How Soon The Recession?

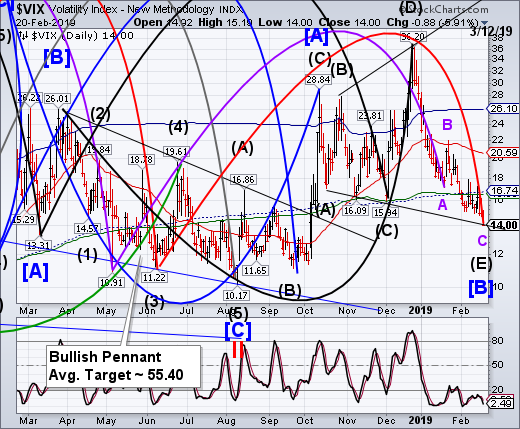

VIX made the second Master Cycle low in 34 days yesterday, patterned after the May-June lows last year. Volatility shorts have been feeling no pain as VIX declined to the trendline of a Broadening Wedge formation. The conditions are ripe for a reversal.

-- The NYSE Hi-Lo Index looks bullish but hasn’t broken out above its February 1 high. The Cycles Model tells us to expect a significant low by mid-March.

(Bloomberg) The renewed rally in U.S. equities has left volatility markets showing little concern that the good times will end any time soon. Recession models beg to differ.

Wells Fargo’s model -- which draws on the spread between three-month and 10-year Treasury yields as well as economic figures -- shows chances of a U.S. recession within 12 months jumped in December and climbed to just above 40 percent in January.

But as the likelihood of a downturn increases, there’s a disconnect with implied one-year equity volatility that’s trending below its average for the past year.

“Despite the increased recession probability, long-dated equity volatility is actually trading lower than in previous years,’’ Pravit Chintawongvanich, a Wells Fargo equity derivatives strategist, wrote in a note. He adds that this dynamic reflects issues with how the market is structured more than outright complacency in derivatives.

Still, the gap may have some ominous implications. A similar split was seen prior to the 2008 financial crisis.

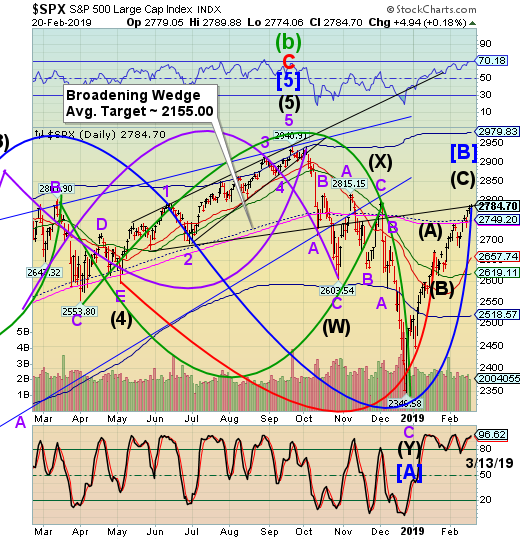

-- The SPX continued the rally into its (inverted) Master Cycle high yesterday, finding resistance at the lower trendline of its Broadening Wedge Formation. Cycles require meeting both time and price targets. In this case, the Broadening Wedge formation may have overridden the Cycles target. In addition, Wave (C) exactly matches the length of Wave (A). The next agenda item is a retest of the December low.

(ZeroHedge) The market's hopes that today's snow-delayed Fed minutes would resolve the debate over the fate of the balance sheet unwind, were dashed with the Fed confirming what traders already knew: the Fed would remain patient, data dependent, focused on the fading inflation impulse, and would seek a plan for when the Fed's balance sheet unwind would end by the end of 2019 suggesting that the QT may continue well into 2020 if not later, dependent on what the Fed concludes is a sufficient amount of required bank reserves.

As Bloomberg notes, "small moves in stocks, bonds and FX as the Fed minutes portray a central bank that still sees a decent economy, slow-growing inflation, a tight labor market and an uncertain path for interest rates." The Minutes punctuated another rather quiet session that saw economically-sensitive stocks such as steel makers, chemical and industrial companies outperform against a flat tape.

-- NDX may have completed its rally today by challenging the mid-Cycle resistance at 7070.62 but closing beneath it. Should it reverse beneath the 200-day Moving Average at 7057.57, it will have completed the right shoulder of a proposed Head & Shoulders formation. If valid, new downside lows may be made. I will publish the target at the break of the neckline.

(Bloomberg) Federal Reserve officials turned into market analysts at Hindsight Capital LLC in the minutes of their January meeting.

Policymakers offered a laundry list of reasons why U.S. equities came under severe pressure at the end of 2018, nearly falling into a bear market.

Here’s what the Fed thinks caused the damage:

The Kitchen Sink: Everything Was Awful

“A variety of factors -- including FOMC communications, weaker-than-expected data, trade policy uncertainties, the partial federal government shutdown, and concerns about the outlook for corporate earnings -- were cited by market participants as contributing to a deterioration in risk sentiment early in the period.”

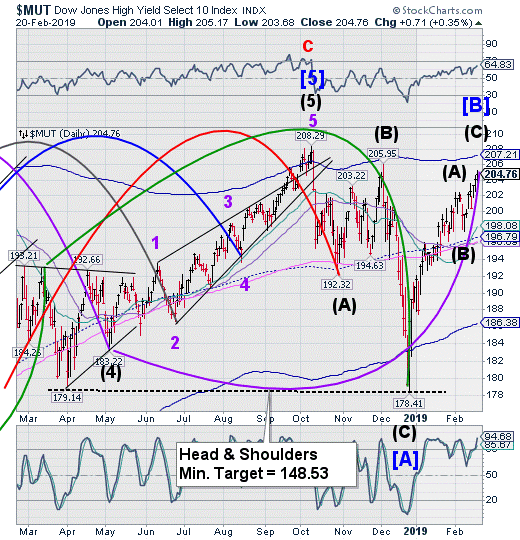

The High Yield Bond Index very nearly broke out above the December 4 high today. This may be giving too much solace to investors as the High Yield Index is on the same pattern as stocks. A Major low appears to be due in mid-March.

(Bloomberg) U.S. junk bonds look expensive after their prices have jumped since last year, and buying leveraged loans is a better bet now, according to Vancouver-based money manager Leith Wheeler Investment Counsel Ltd.

The firm has been increasing its exposure to loans relative to high-yield bonds since the middle of last year, as it has found loans trading with higher yields than bonds, said Dhruv Mallick, a portfolio manager. That’s true even if the two forms of debt are of similar quality, he said.

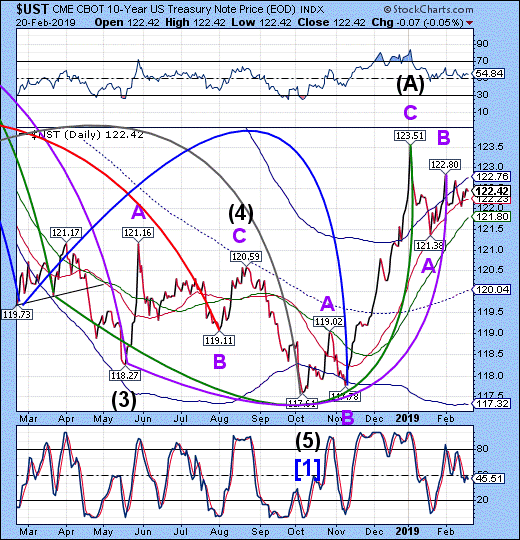

10-Year Treasury Notes are bouncing off the Intermediate-term support at 122.23 and may be forming a potential triangle formation in which it tests the 50-day Moving Average at 122.23 before moving higher. The Cycles Model suggests there may still be time to work on its directionality.

(ZeroHedge) Key update: it appears that in its rush to blast the fastest headline on the Minutes, Bloomberg made a material error, reporting the following:

- BBG: ALMOST ALL FED OFFICIALS WANTED TO HALT RUNOFF LATER THIS YEAR

That, however, is incorrect, and Reuters captured what the Fed really said, which is significantly different from what the Fed actually said, to wit:

- REUTERS (correct): ALMOST ALL PARTICIPANTS THOUGHT IT WOULD BE DESIRABLE TO ANNOUNCE PLAN TO STOP REDUCING BALANCE SHEET LATER THIS YEAR

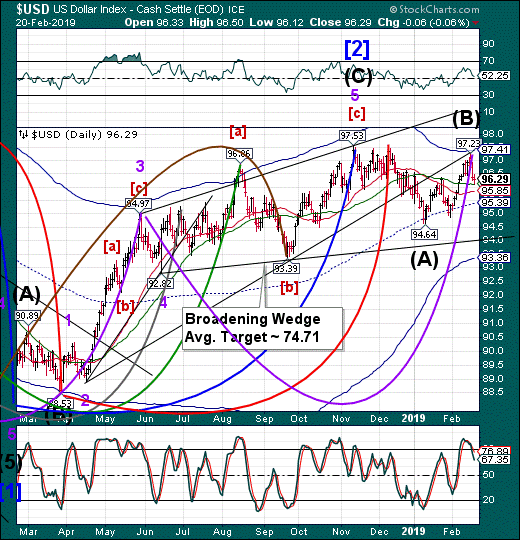

The U.S. Dollar appears to have tested its 50-day Moving Average at 96.09. It appears to have put in its (inverted) Master Cycle high on February 15. The Cycles Model suggests a significant low may be made around mid-March.

(Morningstar) The US dollar has turned in another lackluster performance during trading on Wednesday as traders digest the minutes of the latest Federal Reserve meeting.

The greenback is currently trading at 110.83 yen compared to the 110.63 yen it fetched at the close of New York trading on Tuesday. Against the euro, the dollar is valued at USD1.1340 compared to yesterday's USD1.1341.

The choppy trading came as the minutes of the latest Federal Reserve meeting provided further insight into the central bank's decision to change the forward guidance language and indicate a patient approach to raising interest rates.

The minutes described the Fed's discussions regarding changing the language in its statement from referencing "further gradual increases" in rates to a sentence indicating patience.

--The Yen appears to have put in its Master Cycle low last Thursday. Now it is testing the 50-day Moving Average in a reversal. If the Cycles are correct, there may be an extended rally that could last up to 4 weeks or longer.

(JapanTimes) The “sharply undervalued” yen is poised for a revival even after Bank of Japan Gov. Haruhiko Kuroda surprised markets by warning of further potential policy easing, according to UBS Global Wealth Management.

The fund manager, among the biggest in the world, sees the yen gaining 5 percent to ¥105 per dollar in the next 12 months. Japan’s accelerating wage growth is bound to spur inflation, the company reckons, even as Kuroda said Tuesday that additional stimulus may be considered if the exchange rate affects the country’s economy.

Floundering world economic momentum could also see the yen benefit from safe haven demand, UBS GWM strategists, including Thomas Flury, head of currency research, said in a note to clients on Friday. They said Japan’s macro position is healthy and, despite Kuroda’s remarks, forecast that the BOJ will start normalizing monetary policy in early 2020, even before achieving its 2 percent inflation target.

The Nikkei retested the Head & Shoulders neckline at 21300.00 for a second time to make a belated Master Cycle high. A breakdown beneath the 50-day Moving Average at 20810.87 puts the Nikkei on a sell signal. The Cycles Model calls for a potential decline lasting up to two months.

(BusinessStandard) Headline indices of the Japan share market closed higher on Wednesday, 20 February 2019, as risk sentiments underpinned on tracking overnight gains on Wall Street after US-China trade talks resumed while investors awaited minutes from the US Federal Reserve for clues on policymakers' thinking on interest rates and its balance sheet reduction policy. Most of TSE33 issues inclined, with shares in nonferrous metal, wholesale trade, and marine transportation-linked issues comprised those that gained the most. At the closing bell, the 225-issue Nikkei Stock Average ended up 128.84 points, or 0.6%, at 21,431.49. The broader Topix index of all First Section issues on the Tokyo Stock Exchange finished 6.95 points, or 0.43%, higher at 1,613.47.

The two countries (US-China) started a new round of talks to resolve their trade war on Tuesday, and sessions at a higher level are planned later this week.

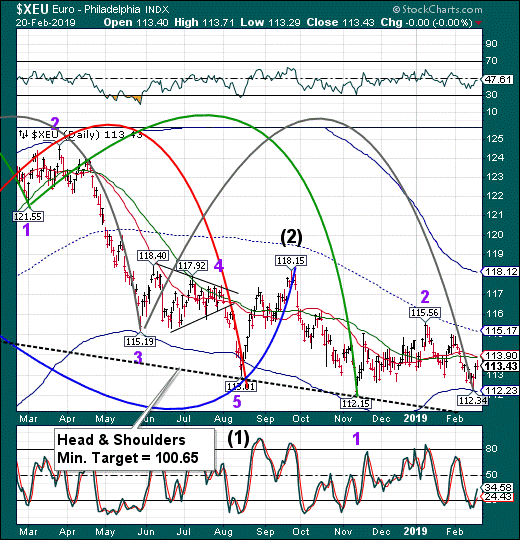

The Euro bounced from its Cycle Bottom support at 112.23 to test its Intermediate-term and 50-day resistance at 113.90. The anticipated Master Cycle low was out in on Friday. Should the Euro overcome resistance, it may make a quick run to the mid-Cycle resistance at 115.17. However, it is on a sell signal, so be wary of a breakdown beneath the Cycle Bottom.

(Forbes) George Soros is worried that the European Union is at great risk of political stratification. He has a reason to worry. Thanks in part to Soros’ own support of open-border politics, which gave rise to nationalist right-of-center figures in places like Italy and now in Spain, Europe is one of the biggest political risks to your retirement funds.

Eurosceptic parties are now forecast to hold more than a fifth of European Parliament seats in May’s elections.

The elections this spring are among the most eagerly watched in recent years. They could pave the way for anti-EU forces across Europe to coalesce in the parliament and disrupt how the bloc functions by taking up senior committee jobs and blocking votes on EU policies, the Financial Times reported this week.

The EuroStoxx 50 Index rally appears to be approaching the combined Head & Shoulders neckline and mid-Cycle resistance at or near 3289.89. The Cycles Model suggests it is on a period of strength through the weekend, but may turn bearish soon after.

(Bloomberg) The grand new-year bounce in European stocks is threatening to fizzle out, forecasters warn.

The Stoxx Europe 600 Index is expected to lose 4.5 percent from Monday’s closing levels to 353 points by the end of 2019, according to the latest Bloomberg poll’s average projection. The Euro Stoxx 50 Index, home of the euro-area’s biggest companies, is seen declining 0.9 percent from current levels, according to the average survey estimate.

European stocks have enjoyed a stellar start to the year, adding about $1 trillion in market value since the Dec. 27 low, buoyed by a dovish U.S. Federal Reserve and optimism over a potential U.S.-China trade deal. However, many concerns that sent international markets tumbling late last year haven’t evaporated. Credit Suisse Group AG said on Monday that the global equity rally is nearing an end, cutting its recommendation for stocks to neutral amid such risks as declining profits, China and complacency about the Fed.

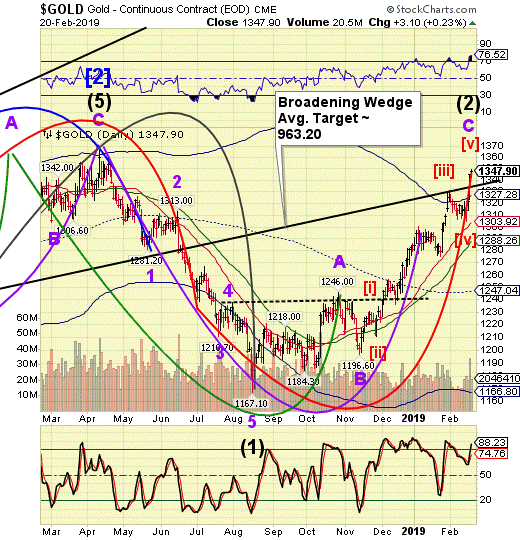

-- Gold made a surprise move to 1349.80, just ticks away from the hoped-for 1350.00 resistance area. Unfortunately, the period of strength may have run its course and the door is ready to slam shut on the belated turn window. The resulting decline may last up to 4 weeks to the next significant low.

(KitcoNews) - Gold prices are trading moderately down in early-afternoon U.S. trading Wednesday. The yellow metal has seen its price back off after the release of the Federal Reserve’s FOMC minutes. Gold prices early on today hit a 10-month high. Chart-based buying is featured this week in both gold and silver markets, as both metals have seen their technical postures improve just recently. April gold futures were last down $0.60 an ounce at $1,344.10. March Comex silver was last up $0.108 at $16.065 an ounce.

The U.S. economic data point of the day is the just-released Federal Reserve FOMC minutes. The minutes expressed some more concern regarding risks to U.S. economic growth, which the Fed says has moderated in recent months. The Fed sees few risks in leaving monetary policy steady, at present. The minutes also said the Fed will exercise “patience” on future interest rate hikes, adding the FOMC will also continue to be data-dependent. FOMC members want to see the unwinding of the big Fed balance sheet of securities stop later this year.

West Texas Intermediate Crude continued its rally from the Broadening Wedge trendline, making a new retracement high. However, the Master Cycle is stretched nearly to its limit suggesting the rally may be over by the weekend. The sell signal here may be just as strong as the signal given on October 3.

(RigZone) Crude oil futures continued their ascent Wednesday.

West Texas Intermediate (WTI) crude oil for March delivery gained 83 cents to settle at $56.92 per barrel. The WTI peaked at $57.55 and bottomed out at $55.48 during the midweek session.

April Brent crude oil futures ended the day at $67.08 per barrel, reflecting a 63-cent increase.

“Last week we had stated: ‘While we favor the conclusion of the pattern with an eventual breakout to the upside, we want to continue to trade the markets against our listed support and resistance levels until a break beyond our major levels can occur either way,’” recalled Steve Murphy, vice president with Rockville Centre, N.Y.-based Rafferty Commodities Group.

“That breakout occurred last week on the daily charts,” added Murphy.

The Shanghai Index challenged the mid-Cycle resistance at 2732.51, closing above it. While it appears to have met its nominal target, the rally may last through the weekend. The Cycles Model indicates weakness may reappear next week, lasting through mid-March.

(CNBC) A Chinese state-run newspaper claimed in an editorial published late Tuesday that the U.S. faces greater pressure to resolve its ongoing trade war with China because failed negotiations would likely have major consequences for stocks worldwide.

On Tuesday, the S&P 500 rose after U.S. President Donald Trump again indicated the world's two largest economies might have more time to find a way to avoid raising tariffs. The current deadline before increased tariffs kick in is March 1, and the Chinese delegation is in Washington, D.C. this week for trade negotiations.

"[Trump's] words further stoked the stock markets of the US, which reached the highest in two months and so increased pressure on the Trump administration to close the deal with China," the Global Times said in the editorial.

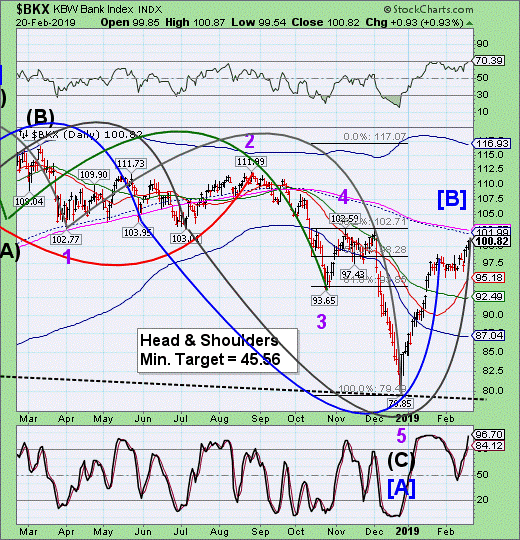

-- BKX made a second Master Cycle high within the past month. The Cycles Model suggests that Cyclical strength may have run its course, but it is possible to test the mid-Cycle resistance at 101.99 by the weekend. The next Master Cycle low may be due in late March.

(Bloomberg) Top Deutsche Bank AG executives were so concerned after the 2016 U.S. election that the Trump Organization might default on about $340 million of loans while Donald Trump was in office that they discussed extending repayment dates until after the end of a potential second term in 2025, according to people with knowledge of the discussions.

Members of the bank’s management board, including then Chief Executive Officer John Cryan, were leery of the public relations disaster they would face if they went after the assets of a sitting president, said the people, who asked for anonymity because the discussions were private. The discussions were about risks to the bank’s reputation and did not relate to any heightened concerns about the creditworthiness of Trump or his company, the people said.

The bank ultimately decided against restructuring the loans to the Trump Organization, which come due in 2023 and 2024, and chose instead not to do any new business with Trump while he is president, one of the people said.

(ZeroHedge) When the Fed dramatically reversed on its hawkish tightening cycle two months ago, the market was shocked - not so much by the reversal, after all the Yellen Fed did an almost identical U-turn in 2016 when a foundering China dragged the world to the brink of a bear market - but by the lack of a credible justification for the Fed's actions, which appeared to be catering merely to the market, something today's FOMC Minutes confirmed.

And while most investors have learned to move on, and accept the Fed as the market's Chief Risk Officer, one who will forever get involved in boosting stock values until the moment its credibility is gone forever (which at this rate will happen quite soon), one analyst was furious at what the Fed's minute revealed today.

As Jefferies economist Ward McCarthy, clearly sick and tired of providing intellectual cover for the idiots in the Marriner Eccles building, wrote in a scathing report published after the Fed minutes were released today, the minutes suggest a "very significant lack of understanding" of the relationship between the size of the Fed’s balance sheet and the economy and "between the balance sheet and the behavior of the money markets."

(ZeroHedge) On a day when Frankfurt's most problematic lender was already in the headlines for its internal deliberations about how to shield itself from the operational and reputational blowback should the President of the United States default on $340 million in loans, a team of investigative reporters from the Wall Street Journal stunned readers by publishing a fascinating, if embarrassing for the German lender, story about a losing bond trade that cost the bank some $1.6 billion over ten years, and would have never been disclosed had it not been for some impressive financial sleuthing.

According to the WSJ, not only did Deutsche magnify its losses by waffling over what to do about the trade, but senior managers at the bank also signed off on efforts to try and conceal losses from regulators and the public by shuffling what insiders at the bank nicknamed "the Berkshire Trade" off of the bank's trading books and concealing it in the opaque "non-core operations unit" - aka Deutsche's "bad bank," a sort of Pet Cemetary for the bank's most toxic assets. Because the trade involved illiquid municipal bonds, the bank had a lot of leeway in how to value the position and whether to even disclose it (it didn't). But when insiders started to question the bank's internal figures, and managers were finally forced to reckon with the magnitude of the losses, panic apparently set in, and attention immediately shifted to how the bank could cover it up. Soon, KPMG, the bank's auditor, also started asking questions, and the bank hatched a plan to "reclassify" the trade to free up reserve capital - though it was scuttled by legal.

Until next week…

Disclaimer: Nothing in this article should be construed as a personal recommendation to buy, hold or sell short any security. The Practical Investor, LLC (TPI) may provide a status report of ...

more

Interesting news about Deutsche Mess.