How The December Fed Minutes Influenced Rate Cut Odds For 2024

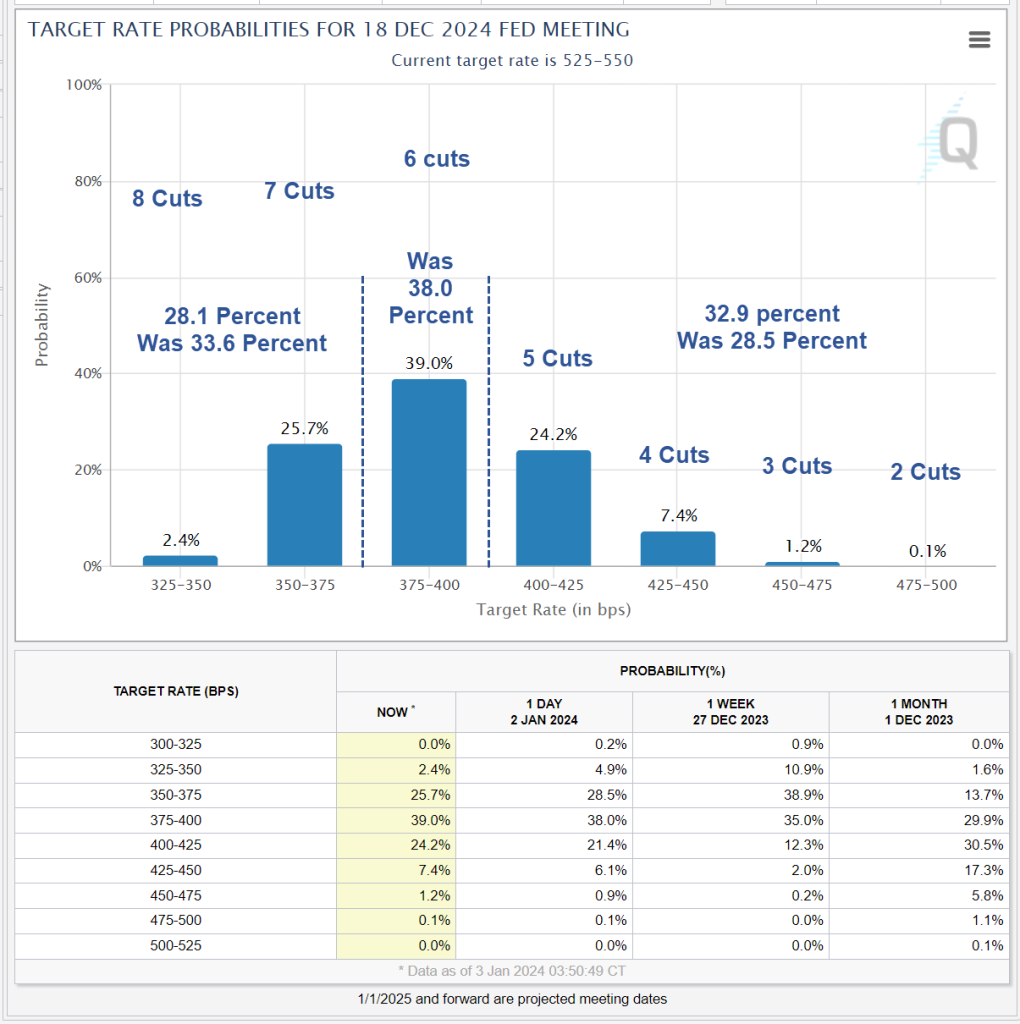

Image from CME Fedwatch, annotations by Mish

The Fed Minutes suggest rate hikes are over but there is no hint of rate cut timing.

Three Key Paragraphs

In discussing the policy outlook, participants viewed the policy rate as likely at or near its peak for this tightening cycle, though they noted that the actual policy path will depend on how the economy evolves.

In their submitted projections, almost all participants indicated that, reflecting the improvements in their inflation outlooks, their baseline projections implied that a lower target range for the federal funds rate would be appropriate by the end of 2024. Participants also noted, however, that their outlooks were associated with an unusually elevated degree of uncertainty and that it was possible that the economy could evolve in a manner that would make further increases in the target range appropriate. Several also observed that circumstances might warrant keeping the target range at its current value for longer than they currently anticipated. Participants generally stressed the importance of maintaining a careful and data-dependent approach to making monetary policy decisions and reaffirmed that it would be appropriate for policy to remain at a restrictive stance for some time until inflation was clearly moving down sustainably toward the Committee’s objective.

Participants discussed several risk-management considerations that could bear on future policy decisions. Participants saw upside risks to inflation as having diminished but noted that inflation was still well above the Committee’s longer-run goal and that a risk remained that progress toward price stability would stall. A number of participants highlighted the uncertainty associated with how long a restrictive monetary policy stance would need to be maintained, and pointed to the downside risks to the economy that would be associated with an overly restrictive stance. A few suggested that the Committee potentially could face a tradeoff between its dual-mandate goals in the period ahead.

The minutes are as expected. The Fed wants to walk back ideas that it will soon cut rates, but with limited success.

March Rate Cut Odds

Image from CME Fedwatch, annotations by Mish

The market believes the Fed will start cutting rates in March.

Possibly in response to the minutes, the market reduced the March odds of at least one cut from 79.0 percent to 70.8 percent.

How Many 1/4 point rate cuts in 2024?https://t.co/rx7DhWGrBS

— Mike "Mish" Shedlock (@MishGEA) January 3, 2024

Looking ahead to December, the median market expectation is for approximately six rate cuts.

More By This Author:

ISM Manufacturing Production Turns Positive But New Orders Down 16th MonthHow Is Canadian Wage Growth Stacking Up To Inflation?

Red Sea Shipping Update, Maersk Pauses Transit Until Further Notice

Disclaimer: The content on Mish's Global Economic Trend Analysis site is provided as general information only and should not be taken as investment advice. All site content, including ...

more