Great Quarter, Guys

There is a longstanding Wall Street cliché about analysts prefacing their post-earnings questions with the phrase, “great quarter, guys”. With more females in C-suites, the “guys” portion seems to have dropped off, but the flattery still persists.This morning’s GDP report brought the phrase immediately to mind as part of the question, “Great quarter, guys.So why exactly do we need rate cuts?”

The initial estimate of 4.3% for Q3 Annualized Real GDP was indeed a stunner. It blew past both last quarter’s 3.8% and the consensus estimate of 3.3%. Frankly, I’m at a loss to understand why economists expected that magnitude of a decline, let alone underestimated the positive revision. It appears that it exceeded all but one of the 49 economists’ forecasts in the Bloomberg survey. The Bureau of Economic Analysis (BEA) normally issues three estimates of quarterly GDP, but the government shutdown caused the scheduled October 30th reading to be canceled. Today’s would normally be the second reading for Q3, not the first. Perhaps that affected the quality of the forecasts.

The blurb on the BEA website states:

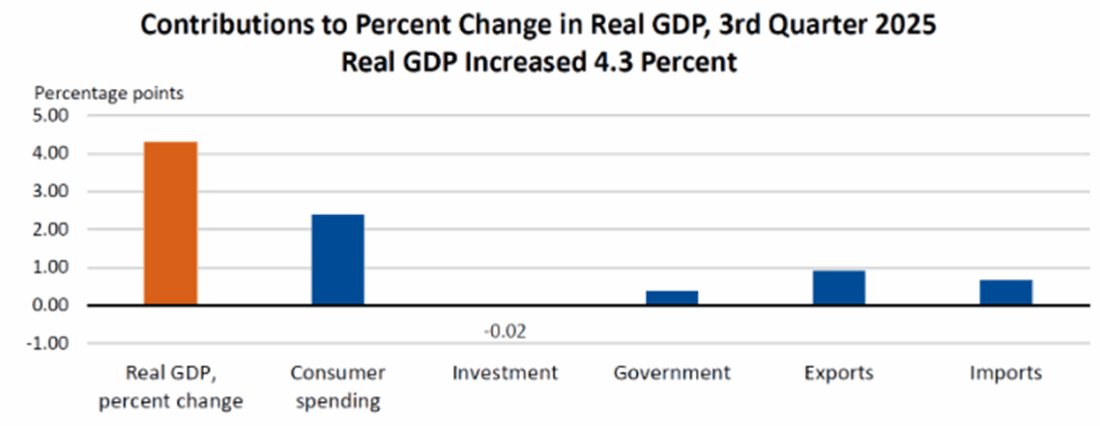

The increase in real GDP in the third quarter reflected increases in consumer spending, exports, and government spending that were partly offset by a decrease in investment. Imports, which are a subtraction in the calculation of GDP, decreased.

The following graph shows the composition of the jump:

(Click on image to enlarge)

Source: bea.gov

Bear in mind that imports are a subtraction from the GDP calculation, which is:

GDP = Consumption + Investment + Government + (Exports – Imports)

or

GDP = C + I + G + NX

Tariffs almost certainly played a role in the positive impact of net exports, but I will need to leave it to others to properly gauge whether there was some front-loading of imports in earlier quarters.And despite consumer concerns, some of which were reflected in this morning’s Confidence and Present Situation reports from the Conference Board, they continued spending money in the third quarter.This was clearly a healthy read on the economy.

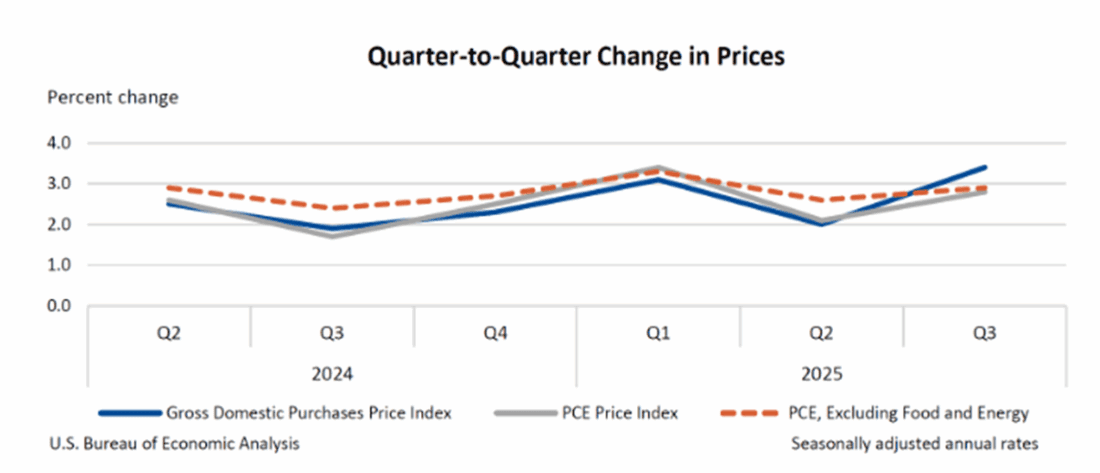

The one potential fly in the ointment came from prices.The Core PCE Price Index rose by 2.9%, in line with consensus but above last quarter’s 2.6%.It should go without saying that it is well above the Fed’s 2% target and moving in the wrong direction.While it is quite fair to question the “maximum employment” portion of the “dual mandate” after recent jobs reports, it is equally fair – if not more so – to question whether the “stable prices” portion of the mandate is being met.The recent trends in the chart below are moving in the wrong direction:

(Click on image to enlarge)

Source: bea.gov

As a result, fixed income markets reacted accordingly. Expectations for a rate cut were pushed back, with chances for a cut by April falling from 86% yesterday to 70% today, and the timing for a second cut moved to December from October.The yield curve flattened, with 2-year yields rising by 4 basis points even as the 10-year remained about the same.

Stock futures traders initially took the report as a modest negative, noting that stocks have tended to move in synch with rate cut expectations. Yet in the “heads I win, tails I win” manner that defines bull markets, traders gravitated back to megacap tech shares on the back of the positive economy. As stated many times, I prefer a market driven by a strong economy over one that relies upon rate cuts to advance. Today’s move, however, is likely more about momentum than a reaction to the data, since economically sensitive sectors like Industrials and Consumer Discretionary are lower today.Santa’s sleigh seems unimpeded.

More By This Author:

The Case For Contrarianism

Options Pricing In Santa

CPI + MU = Relief Today

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC ...

more