Household Debt Cracks $17 Trillion For First Time Ever

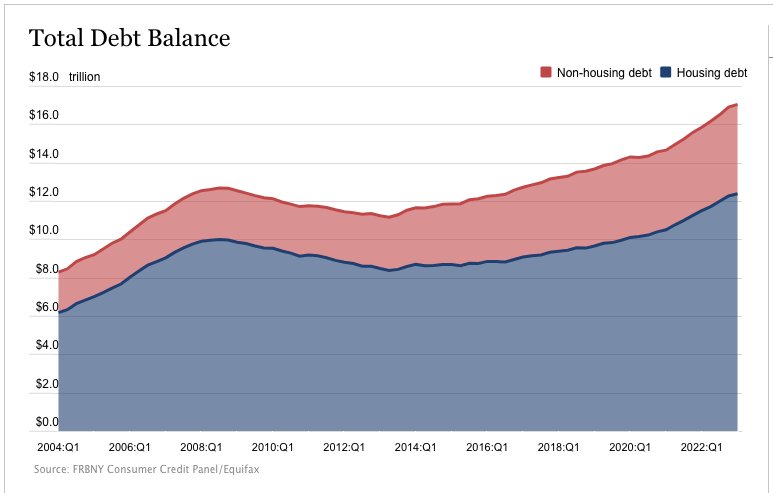

Total household debt eclipsed $17 trillion for the first time ever in the first quarter of 2023 as Americans wrestle with persistent price inflation.

After charting the biggest rise in 20 years during the fourth quarter, household debt climbed again in Q1, rising by $148 billion. The 0.9% increase pushed total household debt to $17.05 trillion, according to the latest data by the New York Fed.

Since 2019, household debt has climbed by $2.9 trillion even with a big drop in credit card debt during the pandemic.

Mortgage balances grew by $121 billion in Q1. Americans now owe $12.04 trillion in mortgage debt. Mortgage balances grew by nearly $1 trillion in 2022.

It appears that people are tapping into home equity in order to make ends meet as prices continue to rise. Balances on home equity lines of credit (HELOC) increased by another $3 billion during the first quarter. It was the fourth consecutive quarterly increase after a nearly 13-year declining trend.

Credit card balances typically decline in the first quarter as consumers pay down holiday debt. Not this year. Credit card balances remained flat at $986 billion in Q1, bucking the trend. It was the first time in 20 years we didn’t see a decline in credit card balances during the first quarter.

Looking at the monthly consumer debt data, we find that many Americans have turned to credit cards to make ends meet. Revolving credit, which includes credit card balances, surged in March, increasing by $17.6 billion. That was a whopping 17.3% annualized increase.

Meanwhile, the average annual percentage rates (APR) currently stand at 20.35%, with many credit cards charging well over that number. That means minimum payments are increasing, and it will cost consumers more to pay off those balances.

Other debt categories also charted increases in Q1. Auto loan balances increased by $10 billion in the first quarter. This also bucked the typical trend of balance declines in Q1. Student loan balances slightly increased and now stand at $1.60 trillion.

As debt rises, along with interest rates, Americans appear to be having a harder time keeping up with their payments. The share of current debt becoming delinquent increased again in the first quarter for nearly all debt types, according to the New York Fed report. This follows two years of historically low delinquency transitions. The delinquency transition rate for credit cards and auto loans increased by 0.6 and 0.2 percentage points, respectively during the first quarter.According to the New York Fed, delinquency levels are approaching or surpassing their pre-pandemic levels.

The only category that saw a decline in delinquency was student loans. Less than 1% of aggregate student debt was 90+ days delinquent or in default in Q1. According to the New York Fed, delinquency rates fell substantially in the previous quarter due to the implementation of the Fresh Start program, which made previously defaulted loan balances current.

The mainstream generally spins increasing household debt as good news. You’ll hear phrases like “robust demand” and “consumers continue to spend despite rising prices signaling economic health.” But an economy built on borrowing and spending has a limited shelf-life.

In reality, the surge in household debt signals that Americans are struggling to make ends meet as prices rapidly rise, and they’re burying themselves in debt to keep their heads above water. The stimulus checks are long gone. Savings are being depleted. The average person has no choice but to borrow.

This is a problem for the Federal Reserve as it tries to battle stick price inflation with higher interest rates. The longer rates stay elevated, the harder it will be for people to maintain these massive levels of debt. At some point, something has to break.

More By This Author:

Talk Is Cheap; What Will The Fed Actually Do?The Inflation Picture Is Even Worse Than Government Numbers Suggest

Federal Tax Revenues Tank As Biden Administration Goes Right On Spending