Green Bond Market Will Continue To Grow

If a bond has a negative yield, then the bondholders will lose their money on their investment. In the long run, their expectations are lower and consequently they lose the incentive to invest — which may have far-reaching repercussions.

Green Bonds Are Changing Investor Expectation’s

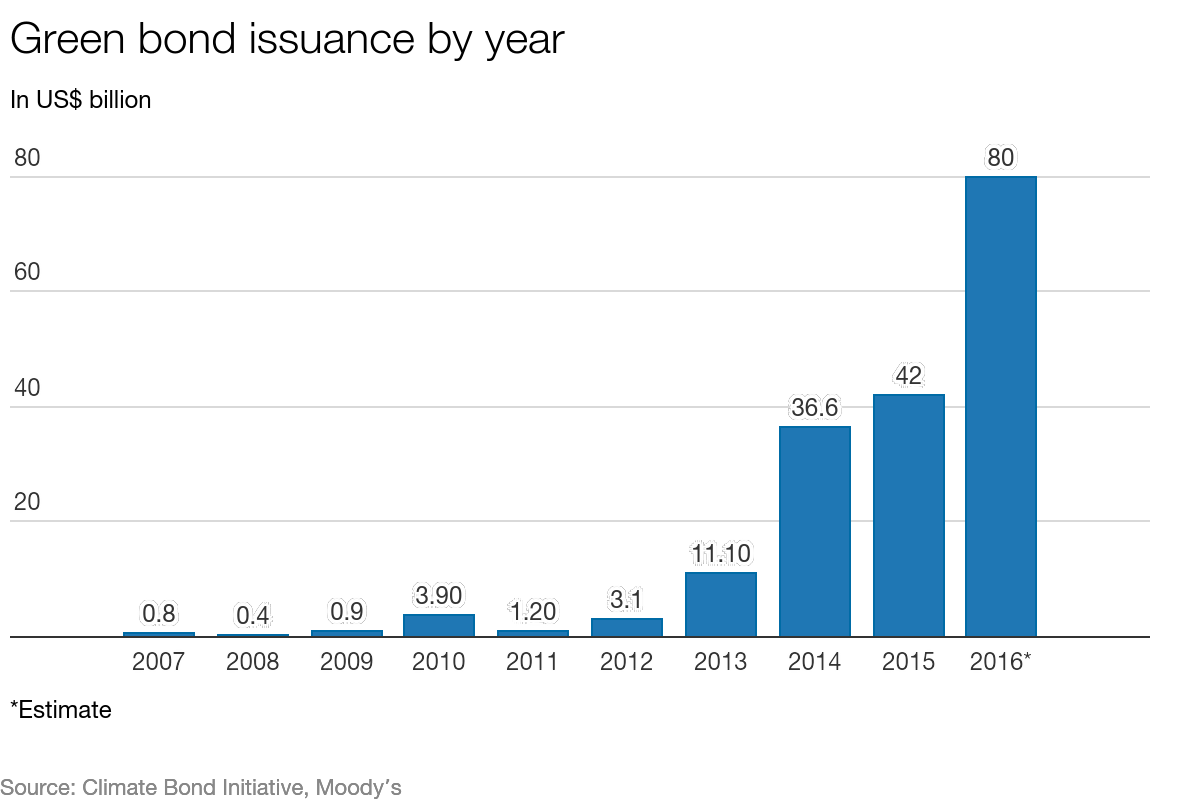

The rapid growth of the green bond market has sparked interest from many audiences.

What are green bonds? Using debt capital markets to fund climate solutions. Green bonds were created to fund projects that have positive environmental and/or climate benefits. The majority of the green bonds issued are green “use of proceeds” or asset-linked bonds.

In this new financial era, how can one ensure that the necessary investments are still coming?In addition, how can investors ensure that they are still receiving financial returns? Green bonds may very well be the solution.

The green bond market provides an innovative way to obtain both a financial return and receive a positive impact. The main characteristic of a green bond is that their proceeds are allocated exclusively to environmentally friendly projects.

According to HSBC, the green bonds market is rapidly increasing; around $80 billion worth of green bonds could be issued by the end of the year. This would represent almost a 100% year-on-year growth.

In this negative-yield bond era, green bonds represent quite a good deal; 82% of them are rated at investment grade and they satisfy the medium long-term preferences of institutional investors, as well as covering a broad range of sectors. Investors are drawn to both the liquid, fixed-income investments that green bonds offer and the positive impact that they can have.

Many institutional investors, such as pension funds, now have mandates for sustainable and responsible investments and are developing strategies that explicitly address climate risks and opportunities in different asset classes. Green bonds can provide the verification and impact measurement that investors need. In the case of World Bank green bonds and IFC green bonds, they also bring AAA ratings.

“Investors increasingly recognize the threats these forces create for long-term financial value and are increasingly considering it in their investment choices,” said Laura Tlaiye, a Sustainability Advisor at the World Bank, one of the first and largest issuers of green bonds with more than US $7 billion issued in 18 currencies.

Green bonds also give smaller investors a way to vote with their money. The State of Massachusetts, for example, received more than 1,000 orders from investors for a green bond that it issued last year – most of them are individual investors interested in supporting their local government’s investment in the environment.

A holistic view of where the economy is headed. Green Bonds enable capital-raising and investment for new and existing projects with environmental benefits. Recent activity indicates that the market for Green Bonds is developing rapidly. The Green Bond Principles (GBP) are voluntary process guidelines that recommend transparency and disclosure and promote integrity in the development of the Green Bond market by clarifying the approach for issuance of a Green Bond. The GBP are intended for broad use by the market: they provide issuers guidance on the key components involved in launching a credible Green Bond; they aid investors by ensuring availability of information necessary to evaluate the environmental impact of their Green Bond investments and they assist underwriters by moving the market towards standard disclosures which will facilitate transactions.

To help investors evaluate green bonds, MSCI/Barclays and others have also launched green bond indexes which score issuers and check their project selection criteria and management of proceeds so as to ensure the promised use and ongoing reporting.

Disclosure: If you want to know where the market is headed each day and week, well in advance then be sure to join my ...

more

It would be really helpful if you would give some information or links for the indexes you mention in the last paragraph.