How Did Covid Change Your Propensity To Buy Things Online?

There are some things you don’t do online such as buy gasoline or eat out at restaurants. What about the rest?

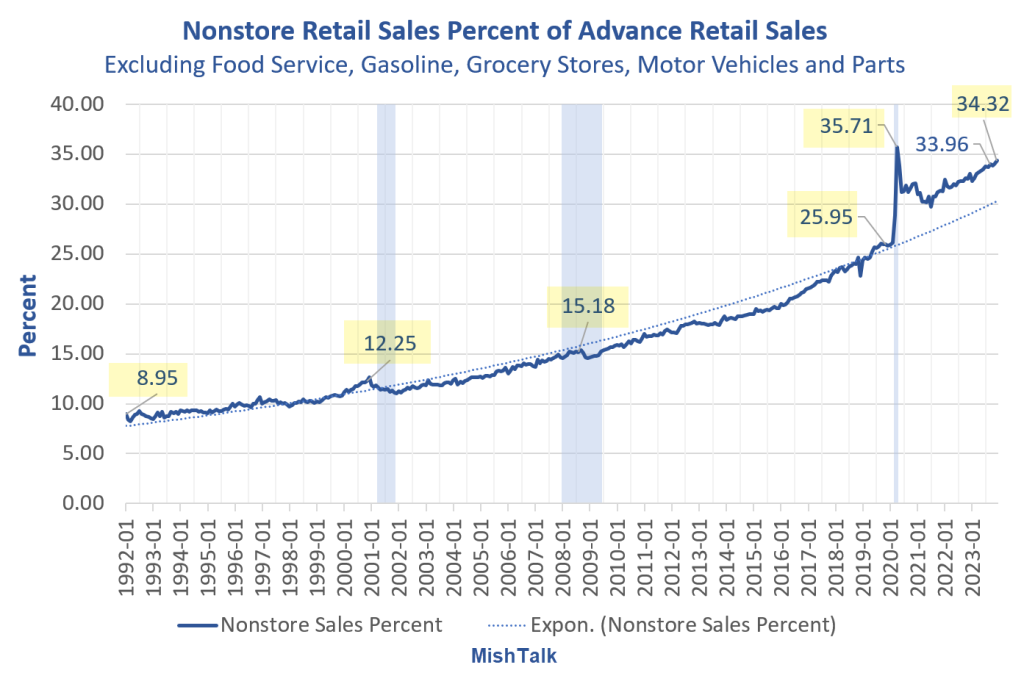

Advance retail sales from commerce department, calculation and chart by Mish

I created the chart by taking total sales and subtracting things one does not normally buy online.

Gasoline is obvious, so is eating out at restaurants.

Although one can buy groceries online and have them delivered, most do not order much food online. Omaha steaks and Christmas cheese packages don’t add up to much. I subtract groceries from the total. The same applies to cars. Most do not buy cars online. But I am sure this will change eventually.

Nonstore Retail Sales as Percent of Advance Retail Sales Detail

Progression

- In 1992, about 9 percent of sales were online

- In the next eight years online sales rose to about 12 percent.

- In another eight years ending to the start of the covid recession, online sales were at 15 percent then dipped in the recession.

- In the 10 years starting from 2010 to 2020 online sales zoomed from 15 percent to 26 percent.

- In the last four years online sales jumped over eight percentage points from about 26 percent over 34 percent, ignoring the initial covid spike.

Covid did not change the trend towards online shopping but it certainly accelerated the trend.

Retail Sales Surge 0.6 Percent, Beating Economist’s Expectations

Economists expected a December rise in retail sales of 0.4 percent. Instead, consumers went on a spending spree. But two-thirds of that was due to inflation. Real (inflation-adjusted) sales rose 0.2 percent.

Retail sales numbers from the commerce department. Real sales adjusted for inflation by the CPI is a Mish calculation.

Real retail sales peaked in April of 2022 (yellow highlight).

For more discussion and more charts please see Retail Sales Surge 0.6 Percent, Beating Economist’s Expectations

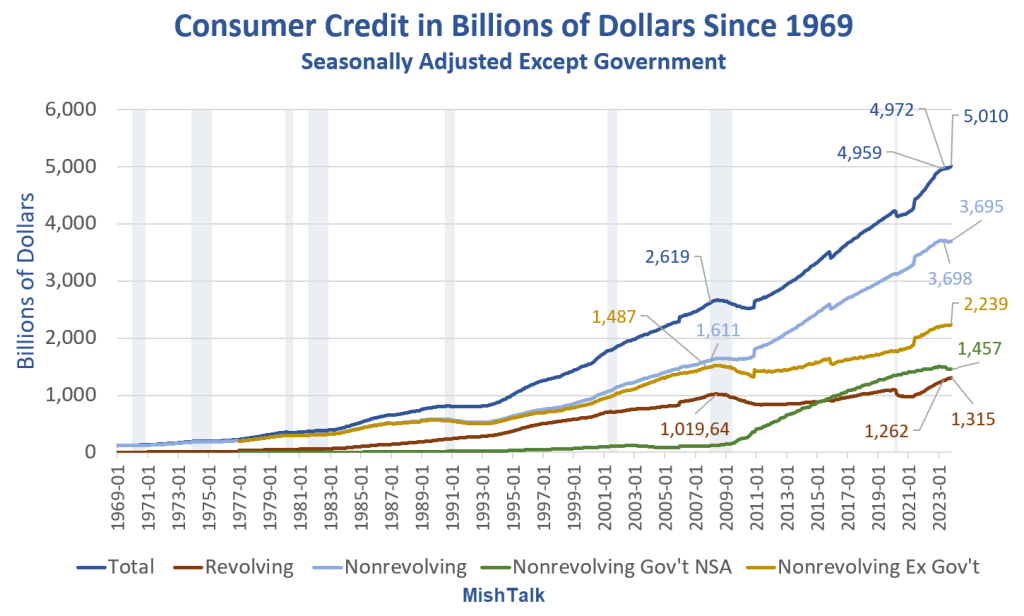

And how are consumers paying for this? I think you know the answer.

Fueled by Debt

Total consumer credit, revolving credit, and credit card interest rates all hit new record highs in November.

Consumer credit data from the Fed, chart by Mish

Consumer Credit Hits Record $5 Trillion

To explain the apparent strength in retail sales, please note Consumer Credit Hits Record $5 Trillion, Credit Card Rates Also Record High

Revolving (mostly credit card debt) is at a record high. For discussion, including a calculation of real, inflation-adjusted debt, please click on the above link.

More By This Author:

Average Price Of Used Tesla Declines 18 Straight MonthsExisting Home Sales Drop To Lowest Full Year Total Since 1995

When Will Record Housing Units Under Construction Impact The Price Of Rent?

Disclaimer: The content on Mish's Global Economic Trend Analysis site is provided as general information only and should not be taken as investment advice. All site content, including ...

more