Hard-Core Investors Found Real Resource Projects In A Vancouver Conference Center

TM editors' note: This article discusses a penny stock and/or microcap. Such stocks are easily manipulated; do your own careful due diligence.

When the market bears are growling, contemplating a trip to a showcase of the companies currently in the grip of that punishment can seem daunting, but resource experts say now is exactly the time hard-core investors need to be out talking to management, hearing their stories and figuring out which companies will be on top when the good times come. The Gold Report spoke to some of the experts at the recent Metals Forum and Cambridge House Vancouver Resource Investment conferences, who shared some of the nuggets they gleaned from the podium and exhibit hall.

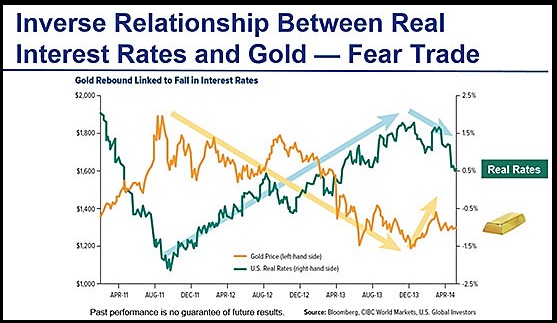

Frank Holmes, CEO and chief investment officer at U.S. Global Investors, gave a talk at the Cambridge House conference titled "Fear Trade Sees Gold as a Store of Value When Interest Rates Are Negative." Holmes always focuses on the global supply-and-demand equation whether it is traveling to better understand the odds and implications of a possible strike in Chile or changes in what he calls the "love trade" based on buying gold for celebrations in India and China. "This is a classic bottom-of-the-trough year," he said. He pointed to companies slashing exploration costs, apathetic investors, and the bottom-line impact of "draconian" regulations for raising capital. "The cost of being a public company is almost prohibitive," he said.

On the supply side of the balance sheet, Holmes warned that reserves for some commodities—particularly copper, gold and zinc where not enough had been invested over the last 15 years—are starting to shrink. "Any disruption in supply or pickup in demand will lead to a higher price. That could happen as soon as this year," he said.

On the demand side, in addition to the traditional seasonal jewelry demand, he cautioned investors to watch the actions of the Federal Reserve as interest rate hikes could cause a rush of fear trade to the safe harbor of gold.

John Kaiser, author of Kaiser Research Online, celebrated the practical spirit of the hard-core companies and investors still attending conferences and moving projects along during a bear market. He was also looking at the implications of a possible Federal Reserve interest rate hike in his presentation at the Cambridge House conference titled "Fast and Slow Trains out of the Bear Market Trough." "It could cause a financial meltdown in the bond market that ripples into general equity markets with knock-on effects similar to 2008, except this time the Fed, which has no tools left, would be helpless to do anything about the resulting malaise. The anxiety among traditional resource investors about this possible outcome that has long-term negative implications for the resource sector has paralyzed them with fear while the rest of the market simply ignores the resource sector as the dud market of recent memory."

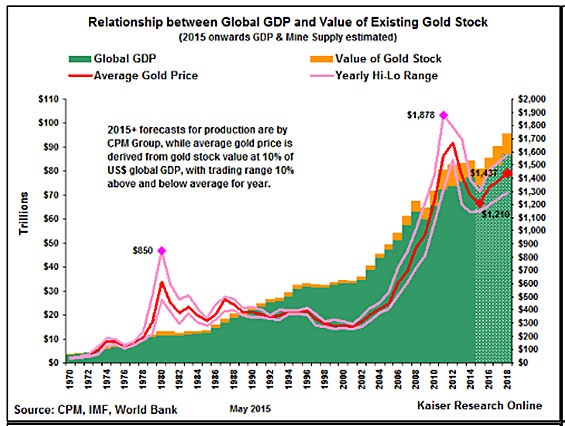

Kaiser believes that "the transition to higher real interest rates is critical to put the American economy back onto an organic growth track, but I think the anxiety about an accompanying earthquake that topples the economy into a depression is misguided. We need the banks to start lending to consumers again so that businesses stop sitting on their trillions, buying back their own stock, and instead start investing in a future. There is no productivity windfall at hand to fuel economic growth so it will require a consumer credit expansion, particularly in the home mortgage area where the deleveraging has come to an end, but net mortgage growth is not yet happening. I suspect that when the interest rate hike happens bond yields will adjust so quickly markets will simply accept the lower bond prices and equity investors will be relieved that the long awaited correction has finally happened. When the so much anticipated "train wreck" of higher interest rates happens, it will not be the catastrophe people expect. It will be the trigger for a rush back into the resource sector that has been busy cleaning up its affairs. This transition to higher real interest rates will be bad for gold in the interim, but if I am correct that higher interest rates are key to putting the global economy back onto a prosperity growth track, gold will not remain weak for long. The scenario that I dread for the resource sector is that the normalization of interest rates will keep being postponed into the future, leaving us stuck with a weak near- to medium-term outlook for all metals."

Or, as Steve Palmer, founding partner, president and chief investment officer of AlphaNorth Asset Management said, it can only get better from here. "The Canadian junior market is very depressed right now and the odds are highly skewed in favor of the upside," he said in his presentation at the Cambridge House conference.

Eric Coffin, editor of Hard Rock Analyst, spoke at the Metals Forum and urged attendees to take the time to listen and talk to mining company management at events like the ones held over the weekend in Vancouver to better understand their potential and the milestones to watch. "It is easier to monitor company progress and you have a much better feel for management if you meet them in person," he said. Personally, Coffin is planning to look at some of the companies he isn't as familiar with now that he has seen their updates.

Thibaut Lepouttre, editor of Caesars Report, flew to the Metals Forum from his home base in Belgium to deliver the message that there are still quality companies out there that have a good chance to continue to advance their projects despite the current turmoil in the markets. "A small conference is a good way to get to know the companies," he said.

The Companies

A number of experts, including Coffin, Lepouttre and Kaiser, commented on the preliminary economic assessment on the Tuvatu gold project in Fiji issued May 31 by Lion One Metals Ltd. (LIO:TSX.V). It showed a net present value of $117 million ($117M), internal rate of return of 67% and preproduction capital costs of $48.6M for gold production of just under 353 ounces (353 oz) with a resource of 1.1 million tons (1.1 Mt) Indicated and 1.5 Mt Inferred. "This is a starter story, a base builder with a capital cost that is within reach for a junior," said Kaiser. Lepouttre was intrigued as well. "The low-capex, low-opex project has a very good chance of getting funding within the next three months. It's definitely a company to keep an eye on," he said.

Nevsun Resources Ltd. (NSU:TSX; NSU:NYSE.MKT) was also a favorite. "This company is always impressive," Coffin said. Nevsun reported $37M in operating cash flow from the Bisha open-pit copper mine in Eritrea in the first quarter of 2015. "Nevsun Resources has a large cash position and is transforming itself into a zinc producer from next year on," Lepouttre said.

Coffin singled out GoldQuest Mining Corp. (GQC:TSX.V) and Excelsior Mining Corp. (MIN:TSX.V) for doing a good job of presenting themselves as value propositions.

Kaiser used Sabina Gold & Silver Corp. (SBB:TSX; RXC:FSE; SGSVF:OTCPK) as an example of a turnaround story. The company had put out a "lousy" economic study in 2013 showing too short of a mine life based on too high of a gold price. Then in February, the board of directors recruited Bruce McLeod to replace Rob Pease as president and CEO. On May 20, McLeod announced a new feasibility study on the Back River gold project in Nunavut, Canada. It showed a 10 year life-of-mine of just under 20 Mt with an average of just over 400,000 oz per year in the first four years and an initial capex of $695M and a $1,200/oz gold base case price. "The numbers look much better and with $28M in cash on hand, the company doesn't have to dilute shareholders for a while," Kaiser said.

Kaiser pointed to InZinc Mining Ltd. (IZN:TSX.V) as a company that "could break out dramatically if there are supply problems in the zinc market." He believes that China's new emphasis on environmental stewardship will preclude it from swooping in and flooding the market again with cheap commodities.

No More Hyperventilation

The best news at the conference, according to Kaiser, was that all the talk about pending hyperinflation was gone. "After five years of being wrong, no one wants to hear that anymore," he said. He classified the attendees not as goldbugs investing based on emotion or ideology, but real investors with an appreciation for how the resource market works. "They are there looking for insights on the cycle and specific companies, not sermons on the debasing of the dollar."

Disclosure:

JT Long conducted this interview for Streetwise Reports LLC, publisher of more