Holiday Sales Rose 7.6%, Better Than Expected

Holiday sales rose more than expected this year as American spending remained resilient during the critical shopping season which runs from November 1 to December 24 — despite surging prices on everything from food to rent and continued worries about a recession just ahead, according to one measure.

Holiday sales rose 7.6%, a slower pace than the 8.5% increase from a year earlier when shoppers began spending the money they had saved during the early part of the pandemic, according to Mastercard SpendingPulse, which tracks all kinds of payments including cash and debit cards.

Mastercard SpendingPulse had expected a 7.1% increase, so the 7.6% rise announced earlier this week was stronger than forecast. The data released Monday excludes the automotive industry and is not adjusted for inflation, which has eased somewhat but remains painfully high.

By category, clothing rose 4.4%, while jewelry and electronics dipped roughly 5%. Online sales jumped 10.6% from a year ago and in-person spending rose 6.8%. Department stores registered a modest 1% increase over 2021.

“This holiday retail season looked different than years past,” Steve Sadove, a senior advisor for Mastercard, said in a prepared statement. “Retailers discounted heavily, but consumers diversified their holiday spending to accommodate rising prices and an appetite for experiences and festive gatherings post-pandemic.”

Some of the increase reflected the impact of higher prices across the board.

Consumer spending accounts for nearly 70% of US economic activity, and Americans have remained resilient ever since inflation first spiked almost 18 months ago. Cracks have begun to show, however, as higher prices for basic necessities take up an increasingly large share of everyone’s take-home pay.

Inflation has retreated from the four-decade high it reached this summer, but it’s still sapping the spending power of consumers. Prices rose 7.1% in November from a year ago, down from a peak of 9.1% in June.

Overall spending has slowed from the pandemic-infused splurges and shifted increasingly toward necessities like food, while spending on electronics, furniture, new clothes and other non-necessities has faded somewhat. Many shoppers have been trading down to private label goods, which are typically less expensive than national brands. They’ve also been going to cheaper stores like Dollar chains and big box stores like Walmart.

Consumers also waited for deals. Stores expected more procrastinators to hit stores in the last few days before Christmas compared with a year ago when people began shopping earlier due to a global disruption of supply chains which created thousands of product shortages.

“Consumers are trying to spread out their budget, and they are evaluating and shopping at different stores,” said Katie Thompson, the lead of consultancy Kearney’s Consumer Institute.

In November, shoppers cut back sharply on retail spending compared with the previous month. Retail sales fell 0.6% from October to November after a sharp 1.3% rise the previous month, the government said in mid-December. Sales fell at furniture, electronics, and home and garden stores.

A broader picture of how Americans spent their money arrives next month when the National Retail Federation, the nation’s largest retail trade group, comes out with its combined two-month results based on November-December sales figures from the Commerce Department.

The trade group expects holiday sales growth will slow to a range of 6% to 8%, compared with the blistering 13.5% growth of a year ago.

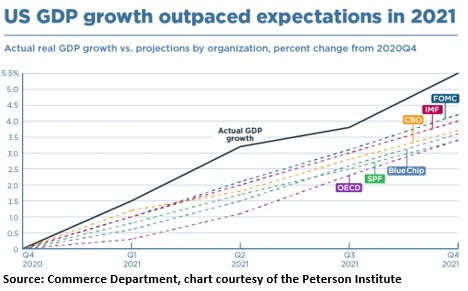

Most forecasters had expected holiday sales to fall off some this year since the economy has not been nearly as strong in 2022 as it was in 2021. Gross Domestic Product rose at a strong 5.5% annual rate by the end of last year, only to cool off significantly with the beginning of this year.

GDP growth this year declined modestly in the 1Q and 2Q but then jumped by 3.2% (annual rate) in the 3Q. Despite the rebound in the 3Q, GDP in 2022 is not expected to end-up anywhere near the 5.5% jump in 2021. So, the rise in holiday sales of 7.6% this year, versus 8.5% for the same period last year, did not come as a big surprise.

What did come as a surprise this month were the latest economic projections for the US economy from the Fed Open Market Committee on December 14. The Fed now forecasts economic growth of only 0.5% for 2023 and 2024. That is down significantly from the Fed’s projections earlier this year.

While the Fed’s latest projection of +0.5% for 2023-2024 does suggest we will avoid a recession next year, most analysts were disappointed to see the Fed projecting a super-slow economy for the next two years.

For what it’s worth, I think there is a good chance consumer spending may beat the Fed’s latest estimates over the next two years, assuming there are no big negative surprises in the economy. I’ll have more to say on this in the weeks just ahead.

More By This Author:

Congress Crafts Record Federal Spending Bill For FY2023Americans’ Net Worth Plunges In 2022

3Q GDP Rises Again, Fed’s Jerome Powell Remains Hawkish, But…