Good Month For New Home Sales Not Yet Enough To Break Downtrend

March 2024 was a good month for new home builders in the U.S. The month saw a rebound in the number of new home sales and also a rebound in the average new home sale prices over February 2024's depressed levels.

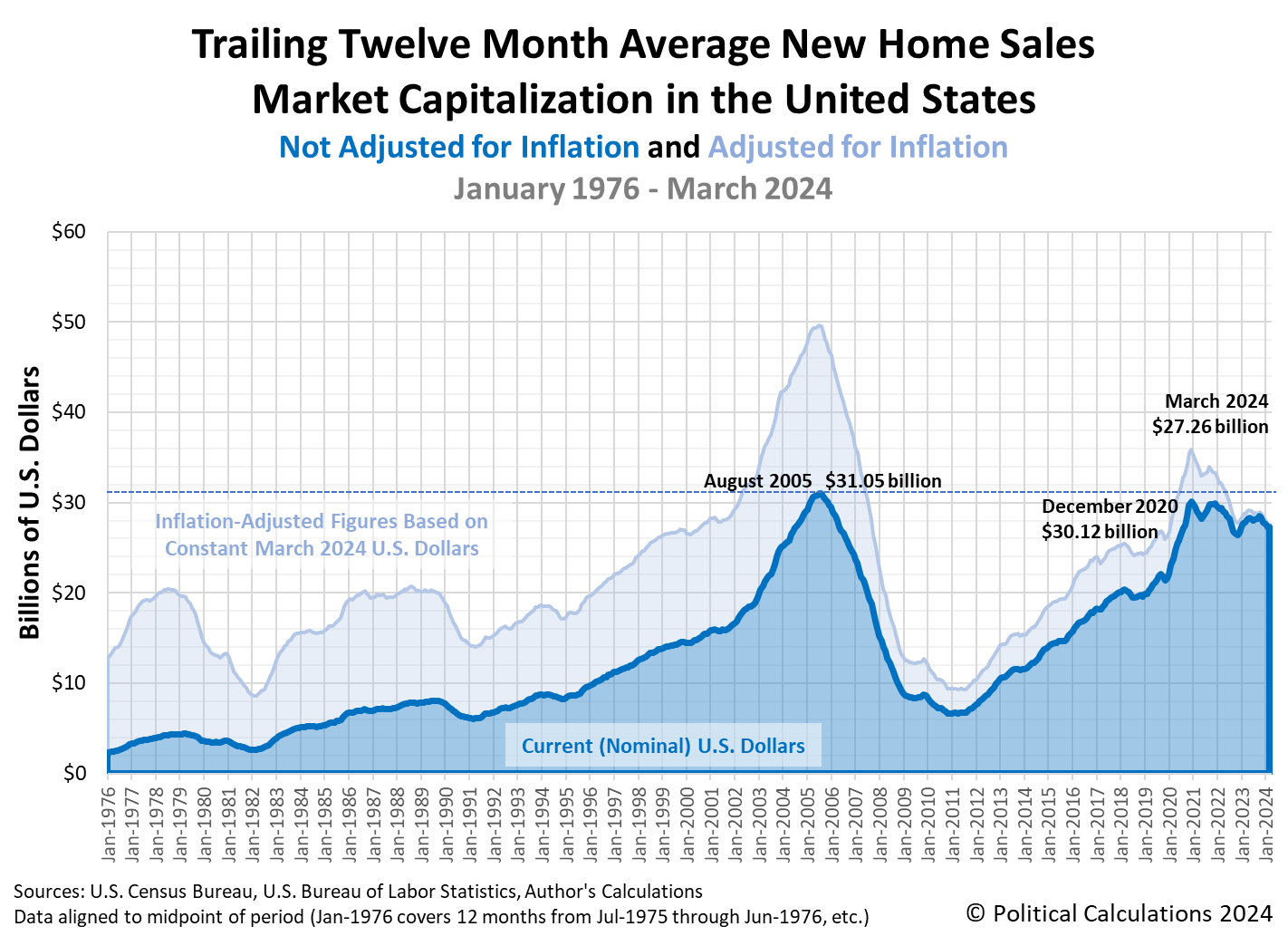

But that wasn't quite enough to definitively break the now six-month long downtrend we've been tracking for the industry, as measured by its trailing twelve month market capitalization. The market cap trend for new homes has been fading after having most recently peaked at approximately $28.46 billion in October 2023.

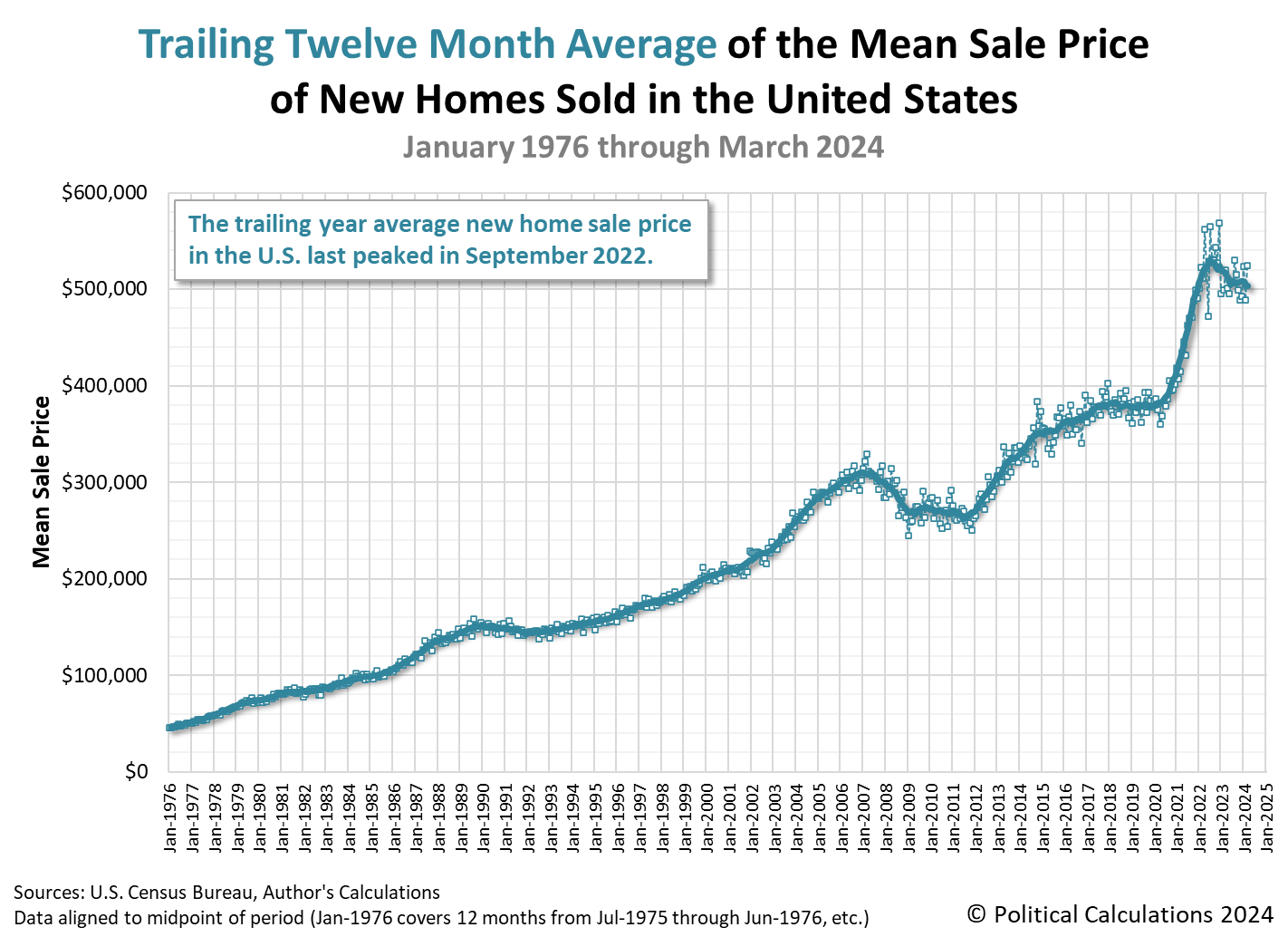

Likewise, the downward trends for the new home market's underlying number of sales and average sale prices remain intact, though the positive data for March 2024 contributed to slowing their descent.

The following charts show the evolution of the U.S. new home market capitalization, the number of new home sales, and also new home sale prices as measured by their time-shifted, trailing twelve month averages from January 1976 through March 2024.

Falling new home sales trend:

Falling trend for new home prices:

Ideally, we'd like to see the trend for falling new home sale prices continue and be coupled with a rising number of sales that more than offsets the decline in their average price to produce a rising trend in the new home market cap. That pattern would be positive for both new home buyers and new home builders. Unfortunately, there are forces at work in the U.S. economy that may make realizing that positive scenario difficult:

Sales of new U.S. single-family homes rebounded in March from February's downwardly revised level, drawing support from a persistent shortage of previously owned houses on the market, but momentum could be curbed by a resurgence in mortgage rates.

The report from the Commerce Department on Tuesday also showed the median house price jumped to a seven month-high from February, likely as fewer builders offered price cuts and sales shifted to higher priced homes. Rising prices and mortgage rates could make housing even more unaffordable, especially for first-time buyers.

We'll examine the relative affordability of new homes for the typical American household in the very near future.

References

U.S. Census Bureau. New Residential Sales Historical Data. Houses Sold. [Excel Spreadsheet]. Accessed 23 April 2024.

U.S. Census Bureau. New Residential Sales Historical Data. Median and Average Sale Price of Houses Sold. [Excel Spreadsheet]. Accessed 23 April 2024.

More By This Author:

Dividends By The Numbers In April 2024Median Household Income In March 2024

Recession Probability Falls After Hitting Double-Top

Disclosure: Materials that are published by Political Calculations can provide visitors with free information and insights regarding the incentives created by the laws and policies described. ...

more