Good Job, Fed! Monetary Stimulus And The 0.0001%

In April 2007 the approximate size of the Fed's balance sheet was $800 billion, meaning that over the last decade it ballooned by 5X to $4.4 trillion. This was supposed to "stimulate" the main street economy, but once again today we got some "in-coming data" that said essentially nuts to that.

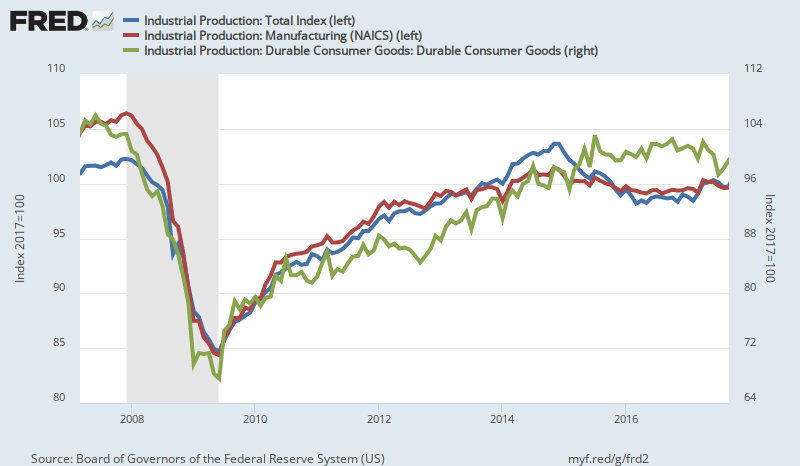

We are referring to the monthly industrial production index for September that the near-sighted financial press greeted as a modest but welcome rebound (o.3%) from last month's hurricanes which came, well, in hurricane season.

Actually, we saw something considerably more salient. To wit, the overall index came in at a level first reached in April 2007, while the sub-indexes for manufacturing and durable consumer goods are actually still 3.5% below where they were before even the first hint of the great financial crisis.

So let's see. After a full decade, the "stimulant" has grown by about 5.5X while the "stimulee" is up by 0.0X. Accordingly, the thought occurs that what is being stimulated may not be the main street economy at all.

Indeed, as we shall suggest below, it is not just the Wall Street casino that is collecting huge windfalls from the central bank's egregious falsification of money. The real bonanza, in fact, is accruing to the very tippy top of that fortunate precinct-------the top 0.0001% or a few thousand hedge fund and private equity operators.

But first let us address the usual canard that in this age of awesome technology and social media dominance that "industrial production" is going the way of the buggy whip and ain't that important no more.

In fact, that is only true statistically and at the most aggregated level of the GDP numbers. That is, private services and government accounted for $12.4 trillion or 64.4% of the $19.3 trillion rate of nominal GDP in Q2 2107. By contrast, goods production amounted to $4.2 trillion, business investment in plants and equipment was $1.6 trillion and residential construction amounted to $740 billion.

So loosely refer to the latter three components of GDP as "industrial production" and you get $6.6 trillion or just 34% of the total GDP. The implication, of course, is that if the industrial one-third has been flat-lining for a decade, there is always the much bigger services side of the economy to pull the weight of growth and jobs and income generation.

Then again, it's not even close to being that simple. We will argue until the cows come home that the $3.3 trillion government sector subtracts from real growth and living standards and that its pork barrel modus operandi inherently generates negative productivity growth.

After all, according to the national income and product accounts fully 22% of that amount or $741 billion is accounted for by defense. As a non-interventionist and anti-Warfare State advocate, we don't see much tangible "safety" or "security" coming from all that military spending, but we are absolutely certain that it does not contribute to private utility and real wealth.

Likewise, $1.4 trillion of services is accounted for by imputed output from owner-occupied housing. But that's just GDP accounting invented by some proto-Keynesian's in the 1930s; it's neither here nor there when it comes to the drivers of growth and wealth in the real world main street economy.

Indeed, the BEA (Bureau of Economic Statistics) at the Commerce Department could plug in any growth rate it wishes for the imputed income and output of what 75 million homeowners do in their castles everyday. It would make no difference at all in the real world.

Beyond that, we also have the conundrum of the private health care sector, which accounts for another $2.2 trillion of services output in the GDP accounts. The short answer in this instance is that the abysmal failure of "repeal and replace" by the current Republican government is proof positive that the US health care sector is riddled with bloat, inefficiency, and waste.

Were it otherwise, the free market solutions being proposed by Senator Rand Paul and a corporal's guard of true Capital Hill conservatives would not have been unceremoniously dismissed with hardly a how do you do.

Moreover, no one to our knowledge has ever argued that health care spending growth has been too weak because of high-interest rates!

That is, the $3.5 trillion of bond-buying since April 2007 could never impact the 12% of GDP accounted for by private health care spending in the first place because it is not interest rate sensitive. Through the back door of the $300 billion per year tax subsidy for employer-provided health plans, private health care is actually driven by fiscal policy---as well as global labor market economics.

In any event, set aside the government sector, health care and imputed homeowner services and you get an altogether different picture. What's left on the "services" side of nominal GDP is $5.0 trillion or well less than the $6.6 trillion of industrial production oriented output.

Yet the Fed has been talking about steady expansion of the GDP for eight years since the crisis----even patting itself on the back whenever possible---when more than half of the relevant economy has been dead in the water for a decade.

The reason for this disconnect, of course, is that the Fed heads never really talk about industrial production, productivity or tangible capital investment in their monthly statement of self-congratulations. They are actually squinty-eyed Keynesian who see everything through the absolutely myopic lens of the BLS' nonfarm jobs report and purported proxies for full employment GDP reflected in the unemployment rate, the PCE deflator, and nominal wage growth.

As we have often argued, however, the PCE deflator doesn't measure inflation-----especially consumer inflation which is pushed up by cartelized domestic services like health care and education and pulled down by global deflation rooted in mispriced capital and malinvestment. So it doesn't remotely measure whether the imaginary bathtub of potential domestic GDP is full to the brim, or not.

Likewise, wages on the margin are set by the India Price for internet intermediable services and the China Price for tradeable factory goods. The disappearance of the domestic US shoe, textile, electronics and household goods industries are proof of the latter. The fact that IBM had zero employees in India in 1993 and now has 130,000, or 45% more than it does in the US, is powerfully illustrative of the former.

But the most ludicrous Fed proxy for output growth is the monthly establishment survey and here's why. The output of the food service and accommodations (hotel and resort) industry amounted to $875 billion (annualized rate) or 4.5% of GDP during Q2 2017. Yet the latter---- along with the vast ocean of bloat and waste encompassed by the health and education cartels, respectively----accounted for 80% of all the payroll jobs growth since the pre-crisis peak in December 2007.

That's right. The HES Complex (health, education and social services) and the Leisure and Hospitality sectors employed a total of 42.9 million persons in December 2007 compared to 49.4 million in September 2017. That 6.6 million or 15% gain account for most of the 8.2 million gain (6%) in total nonfarm employment during the period.

In short, the Fed has its collective head buried in a Keynesian fog. The main street recovery---such as was---has represented nothing more than the natural regenerative forces of capitalism rebounding on their own accord after the Great Recession. Even then, the productivity generating and wealth-creating industrial sector of the US economy is still smaller than it was a decade ago.

Instead, all that massive monetary stimulus embodied in the Fed's unprecedented and fraud-based bond-buying campaign got trapped in the canyons of Wall Street.

There, in turn, it has generated the greatest equity, debt and real estate bubble in modern history---except that Yellen & Co do not see it at all.

As our Keynesian school marm noted over the weekend per the Wall Street Journal:

Ms. Yellen took a more sanguine approach.

While asset valuations today are “high in historical terms,” that may reflect investors’ expectations of a “new normal” of lower interest rates for the foreseeable future than in the earlier decades, she said, adding that financial stability risks remain “at a moderate level.”

No it isn't! And here one blindly obvious reason why.

The mad scramble for yield among money managers induced by nine years of massive financial repression has implanted financial explosive devices (FEDs) throughout the warp and woof of the global financial system. The systematic falsification of financial asset prices has literally touched off a chain reaction of speculation and irrational exuberance that is plenary and embedded in nooks and crannies everywhere.

But the chart below shows one of the most egregious manifestations of Bubble Finance and is symptomatic of the financial rot that has again accumulated after a decade of radical monetary stimulus. To wit, during the past 11 quarters more than $41 billion has been extracted from already highly leveraged, junk-debt ridden LBO companies to pay dividends to their private equity sponsors.

Folks, in an honest free market no one in their right mind would buy the junk debt issued to fund so-called leverage recaps---and especially at the thinnest yields in recorded history. Literally, money managers are being herded to the next slaughter by central bankers who can't even see the massive mispricings and speculative bubbles that are virtually the sole fruits of their madcap money printing ventures.

What makes this blindness doubly outrageous is that fact that the Fed and other central banks are dominated by redistributionist liberals like Yellen, Stanley Fischer, and Lael Brainard. Do these monetary central planners recognize that upwards of $10 billion of the proceeds from the leveraged recaps (i.e. the 20% carried interest portion going to the sponsors) represented in the chart below went to the top partners of a few dozen LBO firms?

That is, the endgame of massive money printing has not been industrial growth, jobs or main street incomes. It has been monumental speculative bubbles which at the end of the day have showered perhaps a few thousand Wall Street operators with tens of billions of ill-gotten gains

If this were merely a matter of injustice and an affront to economic decency it would be bad enough. But the same financial deformations and malinvestments that generated the above chart are rampant throughout the financial system. In fact, the stampede toward speculation and momentum and math-driven financial flows has never been more dangerous than at present.

Currently, there is more than $1 trillion invested in quantitative hedge funds and another $3 trillion in herd-driven ETFs. Needless to say, when it all blows, Yellen and the rest of our benighted central bankers will claim a "mysterious contagion" has again arrived from outer space--just as they did in 2008.

But perhaps this time, the American public will not be so gullible. There is indeed a terrible contagion lurking around the corner, but it did not arrive on a comet from an alternative universe.

It is the handiwork of a few dozen central bankers who have usurped the vast powers that belong rightfully to the capitalist free market. While we do not underestimate the ability of central bankers to dissimulate and eschew blame, we think that perhaps this time they may confront not an open invitation to "do whatever it takes", but a mob wielding torches and pitchforks chanting "three strikes and you are out".

At least we can hope.

Disclosure: None.