How Did Today’s Economic Data Impact Fed Rate Cut Odds?

(Click on image to enlarge)

Data from CME Fedwatch, highlights and annotations by Mish.

To answer the question asked, rate cut odds went down slightly today from 49.1 percent to 47.4 percent.

This is the direction I expected based on the data. I went to CME Fedwatch to check after seeing a string of Tweets today expecting the opposite.

Diane Swonk

Moon for the Fed to start the debate about normalizing rates at its meeting in January. I would expect to add at least one more cut to its forecast in March and debate about cuts to heat up within the Fed. That leaves us sticking to a May cut.

— Diane Swonk (@DianeSwonk) January 26, 2024

The Fed is balancing the needs to…

Warning Sign

I see the data as a big warning sign. Consumers are spending recklessly and using debt, especially credit cards to do so.

The market interpretation is closer to mine.

A month ago, the market expectation was 83.3 percent for at least one rate cut by March. Today, it’s only 47.4 percent.

Weighted Average CME Interest Rate Projection

CME data, chart and calculation by Mish

Peak Rate Cut Odds

Rate cut expectations peaked in December.

In the past month, the market has taken away one rate cut for next year. Data has been stronger than expected and some Fed presidents have warned not to count on rates.

Increase in Real Spending Rose 5 Times the Increase in Real Disposable Income

(Click on image to enlarge)

Spending and price indexes from the BEA, annotations and highlights by MIsh.

Earlier today I noted the Increase in Real Spending Rose 5 Times the Increase in Real Disposable Income

Consumers went on a spending spree in December, dipping into savings or borrowing to do so.

4th Quarter GDP Up a Strong 3.3 Percent

Strong spending fueled fourth-quarter GDP.

For discussion, please see 4th Quarter GDP Blows Past Consensus, Up a Strong 3.3 Percent

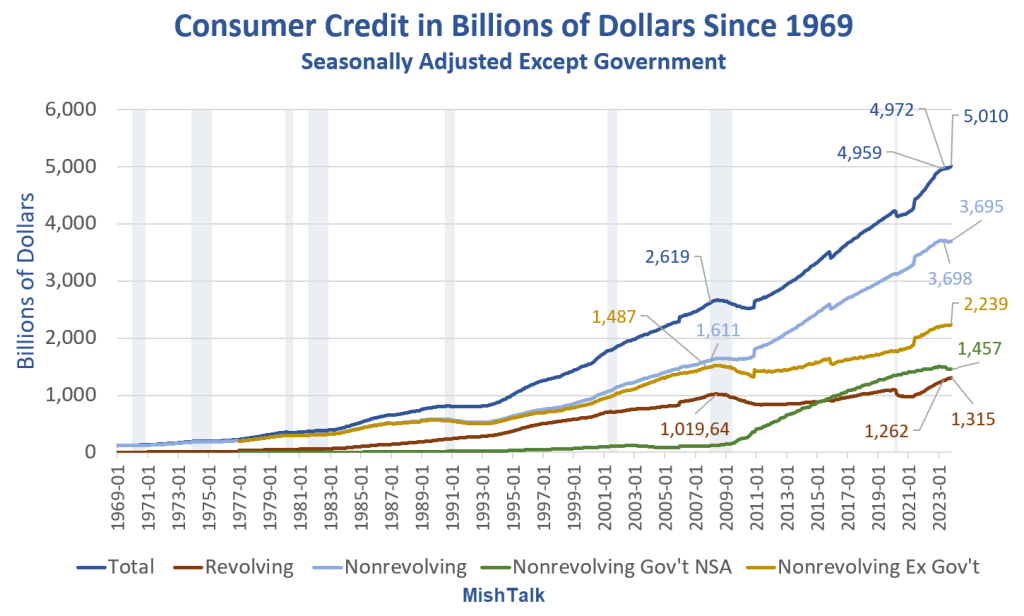

Debt Soaring Out of Sight

GDP is fueled by both consumer debt and government debt. Regarding government debt, Republicans are in on the deal.

For example, The GOP Supports a Child Tax Credit Boost and Affordable Housing Expansion

Without passing anything but continuing resolutions, we went from a House Speake Kevin McCarthy’s proposal of $1.471 trillion bill to Mike Johnson’s $1.66 trillion bill that does not include, Ukraine, Israel, or the US border with Mexico.

Fueled by Debt

Total consumer credit, revolving credit, and credit card interest rates all hit new record highs in November.

(Click on image to enlarge)

Consumer credit data from the Fed, chart by Mish

Consumer Credit Hits Record $5 Trillion

For discussion, please see Retail Sales Surge 0.6 Percent, Beating Economist’s Expectations

Also see How Did Covid Change Your Propensity to Buy Things Online?

Consumers keep spending more and more, and much of that spending is online.

Should the Fed Declare Victory?

Some people want the Fed to declare victory already, despite Core PCE inflation running at 2.9 percent year-over-year.

Two days ago former Fed economist Claudia Sahm said the Fed should cut now.

I said, how about waiting for the data.

For discussion, please see Hoot of the Day, What is the Fed Waiting On?

GDP and spending data was stronger than expected. There is no reason for the Fed to rush into rate cuts and many reasons not to.

More By This Author:

Increase In Real Spending Rose 5 Times The Increase In Real Disposable Income4th Quarter GDP Blows Past Consensus, Up A Strong 3.3 Percent

Hoot Of The Day, What Is The Fed Waiting On?

Disclaimer: The content on Mish's Global Economic Trend Analysis site is provided as general information only and should not be taken as investment advice. All site content, including ...

more