Higher Individual Bullish Investor Sentiment, Weaker Forward Equity Returns?

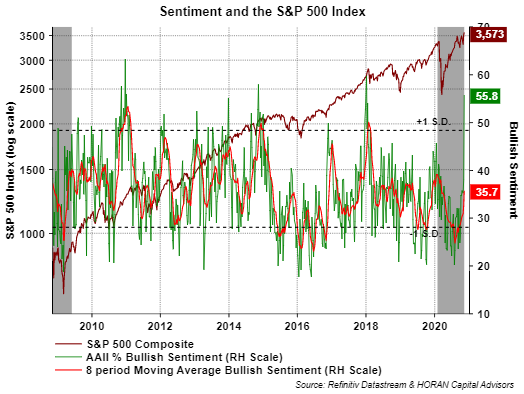

Based on this week's AAII Sentiment Survey, over the course of one week, individual investors are now super bullish. The survey notes bullish investor sentiment jumped 17.9 percentage points to 55.8%. The below chart shows bullish sentiment is above the plus one standard deviation level. From week to week the sentiment readings can be volatile; thus, looking at the 8-period moving average removes some of this volatility. For this week the 8-period moving average of the bullishness reading is 35.7% and far below an extreme.

With investor sentiment readings being contrarian measures, the below chart shows, the 12-month forward return for the S&P 500 Index tends to be low or negative when the bullishness reading is at a high level. Complicating the outlook today is the situation with the Covid-19 virus and the recent spike in cases. Additional lockdowns would most likely place downward pressure on business earnings and the equity market.

Disclaimer: The information and content should not be construed as a recommendation to invest or trade in any type of security. Neither the information nor any opinion expressed constitutes a ...

more