Gramercy Property Is Well Positioned To Deliver Something Special

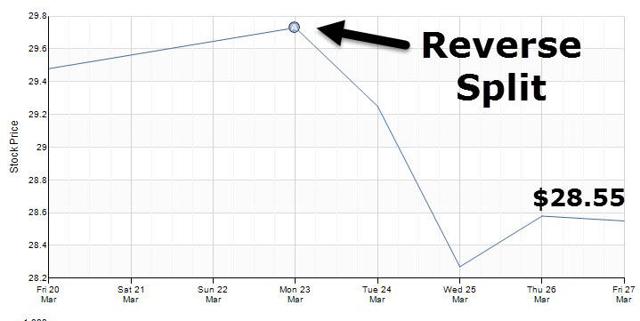

Recently Gramercy Property Trust Inc. (NYSE:GPT) filed articles of amendment to its charter (according to a Form 8-K) providing for a 1-for-4 reverse stock split of the company's issued and outstanding common shares and for a change in the par value of the company's common stock back to 0.1 cent per share from 0.4 cent apiece.

Gramercy noted that as a result of the reverse split, the number of shares of the company's stock outstanding will be reduced to about 47.0 million from about 188.0 million. Also, a result of the reverse stock split, the company updated its 2015 core FFO-per-share guidance in the range of $1.80 to $2.00, according to an investor updated presentation issued the same day. Gramercy also adjusted its first quarter dividend to $.20 per share, up from $.05 apiece in the previous quarter (the dividend is payable April 15).

For the record, I view the reverse split of Gramercy shares as immaterial - meaning I see no effect on the fundamental value of the stock and there are really no advantages or disadvantages to investors (of which I am one). However, there is a good reason to consider Gramercy's reverse split (even though fundamentals aren't impacted) and this argument is rooted in the behavior of Mr. Market. Just take a look at the trading activity since the news.

OK, maybe this was not as big of a sell-off (as the above chart illustrates) but it seems as though the market noise has drowned out the reasons that I own shares in the REIT. Psychologically, a reverse stock split could be viewed as distractive, let's recap the reasons I "doubled down" in January (see article HERE).

Catalyst #1: High Growth

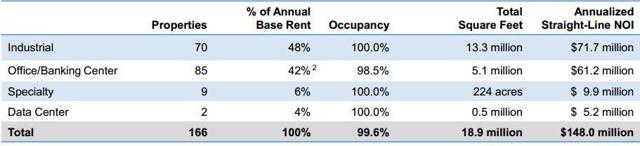

Gramercy is a leading global investor and asset manager of net lease assets. As of March 31, 2015, the company owned 166 properties containing an aggregate of around 18.9 million square feet. The portfolio consists of around 48% Industrial and 42% Office (and the balance in Specialty and Data Center). As of March 31, the portfolio occupancy was 99.6%.

Other key portfolio metrics include 37% investment grade rated tenants and a weighted average remaining lease term of 8.6 years.

Continue reading this article here.

Disclosure: The author is long O, DLR, VTR, HTA, STAG, CSG, GPT, ROIC, HCN, OHI, LXP, KIM, TCO, DOC, UDF, EXR, HST, BRX, WPC, HCP, CLDT, MPW, APTS, BX.

more