Here’s Why Jackson Hole Is Pivotal

The Jackson Hole Symposium is mostly an academic endeavor with a heavy Federal Reserve flavor. The vast majority of what's discussed there will not be market moving; more market yawning. However, Chair Powell and his gang are there, and what he says can matter hugely. He may say nothing! Or he may say a lot. Either way market rates will hang on his early word.

The annual Jackson Hole Economic Symposium will be held 25-27 August

Easier financial conditions sets the scene for a hawkish Chair Powell

We are facing into quite a critical period for market rates. The immediate focus is on Jackson Hole in the coming couple of days, with Chair Powell due to speak at 10:00 am on Friday morning. We’ll get some sound bites over the course of Thursday, but that Friday 10:00 am script will be the most important of the lot. The market discount has notably shifted in the past couple of weeks in anticipation of an expected hawkish tone from Chair Powell. The rationale for this is the growing realization that central banks are ready to home in on taking underlying inflation down as best they can, even at the cost of macro weakness. And how do they do that? They tighten financial conditions. In fact, that’s all they can really do.

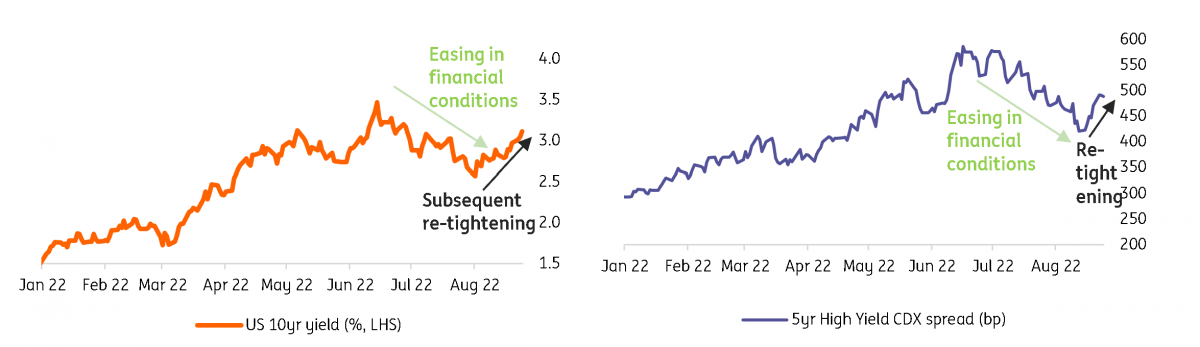

The issue that must have perturbed the Fed since end-June has been the tendency for financial conditions to ease. In fact on the Bloomberg measure, financial conditions had moved from a point of tightness at end-June to one of near normality a week or so ago. Conditions have tightened since, as market rates have risen, credit spreads have widened and the dollar strengthened. It’s not all about these three, but they have dominated the US measure in the past number of months. But here’s the issue – even though the Fed has raised rates by 225bp since March, US financial conditions are back to where they were in February (before the first Fed hike). It’s not quite a simple as that, but the facts as reported are accurate.

US financial conditions are re-tightening, but not by enough yet

(Click on image to enlarge)

Source: Macrobond, ING estimates

As the Fed can only control financial conditions, and as the Fed deems it a policy objective to tame inflation by cooling the economy, the net outcome needs to be a further tightening in financial conditions. This is why the market, rightly, expects a hawkish tint from Chair Powell when he gets up to speak. Now there is a chance that Chair Powell says very little. His script is set to be on the economic outlook, which could turn out to be quite bland.

In fact, he could choose to walk quite a non-committal track; he does not have to make any bold statements at all! If Chair Powell likes what he sees, a balanced text with a hawkish tint is the probable outcome; one that nods indirectly to hikes to come beyond September.

Risk assets are fearful that Chair Powell will harden the market discount

In all probability, Chair Powell will be quietly content that market rates have been edging higher and credit spreads re-widening of late, as this helps engineer the tightening that needs to be done. That way the Fed can endorse the market-made re-tightening in financial conditions with a hike in September. The color of that hike will likely remain unclear, as we have key payrolls and inflation reports to get through before the 21st September FOMC, and Chair Powell in consequence will not pre-commit at this juncture. In consequence, the market won’t either. Expect the discount to remain split between a 50bp and 75bp hike, with only a moderate bias towards 75bp.

What’s laid out above is what we think will happen – a hawkish tint, but not dramatically so. There is a risk that the market has overdone the build for a hawkish commentary, which could unwind some of the rate hike discount. As it is the funds rate is expected to get up towards 3.75%. There is room for that to be dialed back a tad. But at the same time, this is a great moment for Chair Powell to batten the hatches down, harden that discount and tempt a trend towards 4%. Something like that is what risk assets and bond markets fear, which is in part why they have been trading as they have been. We will only know once Chair Powell has stood up to say his piece.

Direction? US 10yr to 3.25%, but 3.5% still the peak

Our directional viewpoint remains as was. The 10yr has broken above 3%, a move we had called for (here). We further argued that a trend towards 3.25% was probable (here), and we remain of that view. At the same time, we also called the peak for the 10yr hit at 3.5% in June some 10-day after hitting it (here); we also maintain that view. When we made that call we also noted we could get back up there.

The danger point ahead is a break above that 3.5% peak. So far we don’t see enough evidence to call for that, but that’s where the bias of risk lies. And that’s why what Chair Powell says in the next couple of days is key. When he does sit down we’ll still point to upcoming data as being pivotal; but the scene will have been (re-)set.

ECB tightening expectations on the rise in the background

The front end is leading European rates higher still. The market is now looking for 100bp of ECB tightening over the next two meetings. It is clearly seeing staving off a de-anchoring of inflation expectations as the top priority even if that means increased economic collateral damage. Such notion can explain the limited impact that the PMIs have had on outright yields, and this is likely to repeat itself with today's German Ifo release.

If not in outright yields, the European Central Bank's dilemma should exert a growing flattening pressure on the curve. The 2s10s swap curve has already come down over the summer from above 80bp to dipping temporarily below 40bp over the past few days. That looks like a lot, but it pales in comparison to the GBP SONIA OIS curve for instance, which currently finds itself inverted by 90bp.

The ECB's increasing prioritization of fighting inflation over shielding the economy may also be expressed in the minutes of the July ECB meeting, which will be released today. The ECB's Schnabel has already hinted at the central bank's assessment that inflation risks have not improved since then, opening the door to the market's increased pricing of tightening. What we may find though is that assessment of the economic backdrop still looks too optimistic.

Events ahead and market view

The focus will turn to the Jackson Hole Symposium which kicks off on Thursday and should set the tone for US rates markets gong forward.

But even before, the message that central banks are not done yet fighting inflation, and are also willing to accept some economic collateral damage could find itself repeated in Thursday's ECB meeting minutes. The damage is already becoming increasingly apparent in the data, just recently in the PMIs and likely today again in the German Ifo release.

European government bond supply will only consist of Italy selling up to €2.5bn in a short-dated 2Y bond on Thursday.

More By This Author:

The Commodities Feed: Oil Bounces BackFX Daily: A Quiet Day Ahead Of Jackson Hole

Double-Digit Eurozone Inflation Is Within Touching Distance

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more