High-Quality Natural Gas E&Ps Are Strong Buys

It's been a long time since I've come across a group of high-quality companies selling at truly depressed valuations. Sure, I've found plenty of undervalued stocks in the past few years, but the last time I was almost giddy about valuations was in 2011. Then, it was the homebuilders that became my target. Today, it is high quality natural gas E&Ps.

Video Length: 00:07:31

What makes the quality natural gas E&Ps so attractive is a combination of factors. Certainly, the historically low natural gas prices are part of the formula. The depressed stock prices are certainly a major element, as well. However, there's also a bigger macro trend at work. There's a strong case that demand growth for US natural gas could exceed expectations over the next decade. This combination of depressed stock pricing and significant macro tailwinds could make the quality gas E&Ps excellent buys for long-term investors.

Natural Gas Prices

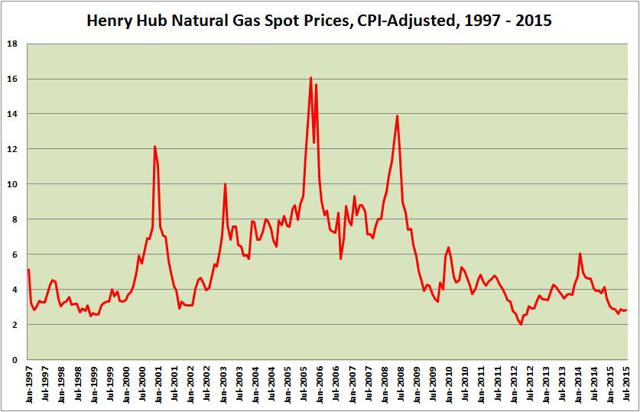

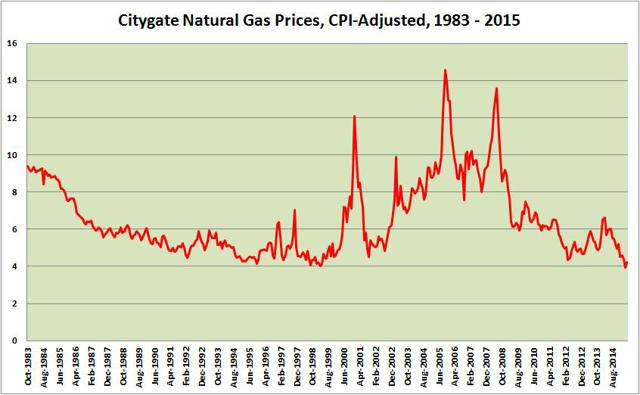

Natural gas prices have plunged alongside of oil in the past few months. Prices are now near historic lows based on inflation-adjusted figures. The Henry Hub spot price has fallen below $3 in 2015, while the current Citygate spot price is likely below $4.

Click on picture to enlarge

Source: Created by author

Click on picture to enlarge

Source: Created by author

On one hand, this looks bad for natural gas E&Ps. Obviously, lower prices don't help the producers of natural gas. At the same time, this is actually quite a bullish indicator.

For starters, from a contrarian value perspective, you want to invest when the prices are low. This creates more limited downside and higher upside. With natural gas being in what is essentially a 7-year bear market and now at multi-decade inflation-adjusted lows, there's simply less that can go wrong.

More importantly, however, is the fact that after researching several of the low cost players in the industry, it seems very unlikely to me that prices (and more importantly, spreads) can stay this low. With Henry Hub under $3 for any considerable period of time, it's likely that we'll see significant cuts in production, which would set the stage for a future spike in prices.

The Players

Let's establish the players. When I speak of "high-quality" and "low-cost" natural gas E&Ps, I'm speaking of a select group of companies. The four that I am most familiar with are Antero Resources (NYSE:AR), Ultra Petroleum (NYSE:UPL), Range Resources (NYSE:RRC), and Cabot Oil & Gas (NYSE:COG).

However, you could throw in several more names. Rice Energy (NYSE:RICE) is noted as one of the lower-cost producers, but I know little about them. EOG Resources (NYSE:EOG) is also in that bucket. Then, there are several names that are more of a blend of oil and gas producing assets including Chesapeake Energy (NYSE:CHK), Devon Energy (NYSE:DVN), and Anadarko Petroleum (NYSE:APC).

While I haven't researched every company, the attributes I seek are as follows:

(1) Low-cost producers of natural gas,

(2) Strong balance sheet or hedging strategy,

(3) Assets weighted heavily towards the natural gas side as opposed to oil

(4) Depressed valuation

While I've kept an eye on Chesapeake and Devon, those companies are not my top recommendations precisely because they violate attribute #3. I am, in fact, not bullish on oil long term and believe there's a possibility that oil prices could stay depressed ($30 - $40 per barrel) or semi-depressed ($40 - $50 per barrel) for a long time. Even in a best-case scenario, it's difficult for me to envision oil shooting up beyond $75 per barrel for any extended period of time.

I am much more interested in the natural gas side of the equation, where we're in the middle of a 7 year bear market, but fundamentals for demand growth look reasonably strong.

Macro Tailwinds

There are two trends that could be major tailwinds for US natural gas demand. The first is natural gas exports. There's been a considerable amount of writing done on the potential of LNG exports to European and South American markets, where natural gas prices are higher. There are many prominent investors, including Carl Icahn and Seth Klarman, buying into this idea with significant stakes in Cheniere Energy (NYSEMKT:LNG), as well. LNG exports are heavily regulated in the US and this has been a hot-button issue in the energy industry. However, with or without deregulation, LNG exports are likely to increase significantly in the coming decades.

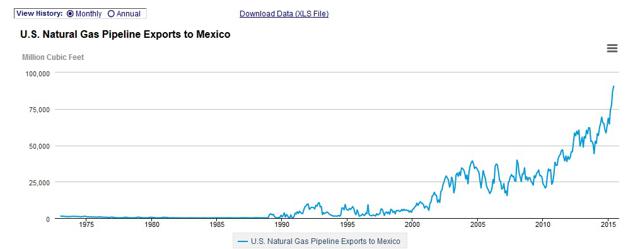

Perhaps less noted, however, is the significant increase in natural gas exports to our neighbor in the south: Mexico. In 2013, Mexico began deregulating its energy markets, which opened the door for more US natural gas imports into the nation. Natural gas exports to Mexico nearly tripled from 2010 to 2015. Moreover, exports are expected to increase significantly in the coming decade, as well. The growing export trade to Mexico hasn't received as much attention as the more controversial LNG trade, but it showcases why natural gas's prospects look so bright.

Click on picture to enlarge

Source: Created by author, EIA

The second trend that could be a tailwind for natural gas is electric vehicles. While the EV market is presently a very small percentage of the overall auto market, the technology is rapidly advancing. As prices fall, EVs will eventually become more attractive than traditional autos powered by the internal combustion engine.

It's also a mistake to view this merely as environmentalist hype. Electric power is a cheaper fuel source than oil and EVs have much lower maintenance costs, as well. The only real hurdles to mainstream adoption of EVs are range and price. The EVs that are somewhat affordable to middle class consumers have dismal range. For instance, the 2015 Nissan Leaf retailed for $29,000 and had a range of a mere 84 miles. Even the luxury EVs, such as those made by Tesla (NASDAQ:TSLA), only have a range of about 300 miles.

With improvements in battery technology, it's likely that EV prices will continue to fall and the range of EVs will continue to improve. At some point, EVs are simply going to be a superior economic choice for many consumers. It's not difficult to imagine in 2025, EVs with a range of 400+ miles selling at prices that are competitive with oil-powered autos. If that's the case, urban and suburban consumers will likely begin to adopt them in greater numbers. The infrastructure for EVs will also begin to develop, encouraging even further adoption.

We shouldn't get carried away with this, because there are still many hurdles to mainstream adoption. I've also learned after 8 years of investing, that it can be tricky predicting the precise timing for things like this. Sometimes, we see technological advancement happen much faster than we expect, and sometimes it's much slower.

Yet, the numbers don't have to be overwhelming to change the economics of energy. Even if we only see 10% - 20% of auto consumers purchasing an electric car in 2025, that's a pretty big shift. It has the potential to significantly increase the demand for power from electric utilities and decrease the demand for oil. As demand increases from electric utilities, we'll see increased demand for natural gas.

It should be noted that in the state of Georgia, electric vehicle sales now account for 1.6% of the new car market. In California, it's about 1.4%. While these are the two states with the highest adoption rates, this certainly showcases why EVs accounting for 10% - 20% of the market by 2025 is not very far-fetched.

All of this can be factored in on top of an already-ongoing trend. Since 2008, when natural gas prices plunged, gas has been slowly displacing coal in the hierarchy of American energy sources. While alternatives have grown, as well, the fact of the matter is that even if solar costs continue to fall, it's still not base load power, and there will still be a heavy demand for base load power forms such as natural gas, coal, and nuclear. It just so happens that natural gas is becoming the most economically viable of the three.

Given all this, it's fair to say there are significant tailwinds for the US natural gas market. Low prices are already driving higher demand. Further demand growth should come from exports to Mexico, LNG exports, and the emergence of electric vehicles. Even if the supply of natural gas has grown considerably, there are reasons to believe that demand will continue to grow significantly, as well.

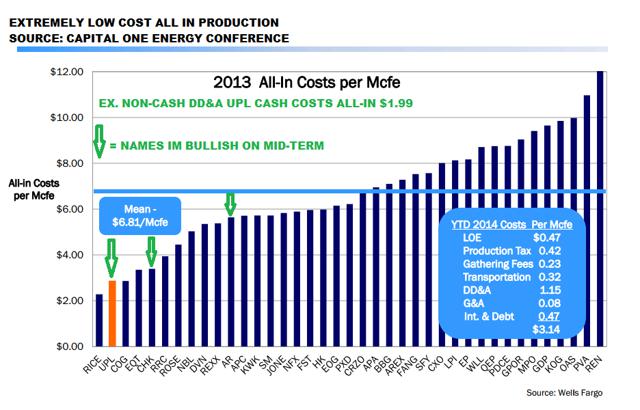

Low Cost Producers

The chart below is a bit outdated since it comes from 2013, but does provide a good reference point for low cost producers of natural gas. Included are Rice Energy, Ultra Petroleum, Cabot Oil & Gas, EQT Corporation (NYSE:EQT), Chesapeake Energy, Range Resources, and Antero Resources.

Click on picture to enlarge

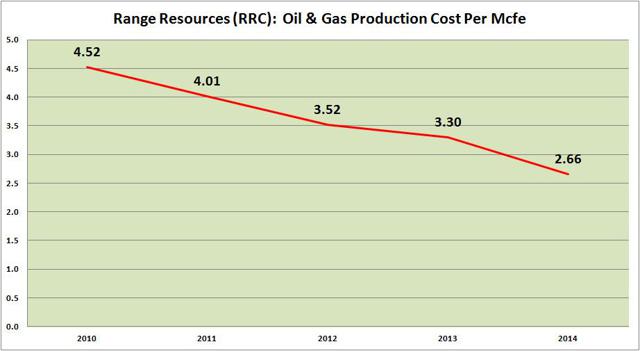

Range Resources stands out as one of the most notable producers in the cost-cutter category. RRC's production cost per Mcfe fell from $4.53 in 2010 down to $2.66 in 2014. This was driven by several factors including lower direct operating expenses, reduced overhead, and lower charges for depletion, depreciation, and amortization.

Click on picture to enlarge

Source: Created by author

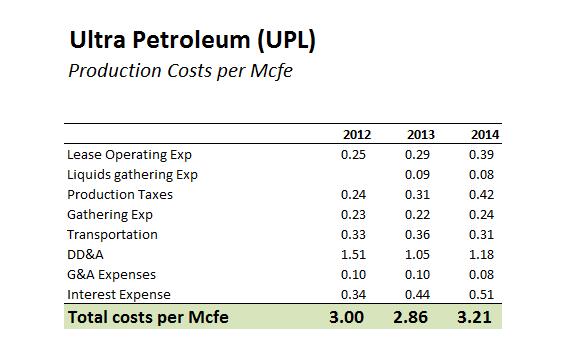

None of the others I've examined were quite that dramatic, but nevertheless, producers like Antero Resources and Ultra Petroleum continue to run low-cost operations. Ultra Petroleum has seen production costs in the $2.80 - $3.40 per Mcfe range for the past few years.

Source: Created by author

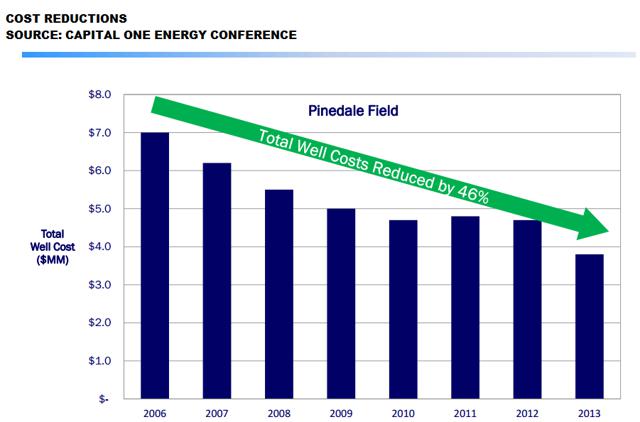

The company has improved efficiency at its Wyoming based Pinedale wells, too. While their production costs were higher than RRC's in 2014, they are still relatively low for the industry.

Click on picture to enlarge

Source: Author, Ultra Petroleum

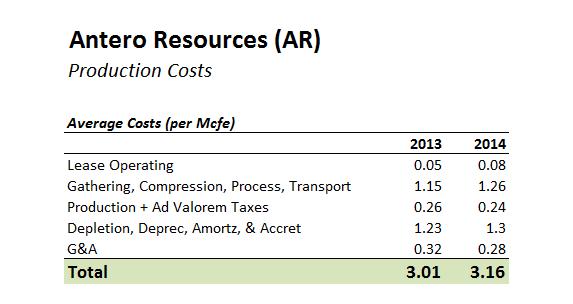

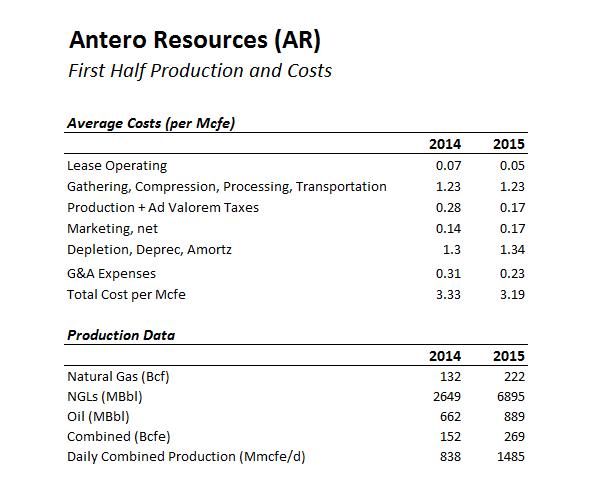

Antero Resources saw its costs rise slightly in 2014, but has seen both production improvements and cost efficiencies thus far in 2015.

Source: Created by author

Antero has seen its daily production rise by 77% in the 1st half of 2015 (vs 1st half of 2014) and has still managed to reduce its total cost per Mcfe from $3.33 to $3.19.

Source: Created by author

There are several takeaways from this data for me. The first is that with the recent price plunge, none of these producers look very profitable without hedges. The second is that all the producers appear to be improving on a lot of metrics.

However, the fact that none of these low-cost producers look that profitable at current prices is not necessarily a bad thing. It means something has to give. Either prices have to go up or production costs have to go down in the long-run. I expect that it will be a combination of both in reality, but I can't see this pricing environment dragging on for much longer than 6 - 12 months without some production cuts. While it might take some time for prices and spreads to rebound, now is the time to buy in my view.

Oil is Global, Natural Gas is Regional

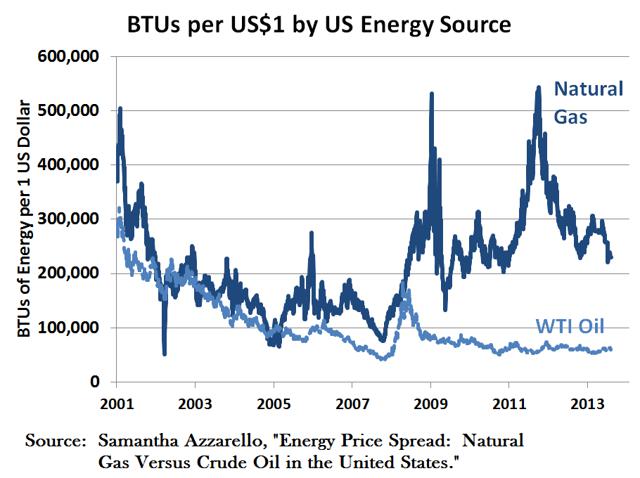

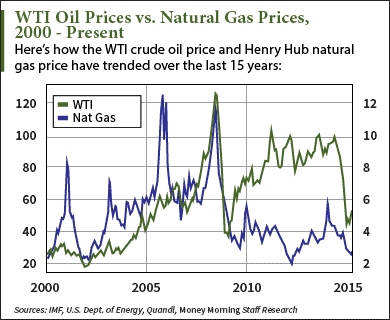

One thing worth nothing here is that the oil price plunge is actually a reversion towards the historical mean. For most of the past several decades, the prices of oil and natural gas have been very highly correlated. That changed around 2008 when natural gas prices plunged, but oil prices shot back up. The reason for this is that oil is global and natural gas is more regional. China's Asset Bubble was one of the major causes behind inflated global oil demand, but it did not impact US regional natural gas prices.

Click on picture to enlarge

With the Chinese markets suddenly plunging, oil prices are reverting back towards their historical pattern, as well. Here's a more another version of the chart above from Money Morning. This version is more updated and looks at the two fuels merely from a price perspective rather than a BTU per $1 perspective. You can see that oil prices are now converging more closely towards natural gas prices.

Click on picture to enlarge

While natural gas prices have fallen considerably on a global basis in the past year, LNG prices in places such as Europe, Japan, and South America are still significantly higher than production costs here in the US. If the LNG export trade heats up, it's completely possible that natural gas prices start to see more convergence globally, as well. This doesn't necessarily mean that prices in the US will be the same as prices in the Czech Republic or Japan; but it could mean the gap between prices in different markets shrinks over time. This would be bullish for US natural gas, but bearish for natural gas in some other nations.

Valuations are Very Low

Now that I've made the macro case, it's time to make the micro case. I plan on researching more names in the natural gas E&P sphere in the upcoming weeks, but for now, I want to focus specifically on Range Resources, which I believe best exemplifies the trend.

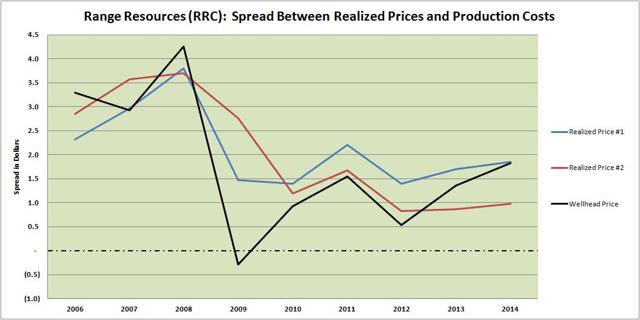

The chart below takes a bit of explaining, but we'll get there. It shows the spread between "realized prices" and "all-in production costs" for Range Resources. The all-in production costs include G&A expenses, depletion, and ad valorem taxes, so this is not the same as "cash costs."

The "realized price" picture is a bit trickier. I've included 3 different measures used in RRC's financial statements. The first is "Realized Prices including Derivatives." The second is "Realized Prices including Derivative Settlements and Third Party Transport." The third is technically not a realized price, but rather "Average Wellhead Sales Price." The second metric seems to be the most reliable indicator of profitability to me, but thought it was worthwhile to examine all of them.

Click on picture to enlarge

Source: Created by author

The takeaway for me is that RRC, using Realized Price #2, has generated spreads in the $0.80 - $4.00 per Mcfe range historically. We are currently in a natural gas bear market, so not surprisingly, they have been on the low end of that in the past few years at around 80 - 100 cents per Mcfe. Based on current prices, they are likely generating a spread lower than 50 cents per Mcfe right now. Yet, if RRC, one of the lowest cost producers, is seeing such a weak spread, then nearly every other company in the natural gas space is struggling, as well.

Assuming, as we might, that we valued RRC's proved reserves at a mere $1 per Mcfe, that translates to an equity value of about $41. That's about 20% higher than it's currently selling (at around $34) as I write this. So basically, assuming that RRC continues to generate the historically depressed spreads of the past few years, then the stock should still be worth a bit more than its current price.

Where this starts getting interesting is when you begin to look at scenarios where E&Ps are able to obtain more reasonable price realizations. At a price of $1.50 per Mcfe of proved reserves, RRC's valuation should jump to about $70. At a price of $2 per Mcfe, the valuation jumps to $100. At $3 per Mcfe, the valuation jumps to $165.

The big takeaway here for me is that RRC it only takes a little bit of pricing improvement to see big gains in the underlying valuation picture. Even a return to a moderate pricing scenario could produce stock returns in the 100% - 200% range and a more bullish scenario could produce returns as high as 600% - 800% on some of these stocks.

On the other hand, even if natural gas prices stay semi-depressed for the next several years, the stock prices are low enough so that it's possible that you could still come out OK. Maybe you don't make spectacular returns, but you're probably not losing your shirt, either.

Conclusions

High quality natural gas E&Ps are cheap. This is a classic risk-reward play. Given the current depressed pricing environment, the downside risks for the low-cost producers are likely limited. Conversely, in a scenario where natural gas returns to a bull market environment, the quality gas E&Ps could see returns as high as 600% - 800%.

UPL, AR, COG, and RRC all look attractive here. If you're buying in, be prepared for further bloodshed as it's completely plausible that things get worse before getting better. In the short-term, some of these stocks could still take 25% - 50% hits. Yet, the lower the stock prices become, the more attractive.

What makes these stocks even more enticing is that there are significant macro tailwinds for natural gas. All of the companies I listed could see significant growth over the next decade. In a best case scenario, we could see improved price spreads, coupled with major volume gains, which could supercharge profitability and cash flows in the future.

Overall, I see the natural gas E&P sphere as the single best sector for investment right now.

Disclosure: Author is long UPL, RRC, AR, and COG.

Wow, I'm really becoming a fan, Jake. Clarity and thoroughness, such a great combination.