High Frequency Trading, PPI Misreads Helped Fuel A Short Squeeze... Now What

Action to Take: With inflation and jobs behind us, it’s time to shift our focus 6,700 miles west to Tokyo. The Bank of Japan appears poised for another rate hike next week, with odds now at 77%. Last August’s unexpected BOJ move sparked a massive selloff in U.S. markets, sending the VIX soaring above 60 in the sharpest drop since Covid. While this hike is more anticipated, Japan is a major holder of U.S. Treasury debt (second to the Federal Reserve.) It's time to pay close attention because the mainstream press appears to have buried the lede, and we will be vigilant.

This is already showing up in Japan’s bond market. Japan’s 40-year government bond yield hit its highest level ever at 2.755%, and 20-year yields are the highest since 2011. Japanese traders, expecting a BOJ rate hike, are likely selling U.S. Treasuries to prepare, adding pressure to global debt markets.

Monitor the VIX for early warning signals. A sudden spike in volatility could easily trigger the market downturn on the back of last weeks’s squeeze. With memories of August fresh in mind, stay defensive until major indexes prove they can break above current resistance.

--------------------------------------------------------

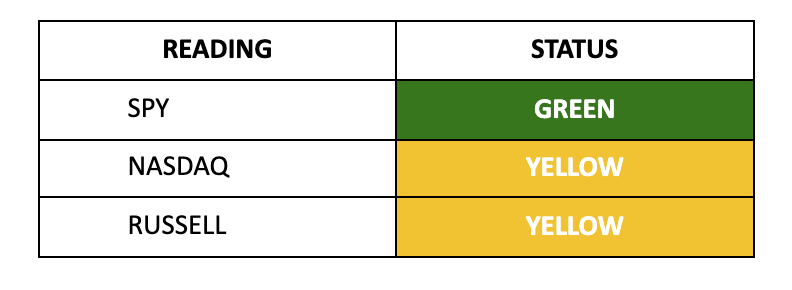

Momentum: Positive for the S&P 500, Even for the Russell 2000.

Wednesday brought one of the strongest CPI-driven market reactions in recent memory, as cooler inflation data triggered a short squeeze. Massive amounts of HFT were involved in Wednesday’s session, with 81% of stocks higher as short sellers scrambled to cover their bets. There’s no way that this many stocks surged because of “fundamentals” or whatever else we’ve been spoonfed to believe these are rational times.

The Nasdaq shot up 2.3%, the S&P 500 gained 1.8%, and while the Russell got off to a strong start, it struggled to sustain buying volumes.

Most sectors had a solid day, with 10 out of 11 seeing improved capital flows. However, utilities lagged, and consumer staples sat out the rally, ending flat. Despite the surge, all three major indexes remain in downtrends.

I’ll explain what this means for the S&P 500 in a moment.

Insider Buying: A Rare Positive Ratio (Blackout Period)

-

The ratio of Buys to Sells: 1.25:1 ($345M to $275M)

-

Top Buy: $336M of Immunovant (IMVT) by 10% Owner Roivant Sciences

-

Top Sell: $79M of Gulfport Energy Corp (GPOR) by 10% Owner Silver Point Capital

Immunovant raised $450 million through a PIPE deal with a healthcare fund, a mutual fund, and Roivant Sciences. The company, partly owned by Roivant (founded by Vivek Ramaswamy), will use the funds to advance its drug pipeline, including its lead autoimmune therapy, IMVT-1402.

Liquidity: We finally got some relief in the funding markets Wednesday, as cooler inflation sparked an aggressive bond rally that sent the 10-year yield tumbling 14 basis points to 4.65%. This pullback from recent highs has eased pressures weighing on risk assets. But don’t get too comfortable—next week's transition brings fresh uncertainty around fiscal policy and Treasury supply that could quickly push yields higher again. We’ll better understand where things stand with next week’s 10- and 20-year Treasury auctions. CrossBorder Capital said its liquidity measure decreased by about $1 trillion since December.

Market outlook:

-

10-year Treasury yield finds footing at 4.68% after biggest drop since November. But don’t get overly comfortable here.

-

WTI pulls back to $78.50 after hitting a six-month high; EIA reports eighth straight inventory decline, and new sanctions on Russia are catalysts for now.

-

G7 nations eye price floor for critical minerals on China concerns; Canada leads push for market stabilization ahead of June summit. What are the unintended consequences of these actions? We’ll find out.

-

Treasury moves to lock in Russia sanctions ahead of transition by adding Congressional review requirement in an attempt to Trump-proof sanctions

-

Transportation Department targets airlines over delays; sues Southwest (LUV), fines Frontier (ULCC)

-

Prominent short-seller Hindenburg Research closes shop, ending 7-year run of high-profile short reports

Lower highs… and lower lows.

We preach these things about our signals and how capital flows through the market. While we’re sitting in Green territory - aided by huge volumes- one can see the fingerprints of algorithms on yesterday’s surge.

As I’ve noted… markets don’t go straight down. And algos will drive trading in unexpected directions based on headline numbers. For two days, we’ve pushed back up to the top of a downward channel. This is evident in that push since the PPI number was released on Tuesday.

You can draw a straight line down across that channel from the early days when our signals first turned negative. And, you can find short-term oversold reversals from December 20, January 3, and January 13.

All heavy volume… and all based on… what underlying improvement in the state of affairs?

I spent some time yesterday re-reading the PPI report. And there’s really nothing to cheer about. Here’s Yahoo! Finance covering the PPI report.

“The Producer Price Index, which tracks price changes companies see at a wholesale level, rose 3.3% over last year, up from 3% in November but less than economists expected. It rose 0.2% over the previous month, also less than expected.”

But… PPI went up to 3.31%.

Why? Services.

Services accelerated back to 4%, the highest move since February 2023. This is EXACTLY the problem that the Federal Reserve faces. Services are sticky on prices in a service-based economy.

In economics, which no one cares about anymore based on national conversations, services are intangible acts or actions people pay money for. Examples include barbering, healthcare, education, and phone repair.

They’re not something you can hold or store in your home.

Wages are an important component of this - which is why tomorrow’s job report is so important. If we see wage growth increase sharply - especially in healthcare - that’s a reason for concern about rate policy. Wage spirals remain a serious threat.

Oh - there’s more, by the way. They also revised the PPI from November to 3%, a small but upward tick higher than the previous 2.98% figure. But that’s still going in the wrong direction.

This is all ahead of this month’s bigger move in oil and gas prices, which are important parts of the household budget in America.

This is where the accounting of PPI measurements can get fuzzy and confusing. Oil prices have collapsed in the last two years - since that hedge fund selloff we signaled on June 8, 2022. We didn’t know why selling started - just that it did. And by two Fridays later, after a huge drop in the S&P 500, we found out that hedge funds sold at their biggest rate in 15 years, according to the Commitment of Traders Report.

WTI crude collapsed in a post-Ukraine War launch runup.

Since then, oil prices have dropped significantly, from nearly $120 per U.S. barrel to the mid-$60s. However, that selling has stopped, and we’ve seen a prolonged push higher on oil since late December.

Falling oil prices offset the huge runup in services inflation, which economists like Paul Krugman and members of the Federal Reserve have ignored.

The energy portion of the PPI figures jumped by 3.5% in December compared to the previous month. However, because oil prices had been dropping throughout the year, the headline will say that energy prices are down 2% over 2024.

This is one reason economists remove energy and food from the PPI number to give us a “core reading.” However, the core reading ignores what people buy.

But even the Core Reading was up 3.55% in December over the year. Again - another surge we haven’t seen since… February 2023.

As I’ve noted… we printed too much damn money in the last few years - even if Janet Yellen isn’t willing to admit that inflation is a monetary phenomenon.

This is all happening while the Fed has been cutting interest rates and failing to do what it should have done in 2022-23: raise the Fed Funds rate to at least 6% and push the economy into a much-needed reset. We didn’t get that, though—we got politics.

I can’t sit here and scream at Jerome Powell without yelling more at Janet Yellen, Ben Bernanke, and Alan Greenspan, all former Federal Reserve Chairpersons whose policies have compounded into today’s fiscal situation - the consequences of the cheap-money era, which got looser and looser until it went.

Four years later, our purchasing power has “officially” declined by about 22%.

However, logic says the figure is much higher when you dig into the data.

In early 2022, I pointed out that Federal Reserve Chairman Jerome Powell had quietly forecasted that inflation would not be normalized until 2025—even though the market expected it to be tamed that year.

Surprise, Powell has pushed that number to 2027 now… and that’s when it will be another Federal Reserve Chair’s problem.

Meanwhile, Yellen—an architect of crisis in the last 30 years—will have long retired to the speech circuit, where she will deny that policy actions happened and that the consequences can’t be attributed to her.

This year is shaping up to be much more volatile than I first expected. The algorithms will take advantage and pull retail investors in every direction. I wouldn’t be shocked to see this rug pulled sooner than later…

We can thank our policymakers…

Keep your hands and feet inside the ride at all times.

Stay positive.

More By This Author:

Breaking Even And The Week Ahead

A Zombie Stock Market Races Toward The Inevitable

MicroStrategy To QQQ, Bitcoin To The Moon?