Have Workers Gotten Back Their Share Of Income?

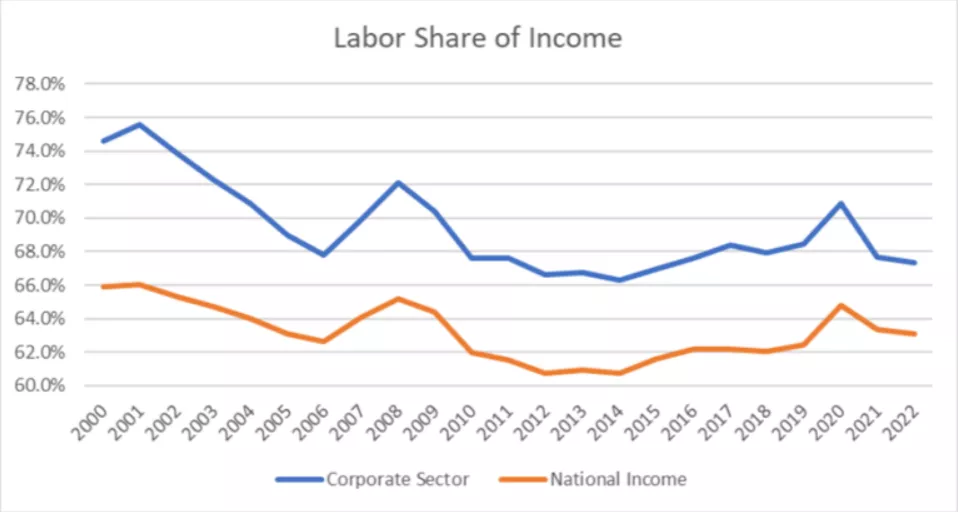

I was surprised to see a Twitter thread last week from Jason Furman in which he said that the labor share of national income in 2022 was actually above its pre-pandemic level. I have been following this issue closely and the labor share of corporate income was still down by more than a percentage point from its 2019 level.

If that sounds trivial, it can be understood the following way: if the wage share rose back to its pre-pandemic level, and it was evenly shared, every worker would have a 1.7 percent increase in real pay. That won’t make anyone rich, but for a full-time full-year worker earning $25 an hour, the increase would be worth $850 a year.

But Jason said there is no prospective dividend like this because the labor share is already above its pre-pandemic level. Jason referred to the labor share of national income, and using this measure, he was right. I looked back to 2000 and saw that the labor share of national income had not fallen anywhere near as much as the labor share of corporate income, as shown below.

Source: Bureau of Economic Analysis and author’s calculations.

The question is: what is going on here? My reason for preferring the labor share of corporate income is that profits and labor compensation are well-defined in the corporate sector. We have a corporation that earns profits and it pays out wages and benefits to workers. The corporate sector is also about 75 percent of the private business sector, so generally what is going on in the corporate sector tells us what is going on in the business sector as a whole.

But not this time. Apparently, there was a large increase in the labor share of income in the non-corporate sector. The Commerce Department has not published data for the non-corporate sector for 2022 yet, but in 2021 the labor share stood at 41.4 percent, up by 2.2 percentage points from its 39.2 percent share in 2019. A further increase in 2022 could certainly be enough to raise the economy-wide labor share above its 2019 level.

So, what do we make of this large rise in the labor share in the non-corporate sector? That’s a difficult question to answer, but it’s certainly peculiar that the labor share in the non-corporate sector would be going in the opposite direction as the labor share in the corporate sector.

There is at least one possible explanation that doesn’t involve ordinary workers in the non-corporate sector gaining relative to their counterparts in the corporate sector. Most of the businesses (by revenue) in the non-corporate sector are organized as partnerships. This would include private equity and hedge funds. The earnings of the partners in these funds, which often are in the millions or tens of millions, are largely classified as wage income. If these partners were getting more wage income, or simply classifying a larger share of their fund’s earnings as wages, it could lead to a larger labor share of income in the national accounts. That doesn’t especially help the worker in a fast food restaurant owned by a private equity company, but this could explain the rise in the labor share that Jason noted.

This is obviously speculative and there could be a different story here, but in the corporate sector, where we do have solid data, we know the labor share has not recovered to its pre-pandemic level. And, if we want to go back to ancient history, the labor share is still down by 7.2 percentage points from its 2000 level. It would be a useful exercise to sort out what is going on with the labor share in the non-corporate sector, but it doesn’t seem unreasonable to think that the labor share in the corporate sector would at least return to its pre-pandemic level.

More By This Author:

The Really Great February Jobs Report

In Defense Of Taxing Stock Buybacks

Is Inflation Out Of Control, Again?