Homebuilder Sentiment Slumped (Again) In October Amid "Housing Affordability Crisis"

"It is difficult to get a man to understand something, when his salary depends on his not understanding it."

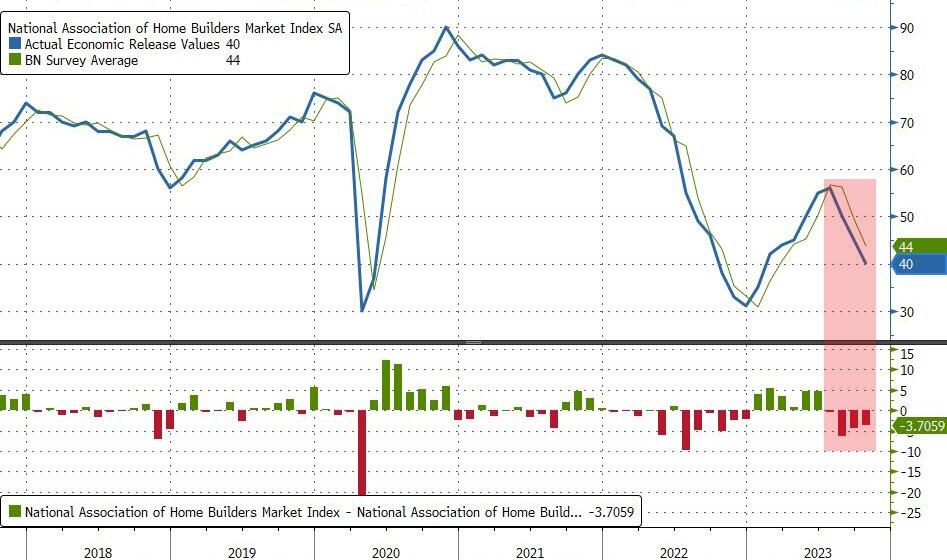

The quote - attributed to Upton Sinclair - sums up the blind optimism that has dominated homebuilder confidence data for the last six months. But reality is really starting to sink in and this morning's data for October shows another big disappointment as the headline NAHB confidence index printed at 9-month lows (down 5 to 45, vs 49 exp). That is the 4th straight monthly miss in a row (and 5 upside surprises)...

(Click on image to enlarge)

Source: Bloomberg

Alicia Huey, NAHB chair, said in a statement: “Builders have reported lower levels of buyer traffic, as some buyers, particularly younger ones, are priced out of the market because of higher interest rates."

Measures of current and expected sales, as well as a gauge of prospective buyer traffic, also dropped to their lowest levels since the start of the year.

(Click on image to enlarge)

Source: Bloomberg

Adding that “higher rates are also increasing the cost and availability of builder development and construction loans, which harms supply and contributes to lower housing affordability,” Huey said.

(Click on image to enlarge)

Source: Bloomberg

Builder sentiment in all four major US regions declined from a month earlier.

In order to get buyers to close deals in the current high interest-rate environment, many builders are offering financial incentives. The share of builders offering all types of buyer incentives rose to 62% this month, matching the cycle high reached in December.

And if homebuyer confidence is anything to go by, homebuilder confidence has a long way to go to catch down to the harsh reality of almost 8% mortgages (when median mortgage holders' rates are around 3-4%)...

(Click on image to enlarge)

Source: Bloomberg

If manipulating affordability lower was The Fed's goal, they failed.

“The housing affordability crisis can only be solved by adding additional attainable, affordable supply,” said NAHB Chief Economist Robert Dietz.

“Boosting housing production would help reduce the shelter inflation component that was responsible for more than half of the overall Consumer Price Index increase in September and aid the Fed’s mission to bring inflation back down to 2%. However, uncertainty regarding monetary policy is contributing to affordability challenges in the market.”

And don't expect them to be building homes at the same pace (building permits are about to plunge)...

(Click on image to enlarge)

And the sudden realization by homebuilders that this is more than transitory - and their margins can't keep soaking up incentives forever - then the real pain is yet to come.

More By This Author:

BofA Reports Best Ever Q3 Earnings Even As Held-To-Maturity Losses Soar By $26 BillionUS Taps 2,000 Troops for Potential Deployment To Support Israel

Yields, Stocks, & Crypto Jump; VIX, Gold, & Crude Dump

Disclosure: Copyright ©2009-2023 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more