Goldman Traders Just Had The Most Losing Days Since The 2011 US Downgrade

Things sure have changed for the world's most important FDIC-backed hedge fund.

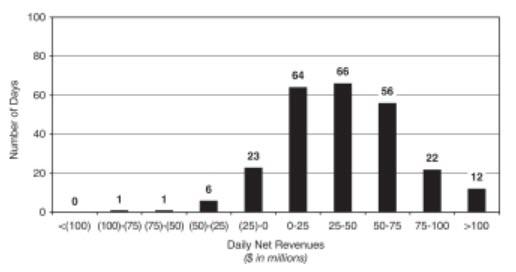

Back in 2010, when QE was raging and a blind monkey had to try hard to lose money, Goldman reported that quarter after quarter, it had zero losing trading days, as the following chart from Q1 2010 shows.

(Click on image to enlarge)

In retrospect Goldman had only the Fed to thank for such flawless quarters, because as Bloomberg notes, the end of 2018 - when stocks revolted as the mere thought of the Fed's ongoing balance sheet shrinkage and rising rates, sending the S&P to the verge of a bear market - proved to be a rough one for Goldman Sachs, and in Q4 Goldman's traders posted losses on at least 19 days in the last quarter of the year, including one day where losses approached almost $100 million.

It was the worst quarter for the FDIC-backed hedge fund since the third quarter of 2011, when the US was downgraded by S&P, sending markets reeling, and was nearly double the 12 trading days of losses suffered for the first three quarters of 2018.

(Click on image to enlarge)

For the full year, Goldman reported 31 trading day losses, with the most, or 29, occurring on days when the bank lost between $0 and $25MM and suffered one day in Q4 when it lost between $75MM and $100MM.

(Click on image to enlarge)

Confirming once again that VaR models are a complete waste of resources, the bank reported that at least two of the daily losses exceeded what Goldman’s value-at-risk estimate would expect on 95% of days. That said, the bank also had some hefty gains including 12 days in the year when traders pocketed more than $100 million for the firm as shown in the chart above.

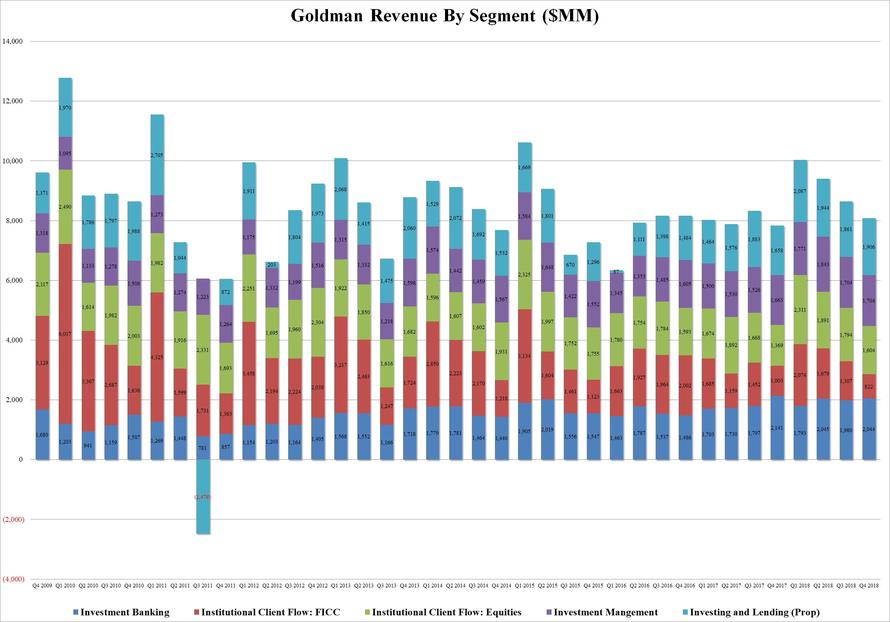

Goldman's dismal trading performance in Q4 was already known: as we reported last month, Goldman’s FICC traders posted the lowest revenue since the financial crisis in the fourth quarter and the bank's new DJing CEO D-Sol, is carrying out a review of the trading business.

(Click on image to enlarge)

As Bloomberg adds, "the bank’s executives have proposed plans to trim the fixed-income trading unit, people with knowledge of the matter have said. That would likely include personnel cuts as well as a reduction in the capital dedicated to its core trading business within the fixed-income group."

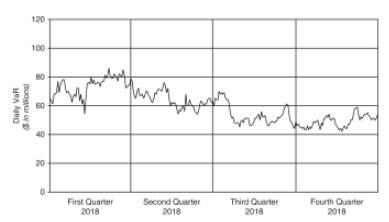

Finally, suggesting that Goldman is accelerating its conversion to a boring depositor-lender bank, Goldman also revealed that its daily VaR continued to decline to $57 million as of December 2018 from $65 million as of December 2017, with the "overall decrease primarily due to reduced exposures" as not even Goldman had any idea how to trade a market where the Fed wasn't explicitly backstopping each and every trade.

(Click on image to enlarge)

The good news is that in Q1, Goldman certainly got its mojo back and with the generous backstop of the once again dovish Fed and the "Powell Pause", it is almost certain that Goldman will have almost no trading losses in the current quarter.