Headlines To Take You Through Xmas

8:20 am Friday, Dec. 23 Pre-Merry and Merry Christmas! We are getting white-out conditions with an outside temperature of 6 degrees and a wind chill of -15 degrees.

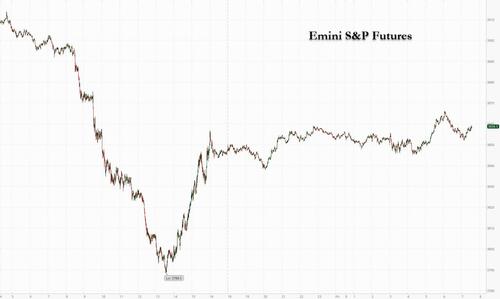

SPX futures are somewhat higher prior to the PCE print. I thought it best to wait until after the print to make my observations.

Today’s op-ex shows Max Pain at 3840.00 with a red-hot contest tilted toward calls at 3850.00. Short gamma begins at 3830.00.

ZeroHedge reports, “US stock futures edged higher after Thursday’s slump as investors weighed strong job data and prospects of further policy tightening to cool inflation ahead of today’s closely watched core PCE print which may reverse the negative sentiment (especially if it comes at 4.5% Y/Y or lower) and send stocks sharply higher (see here for more). Contracts on the Nasdaq 100 and the S&P 500 gained 0.3% by 7:30 am ET one day after the S&P 500 cash index plunged 1.5% on Thursday and was set for a third consecutive weekly loss, the longest losing streak since September. The index is also on pace for its second-worst December on record, while the Nasdaq 100 is on course for its steepest slump in the month since 2002.

VIX futures have gone down to 21.65, right at the Triangle trendline. It may be poised to make a deeper low, near 19.20, or possibly lower, as today is day 263 of the old Master Cycle. However, the corrective decline may be complete having made a near-60% retracement of Wednesday’s ramp higher.

Next week’s op-ex shows Max Pain at 24.00 with long gamma at 25.00 with 16,374 expiring call contracts. Short gamma starts at 23.00. Barring some earth-shattering news, VIX may stay beneath 25.00.

TNX has moved above Intermediate-term resistance at 36.97. It has entered a period of strength lasting through next week and is on a buy signal.

ZeroHedge observes, “Twas the last trading day before Christmas and all through the market, not a trader was twitching… until today’s PCE print hits…

The Fed’s favorite inflation indicator – Core PCE Deflator – printed slightly hotter than expected in November +4.7% YoY vs +4.6% exp (MoM was in-line at +0.2% after an upward revision for October)…

Source: Bloomberg

That is below the 4.8% forecast in the FOMC’s December SEP.”

Crude oil futures are consolidating within yesterday’s trading range with a high of 79.70. The Cycles Model suggests another probe higher before the reversal. If so, a probable target may be the 50-day Moving Average at 82.23.

Gold futures are also consolidating, having bounced to 1808.20 this morning. The Cycles Model suggests today may be the last day of strength this year with a decline to follow through the end of January. Gold is on an aggressive sell signal with a lower high, to be confirmed at a decline beneath mid-Cycle support at 1781.03.

More By This Author:

Nothing in this email or article should be construed as a personal recommendation to buy, hold or sell short any security. The Practical Investor, LLC (TPI) may provide a status report of ...

more