'Goldilocks' Gored By Growth Gains; Bitcoin Bounces As Rate-Cut Hopes Hammered

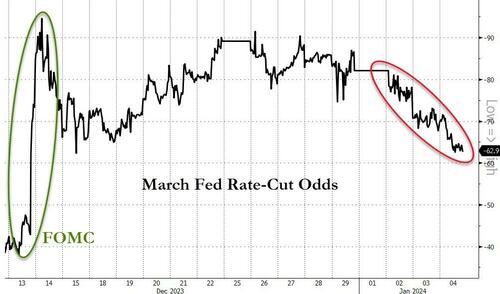

Strong jobs data (ADP jobs added more than expected, slowing wage growth, and initial jobless claims at 2023 lows) and strong Services economy survey data (PMI at 5 month highs) prompted higher Treasury yields today, and sent rate-hike expectations tumbling for March...

Source: Bloomberg

In the words of one veteran trader (who happens to be long and wrong), "the growth's just too damn hot... The Fed can't stand by as the market runs wild on rate-cut hopes." (edited for NSFW words)

And rate-cut expectations for 2024 have tumbled overall...

Source: Bloomberg

And yields surged back to (or above) yesterday's highs (curve basically all up around 6-7bps today). It's been an ugly week for bonds to start 2024...

Source: Bloomberg

As the 10Y Yield surged back up to 4.00% (and stalled again)...

Source: Bloomberg

The 10Y yields has broken back above its recent downtrend line...

Source: Bloomberg

And the longest-duration stocks suffered (MAG7 has erased all of December's gains)...

Source: Bloomberg

And as goes MAG7, so goes the market (for now) as the 492 ain't helping. Nasdaq was the day's biggest loser while The Dow managed very small gains. A late-day slump ($4BN MoC to sell), wiped off any lipstick left on any pigs...

Nasdaq is down 5 days in a row - the longest losing streak since Dec 2022.

Small Caps (Russell 2000) and Big-Tech (Nasdaq) are down around 3.5% to start the year...

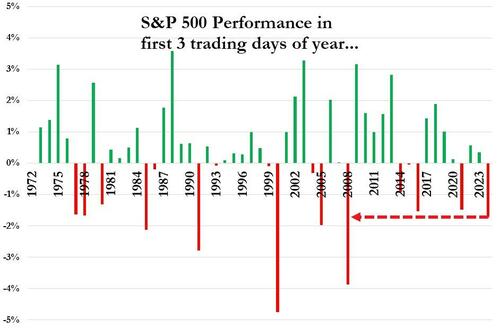

The S&P is down almost 2% - the worst start to a year since 2008...

The 200bps underperformance of Nasdaq relative to the S&P 500 in the last 5 days is among the largest in the last two years...

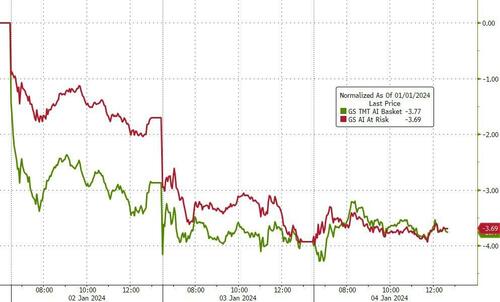

And it's not just an AI thing as AI-at-risk names are down just as much in 2024 so far...

Source: Bloomberg

Anti-Obesity drug names are outperforming though in 2024 so far...

Source: Bloomberg

Value stocks have outperformed growth for the last few weeks, breaking the downtrend...

Source: Bloomberg

After yesterday's pukefest to $41k (on nothing), Bitcoin ripped back up to $44k today as the spot ETF approval seems imminent-erer...

Source: Bloomberg

The dollar rallied for the 5th straight day (its longest win streak since September), rallying back during the European session after Asian weakness. This is the best start to a year for the dollar since 2005.

Source: Bloomberg

Oddly - again - with 'growth' fears sparking higher yields, lower rate-cut hopes, oil prices... tumbled. The driver was major inventory builds in gasoline and distillates (because the middle east is still a shit-show). WTI came within a tick of $74 intraday overnight before dropping back to almost a $70 handle before bouncing back...

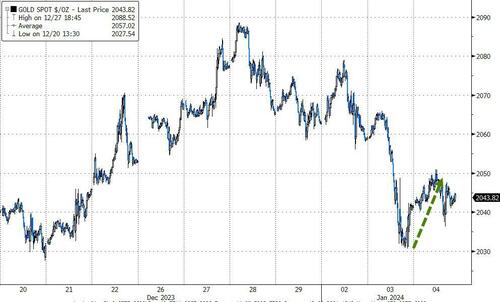

Spot Gold managed very modest gains on the day, holding above $2040...

Source: Bloomberg

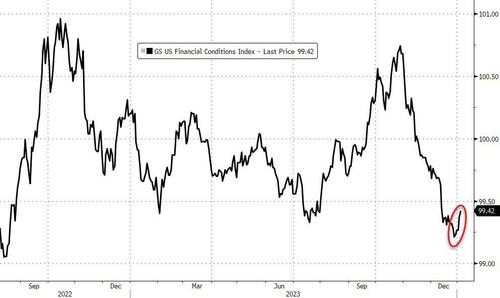

Finally, financial conditions are starting to tighten (a little for now, but that's a start)...

Source: Bloomberg

And remember The Fed Minutes specifically pushed back against too much exuberance in financial markets:

“Many participants remarked that an easing in financial conditions beyond what is appropriate could make it more difficult for the Committee to reach its inflation goal.”

So, be careful what you wish for - the porridge is too hot for Goldilocks here and if tomorrow's payrolls print is 'hot', hopes and dreams of 'just right' rate-cuts in 2024 will be dashed on the hungry chins of ravenous bears.

More By This Author:

Initial Jobless Claims End 2023 At Year LowsManufacturing Jobs Decline In Latest ADP Report, Services Soar

More Than 140 Drug Brands Will Have Their Prices Hiked Heading Into 2024

Disclosure: Copyright ©2009-2023 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more