Gold Tanked As China Deal And Middle East Diplomacy Sparked Market Euphoria

Image Source: Pixabay

- The XAU/USD currency cross fell by over 1.5% as safe-haven demand waned due to global trade and geopolitical tensions easing.

- A trade deal between the US and China was signed. More agreements are expected before July 9, which boosted sentiment.

- Iran signaled diplomacy. The Israel-Gaza war may end in two weeks, according to Al Arabiya.

- Core PCE rose above forecasts. Meanwhile, the Fed’s Kashkari still expects two rate cuts in 2025.

The price of gold tumbled by over 1.50% on Friday amid an improvement in risk appetite, driven by several factors. The de-escalation of the Israel-Iran conflict, the trade agreement with China, and ongoing negotiations between the United States and its peers to reach commercial deals were welcomed by investors, who had previously sought refuge in bullion’s safe-haven demand.

The XAU/USD cross was seen trading at around $3,274 after hitting a daily high of $3,328. On Thursday, the White House announced that the US and China have formally signed a trade agreement, effectively ending the ongoing “trade war.” US Commerce Secretary, Howard Lutnick, said that additional deals are looming as the July 9 deadline approaches.

Regarding geopolitics, Iran has shown signs of flexibility, leaning toward diplomacy, as its representative in the UN said that Tehran is open to forming a regional nuclear consortium in the event of an agreement with Washington.

Adding to the upbeat mood has been the possibility of the end of the Israel-Gaza war within two weeks, as revealed by Al Arabiya.

In the US, the Federal Reserve's preferred inflation gauge, the core Personal Consumption Expenditures (PCE) Price Index, came in line with estimates in May but failed to show any progress toward disinflation.

Meanwhile, the Minneapolis Fed's Neel Kashkari commented that he still sees the potential for two rate cuts in 2025.

Market Movers: Gold Price Appeared Set for Correction Amid Steady US Dollar and US Yields

- The price of gold seemingly lost its luster due to market participants becoming increasingly optimistic about the global economy. News of the trade deal with China, as well as those with other countries, including South Korea, Vietnam, and the EU, was welcomed by investors.

- Howard Lutnick, the US Commerce Secretary, added that China is “going to deliver rare earths to us,” and once they do that, “we’ll take down our countermeasures,” Lutnick told Bloomberg News in an interview.

- Core PCE in May rose by 2.7% year-over-year, a tenth above estimates and April’s data. Headline inflation for the same period increased by 2.3% year-over-year as expected.

- The University of Michigan (UoM) revealed that Consumer Sentiment in June improved moderately. The Index rose from 60.5 to 60.7, while inflation expectations were downwardly revised, with households expecting prices to rise from 5.1% to 5% over the next year. For the next five years, inflation is projected to be around 4%, down from 4.1%.

- The US 10-year Treasury note has appeared flat, yielding around 4.242%. The US Dollar Index (DXY), which tracks the performance of the buck’s value against a basket of six peers, was virtually unchanged at 97.28.

- Minneapolis Fed President Neel Kashkari said an inflation boost is likely coming, but actual inflation indicates renewed progress toward the 2% target. More time is needed to determine whether the effects of the trade war are delayed, or if they will be smaller than initially thought.

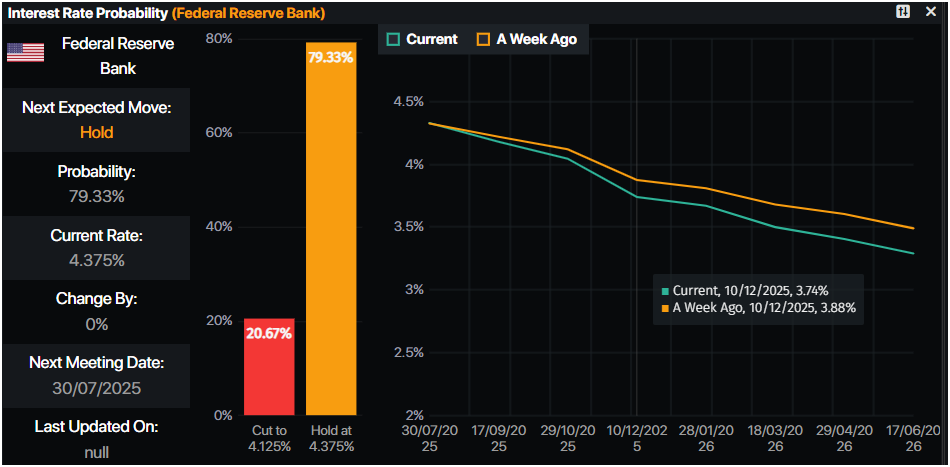

- Money markets seemed to suggest that traders are pricing in 63.5 basis points of easing toward the end of the year, according to Prime Market Terminal data.

(Click on image to enlarge)

Image Source: Prime Market Terminal

XAU/USD Technical Outlook: Gold Price Set for a Pullback to $3,200

The uptrend in the price of gold has remained in place, but in the short-term, it could drop further after breaking below the 50-day Simple Moving Average (SMA) at $3,323. The Relative Strength Index (RSI) indicated that momentum turned bearish despite the price action achieving higher highs and higher lows.

For a bullish continuation, the XAU/USD currency cross would have to climb past the $3,300 mark. The following key resistance would be the 50-day SMA at $3,323, followed by the June 26 peak of $3,350. If surpassed, up next would be the $3,400 level. On the flip side, if the XAU/USD cross tumbled below the $3,300 level, the May 29 low of $3,245 and $3,200 would be up for grabs.

(Click on image to enlarge)

More By This Author:

Silver Price Forecast: XAG/USD Steadies Near $36.60 Up Over 1.80% WeeklySilver Price Forecast: XAG/USD Climbs Above $36.00 On Weak Us Dollar

EUR/USD Extends Rally Above 1.1600 As Ceasefire Sinks US Dollar

Disclaimer: Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only ...

more