Here Is How To Tackle Bullish Price Volume Action Vs. This Bearish Analog

Image Source: Unsplash

Based on the Wyckoff trading method, S&P 500 is still testing the axis line with bullish price volume action. Yet traders and investors must watch out for this bearish analog that could be triggered by the coming FOMC.

Watch the video below to find out how you can tackle the current bullish price volume action in S&P 500 yet still anticipate the bearish scenario with a Wyckoff upthrust.

Video Length: 00:12:31

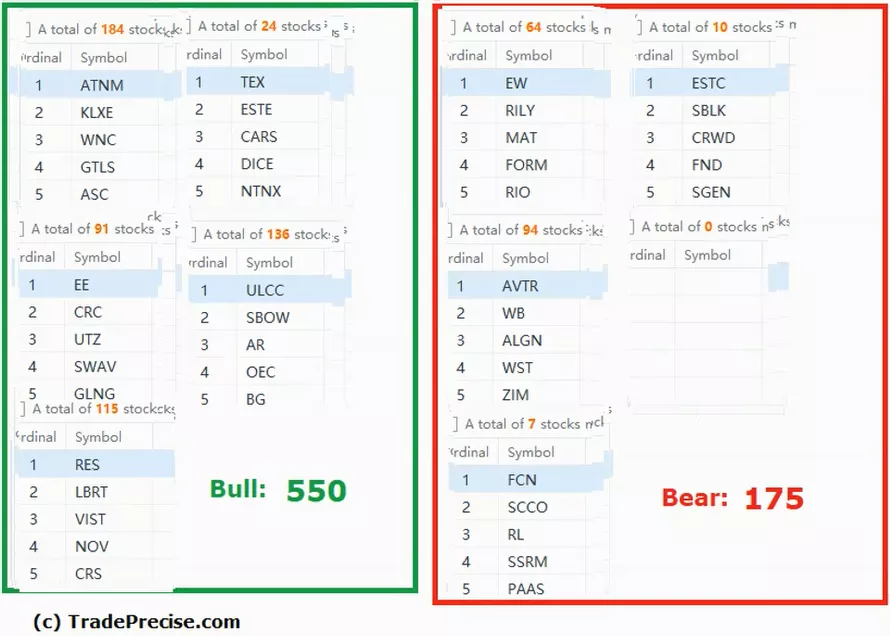

The bullish setup vs. the bearish setup is 550 to 175 from the screenshot of my stock screener below.

Although the market breadth has been improving as shown in the screener above, many of the outperforming stocks are overbought and suitable for selling into strength to lock in at least partial profit. Conservative trade management will go a long way in this volatile market environment.

More By This Author:

Will Cisco Continue The Bullish Momentum?

Walmart Still Bullish Ahead Of Earnings According To Wyckoff Analysis

Could Amgen Continue To Soar In This Bear Market?

Disclaimer: The information in this presentation is solely for educational purpose and should not be taken as investment advice.