Here’s Why Gold’s Overpowering The Fed By A Mile

Photo by Dmitry Demidko on Unsplash

On Wednesday, the Federal Reserve did exactly what Fed Watch signaled it would do and what we expected it to do – nothing. The FOMC held rates steady at 3.50%-3.75%. Fed Chairman Jerome Powell’s statement was his usual measured yet noncommittal self about watching the data and remaining flexible.

As Powell shared when responding to reporters, “What we’re saying is, we’re well-positioned as we make decisions meeting by meeting, looking at the incoming data, the evolving outlook and all that.”

Within hours of the announcement, gold surged 7% to a fresh all-time high of $5,500. What’s important to note is that this reaction was not on a rate cut. It was on a hold. In other words, the most boring possible outcome pressed gold to one of its biggest single day moves in years. This wasn’t supposed to happen. At least not according to conventional wisdom, which for decades has said that rate hikes are bad for gold while rate cuts boost its value.

The logic went that higher yields make non-yielding gold less attractive compared to bonds and savings accounts. Lower yields do the opposite. It’s the kind of clean, intuitive framework that gets taught in finance courses for undergraduates and repeated on business cable news channels.

There’s just one problem; it doesn’t hold up in the real world. Gold has been defying rate expectations for decades.

The 1970s saw gold explode higher even as Paul Volcker jacked rates into the double digits. The 2000s saw gold rally through both former Fed Chair Greenspan’s cuts and his hikes. The pattern keeps repeating. But the last 10 years make the case as clearly as any period in history – two full hike cycles, two cut cycles, and gold up over 400% through all of it.

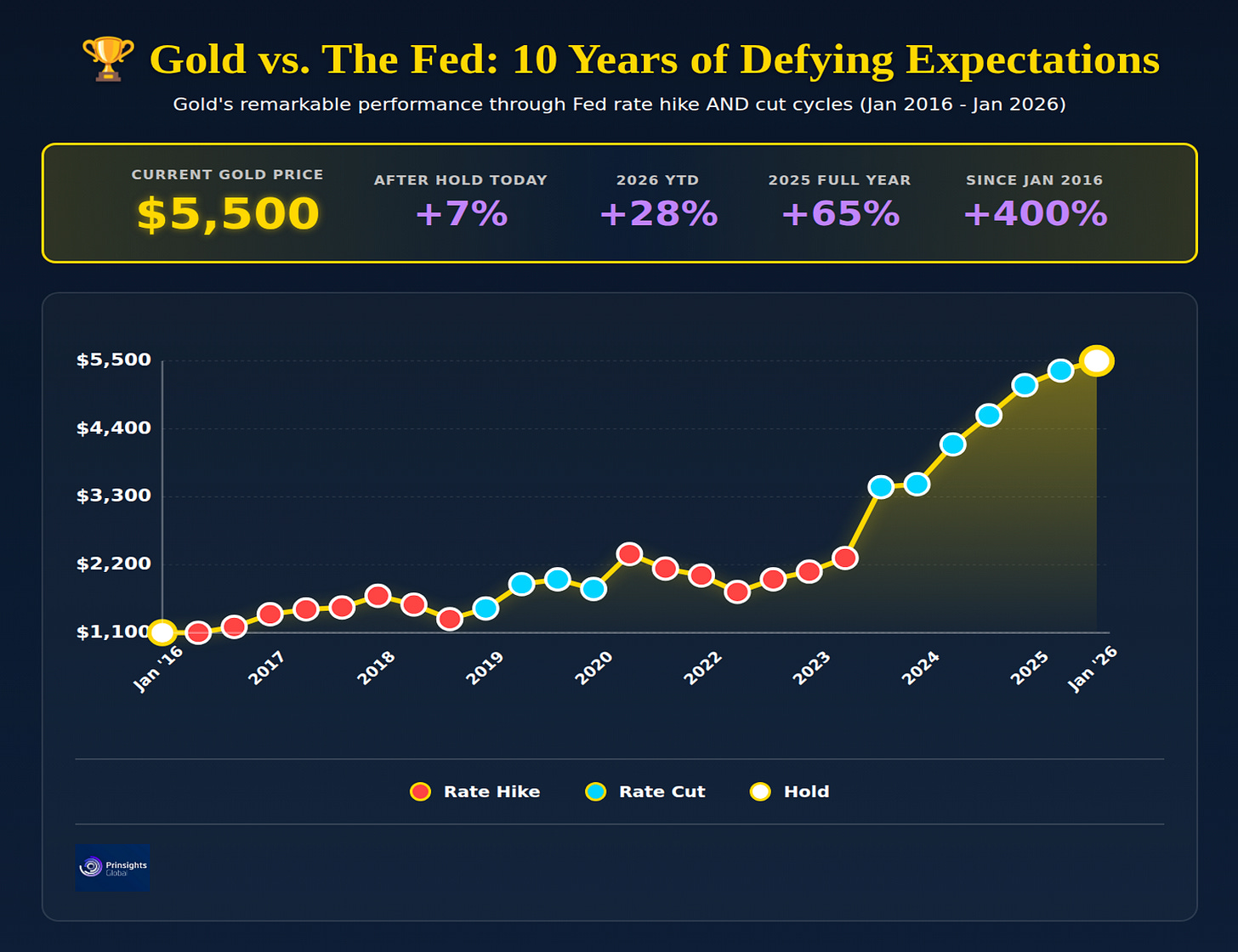

(Click on image to enlarge)

The 10-Year Scorecard

Since January 2016, gold has risen from $1,100 to $5,500. That’s a more than 400% in return through 15 rate hikes, 10 rate cuts, 53 holds, a pandemic, an inflation spike, 2 wars, and a Fed that’s been often stuck feigning power over inflation and uncertainty.

Look at the chart above. Every red dot is a rate hike that’s supposedly bad for gold. Every blue dot is a rate cut that’s supposedly good. The white dots are holds. And yet the gold price line keeps going up.

During the 2016-18 tightening cycle, the Fed raised rates 9 times. Meanwhile, gold rallied by 17%. Then, during the 2022-23 hiking period, the most aggressive one in 40 years, rates went from near-zero to 5.5%, while the gold price rose by 50%. It bottomed at $1,615 in October 2022, and then it climbed to $2,400 by mid-2023, right in the midst of the tightening.

And during rate cuts, gold surged 39% from 2019-20 and another 26% in 2024. This year alone it’s up 28% in less than a month. What does that mean for a certainty-starved world? Gold wins either way.

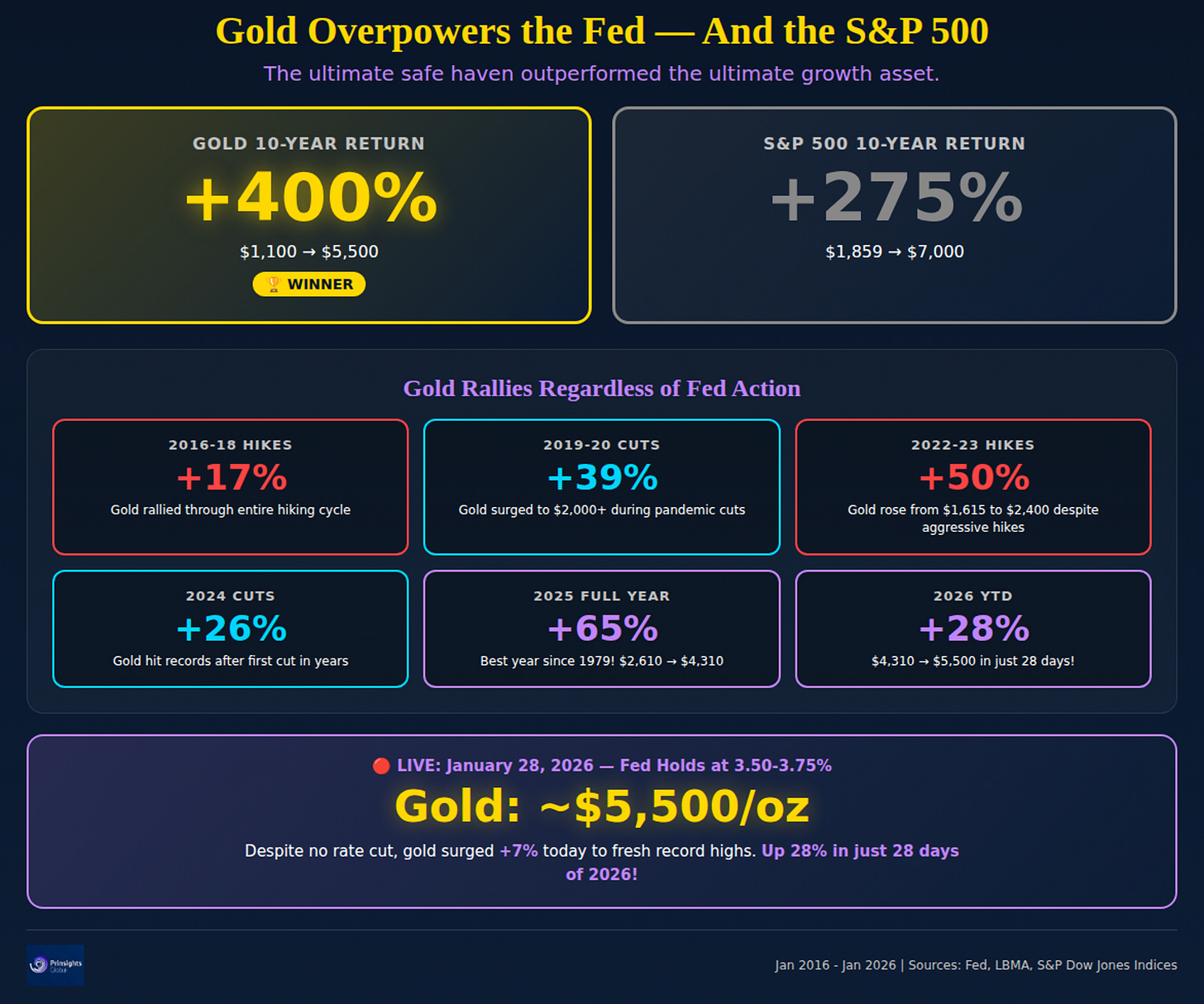

Gold vs. The “Growth Asset”

Here’s where things get interesting. Over the same decade, the S&P 500 returned +275%. That was a great run by any measure, including three consecutive years of double-digit gains, an AI boom, and a market that just crossed 7,000 for the first time.

But gold, the “safe haven” which was often labeled as the “boring” asset – you know, the thing your financial advisor says to keep at just 5% max of your portfolio – returned +400%. That means that the ultimate safe haven outperformed the ultimate growth asset. By 125 percentage points.

(Click on image to enlarge)

Why Gold Wins

Gold isn’t reacting to the Fed. It’s reacting to a slow-motion crisis of confidence in the institutions that underpin the global financial system – all packaged with a long-term geopolitical repositioning of global power that’s underway.

China, India, Russia, Poland, Turkey, and other central banks have been accumulating physical gold at a record pace. These are sovereign nations are quietly reducing their exposure to the dollar while also building reserves in the one asset that doesn’t depend on anyone else’s balance sheet. That’s because they see what’s coming – even if Western investors don’t (or won’t).

Then there’s the dollar. It just hit four-year lows, and remarkably, nobody in the administration seems bothered. President Trump prefers a weaker currency because it helps exports and the debt math. And, while recent economic figures came in rosy, they are only one part of the story.

Underneath it all, the fiscal situation keeps deteriorating. Deficits are exploding. The debt is mounting. Neither party has any serious plan to address it, and the bond market is flailing. Gold is the asset that doesn’t depend on anyone’s promise to pay, not the Treasury, not the Fed, and not any government.

Add in the geopolitical chaos, wars, tariffs, trade uncertainty, sanctions, and economic instability, and what we are left with is an environment tailor-made for continued gold upside.

What We’re Doing About It

This is exactly why we’ve been positioning in gold miners and more junior developers.

More By This Author:

The Fed Vs The White House: Why Gold Is The Clear WinnerThe 2026 Power Play: Why The Grid Is The Trade That Matters

The $12,000 Signal: This Massive Disconnect Is Fueling A Copper Supercycle

In our recent Pulse Premium monthly issue, we released a dual-metal miner that has exposure to gold along ...

more