Gold Weekly Forecast: Fed Outlook, US Data To Steer Price Action

Image Source: Unsplash

Gold ended the week on an optimistic note, as it rose above the $3,370 level following Fed Chair Powell’s statements at Jackson Hole which triggered the downslide in the dollar and yields.

Powell indicated a change of course toward adaptable inflation as the higher interest rates are weighing on the labor markets. This weekend will put focus on another data-intensive week that may determine whether gold can continue its recovery or if will be put under pressure once again.

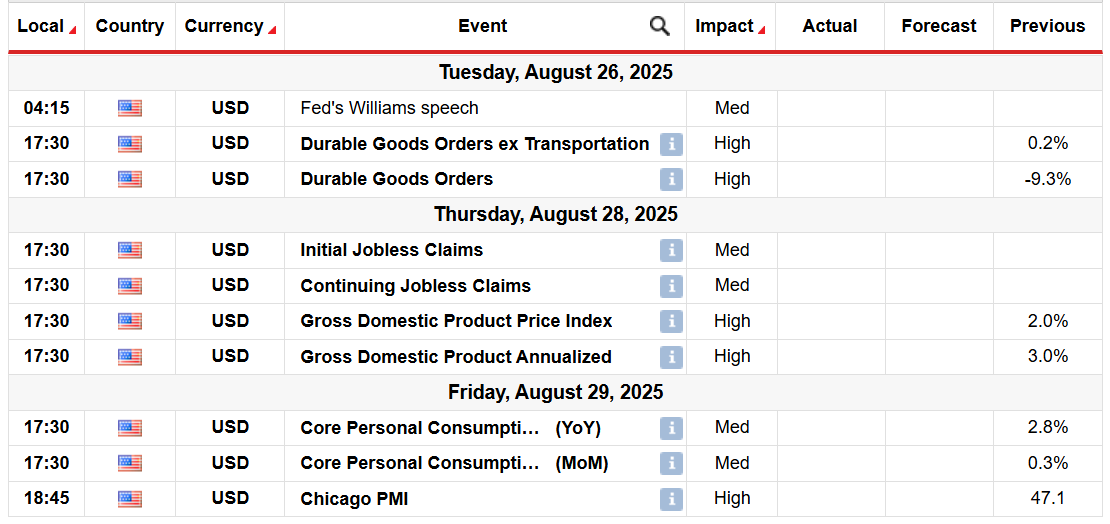

The motivation to invest in gold will mainly be found in US macro-economic releases, which will be testing the Fed policy outlook. On Tuesday, Durable Goods Orders data is due, which will indicate business activities. Following a sharp 9.3% plunge in June, markets are anticipating a further 4.0% decrease. This could also be a mixed bag as a lower print would drag on the dollar and benefit gold, whereas an outperformance would push up Treasury yields and halt gold bulls.

The most important release of the week is the July Core Personal Consumption Expenditures (PCE) Price Index, which is due on Friday. Inflation remains sticky, and any upside surprise would prompt a reassessment of future rate cuts. Stronger-than-anticipated PCE would drive Treasury yields up and gold down. A weaker number, on the other hand, would support bets on the dovish Fed and could see another upside swing in the XAU/USD currency cross.

On Thursday, markets will see the second estimate of Q2 GDP growth. The first reading increase was healthy, with 3% annualized growth. A downward adjustment would reaffirm the idea that the US economy is slowing down. This would augment gold, as traders often seek out safe havens during periods of economic downturn.

(Click on image to enlarge)

Geopolitical tensions calmed down further following the easing of tensions in Ukraine, which capped gold demand last week. According to the CME FedWatch Tool, the probability of a 25 bps reduction in September is now at around 90%.

Traders anticipate seeing consistent easing into the close of the year. Such weighted dovishness, however, may also constrain the ability of the dollar to weaken further unless future data clearly warrants against the move.

Gold Weekly Technical Forecast: Bulls to Challenge $3,400 Level

(Click on image to enlarge)

Gold daily chart

The daily chart provided shows the price above the confluence of 20- and 50-day MAs near the $3,350 mark. The price was seen playing within that range, well below the upper boundary of $3,440. The 100-day MA continued to support the bulls. The next key resistance for gold can be found at the $3,400 level.

On the flip side, breaking the $3,300 support at 100-day MA would open the path for losses towards the $3,260 support level ahead of the next support at $3,200.

More By This Author:

Gold Price Holds Weak Tone Amid Fed, Geopolitical RiskGBP/USD Price Analysis: Pound Holds Ground After Pullback

USD/JPY Outlook: Gains As Traders Await Trump–Zelensky Talks

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more