Has Housing Bottomed?

Image Source: Unsplash

There was a glimmer of hope in the housing data from January. The stock market rallied sharply and there was a lot of commentary about how the economy is headed back to boom time. I am not so confident and I still firmly believe that the “muddle through” scenario I mentioned in my full-year outlook is the baseline. And I would argue that the asymmetric risk to this outlook is to the downside, not the upside.

Housing is the Economy.

I hesitate to attribute economic growth entirely to one sector, but the US housing sector is so large that it has a disproportionately large impact on baseline growth. So when housing moves a lot in one direction or the other it has a disproportionate impact on aggregate growth. This was the basic gist of the famous Ed Leamer paper which was published in 2007 before we all realized this was all too true.

I officially turned bearish on housing in April of 2022. The basic gist of my view was that housing prices had become unhinged from fundamentals and rising interest rates reduced affordability to an extent that would significantly reduce demand. This is looking pretty good so far as house prices peaked last Summer and all the housing data has crashed since, but I don’t think it has fully played out.

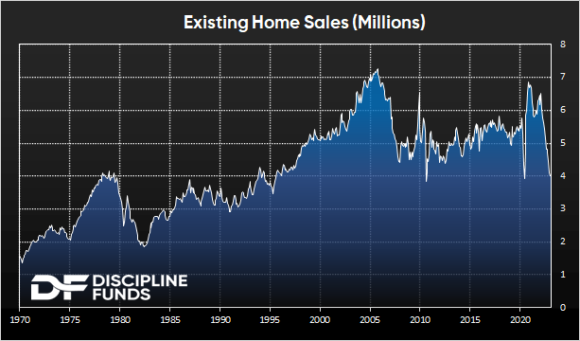

Housing data has turned very negative in recent months. Some of the data is shockingly bad. Existing home sales are at levels last seen during the COVID low and Great Financial Crisis.

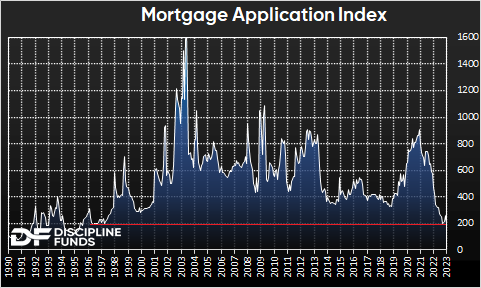

It’s tempting to look at data like this and assume that it’s closer to the bottom than the top (which would be a good thing). But it’s hard to see how this recovers significantly because the affordability issue is the main driver in housing demand. And housing affordability is nowhere near where it needs to be for demand to come back. We were reminded of this morning when the mortgage application data was released. After a brief respite last month, the latest release showed a new low. A low we haven’t seen in almost 30 years.

This is breathtaking data. But house prices haven’t really budged all that much yet. Yes, we’re starting to see real signs of pressure in some higher-tier markets like San Francisco (where prices are already off 10%+), but it hasn’t been all that broad thus far. But if I had to use the old baseball analogy I’d say we’re in about the 4th inning of this game and the pitcher needs relief.

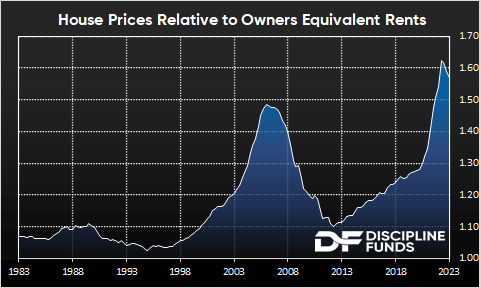

The affordability equation is a fairly straightforward one. House prices are too high relative to mortgage rates. And rents vs house prices are as wide as they’ve ever been. So renters who are thinking about buying are more likely to keep renting. And owners who want to move will hang onto their “golden handcuffs” with a low mortgage until things change. So we need either a big adjustment lower in interest rates, a big decline in prices or the most likely scenario is that we eventually get some combination of the two.

For perspective, here’s the rent vs price data. This data is highly mean reverting because people have to live somewhere and the relative cost of renting vs buying is one of the main drivers in housing demand. We often hear that inventory is low in this market and that means house prices can’t fall, but this ignores the fact that people can choose to rent. And the math on buying vs renting at present is pretty black and white – renting is far more affordable.

The most troubling aspect of this data is just hot out of whack it remains. Rents have increased significantly in recent years, but house prices haven’t come down much. So that either means that rents have to move much higher or house prices need to come down a lot. Or, some combo of the two.

The problem is that if rents continue to rise significantly that will bleed into inflation data because shelter is such a large component of inflation metrics. Which means the Fed will remain higher for longer. Which means that demand for housing will remain weak. On the other hand, many real-time rental metrics are showing signs of slowing which would mean that the future reversion is most likely to come from price declines. So it’s hard to put together a scenario where home prices don’t have a come-to-Jesus moment at some point in the coming years. The only question is when?

Of course, the outlier Goldilocks scenario in all of this is that inflation crashes lower at some point and the Fed is able to ease rates back as a soft landing occurs. But that doesn’t look very likely any time soon as mortgage rates are shooting back up to 7% and the Fed reaffirms their aggressive rate outlook. My baseline outlook for this year is 3% PCE inflation at year-end. But even in that scenario, which is relatively optimistic, the Fed will remain at or near 5% rates all year. In other words, mortgage rates aren’t coming down any time soon unless something breaks and the Fed backpedals.

Fight the Fed or Fight the Market?

The start of 2023 raised an interesting question. As the stock market rallies, home prices remain firm and even homebuilders rallied, you have to ask yourself whether you fight the Fed and remain bullish or fight the market and remain bearish about potential outcomes.

I’ve been saying this for over a year now, but housing downturns are very long drawn-out events. There will be many moments where it looks like there’s light at the end of the tunnel. But I don’t think we’re there yet. Housing is a big slow-moving beast and the basic math on affordability still looks very dreary to me. I have a feeling we’re going to be talking about this housing downturn well into 2024 and hopefully, by then things have normalized enough that we can get back to life as usual. Until then, I still think it’s prudent to be cautious about how we navigate the current environment.

More By This Author:

Three Things I Think I Think – No Landing

Bankrupt Ideologies, Interest Rates And Retirement

Silly Debates, Important Charts And Lessons Learned