |

| AGEN | Agenus Inc/DE | 96.85 | $576 |

| AGN | Allergan PLC | 97.17 | $60,679 |

| ATEC | Alphatec Holdings Inc. | 99.55 | $428 |

| ANIK | Anika Therapeutics Inc. | 98.71 | $825 |

| ATRS | Antares Pharma Inc. | 98.33 | $772 |

| BDSI | BioDelivery Sciences International Inc. | 99.2 | $612 |

| CBPO | China Biologic Products Holdings Inc. | 97.28 | $4,483 |

| CNMD | CONMED Corp. | 98.17 | $3,214 |

| CCRN | Cross Country Healthcare Inc. | 99.17 | $433 |

| CUE | Cue Biopharma Inc. | 98.43 | $272 |

| DVA | DaVita Inc. | 97.52 | $9,609 |

| DXCM | DexCom Inc. | 99.83 | $20,799 |

| DRNA | Dicerna Pharmaceuticals Inc. | 99.58 | $1,645 |

| EW | Edwards Lifesciences Corp. | 98.11 | $51,070 |

| HARP | Harpoon Therapeutics Inc. | 98.58 | $460 |

| INCY | Incyte Corp. | 97.03 | $20,280 |

| JYNT | The Joint Corp. | 98.67 | $266 |

| KPTI | Karyopharm Therapeutics Inc. | 99.91 | $1,099 |

| NVRO | Nevro Corp. | 99.95 | $3,465 |

| REPH | Recro Pharma Inc. | 99.86 | $374 |

| SEM | Select Medical Holdings Corp. | 97.62 | $2,967 |

| THC | Tenet Healthcare Corp. | 97.05 | $3,341 |

| VRTX | Vertex Pharmaceuticals Inc. | 96.96 | $57,049 |

The list has plenty of variety, but it also includes several names with above-average volatility. Again, the main idea is not buying any particular stock based solely on its momentum characteristics, but rather using this list as a source of ideas for further research.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in ...

more