Housing And Temp Help Signal Further Jobs Gains

“Davidson” submits:

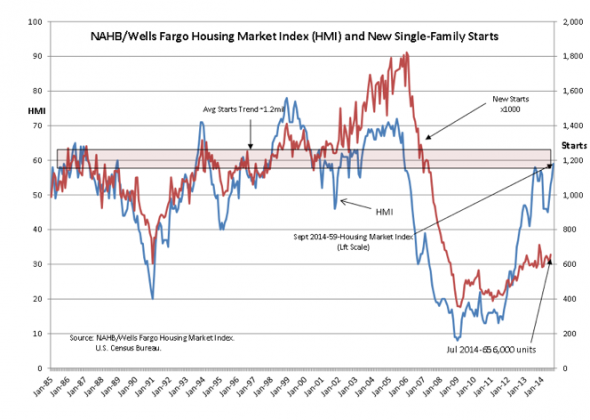

The National Assoc. of Home Builders Housing Market Index bumped 4pts to 59 with this morning’s report. Also this morning we had positive surprises from Lennar and Nucor, both highly cyclical issues. The general employment and other economic trends support improved housing and construction activity going forward. Higher employment in construction reflects somewhat easier even though historically tight lending conditions. I expect slow but steady increase in credit spreads unless the Fed makes a misstep which should result in further expanding economic activity.

Current conditions support a scenario in which our economy can continue to expand the next 5yrs-7yrs with equity prices to follow.

Things look very good to me for equity ($SPY) gains next several years.

My 2 cents:

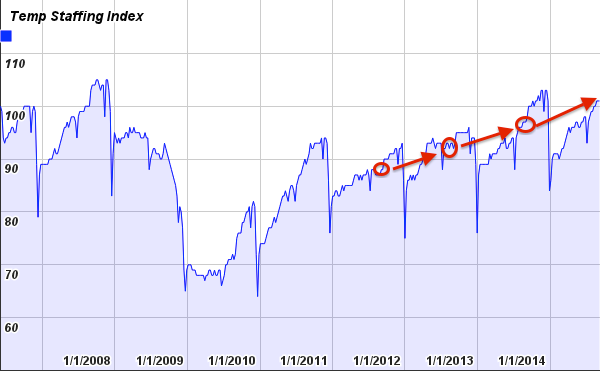

We can look no further than the temp help data for more proof of continuing employment conditions improvement:

The red dots/line correlate to week 36 from the past few years for comparison:

Temp help data leads non-farm payrolls by roughly 3-6-months meaning continued YOY gains here mean continued YOY gains for NFP.

The fact that are a whisper from last years holiday high level in September bodes very very well for employment data for the remainder of the year (auto sales are telling us the same thing).

Comments

No Thumbs up yet!

No Thumbs up yet!