Gold Pullback Looking For Support To The Upside

Image Source: Pixabay

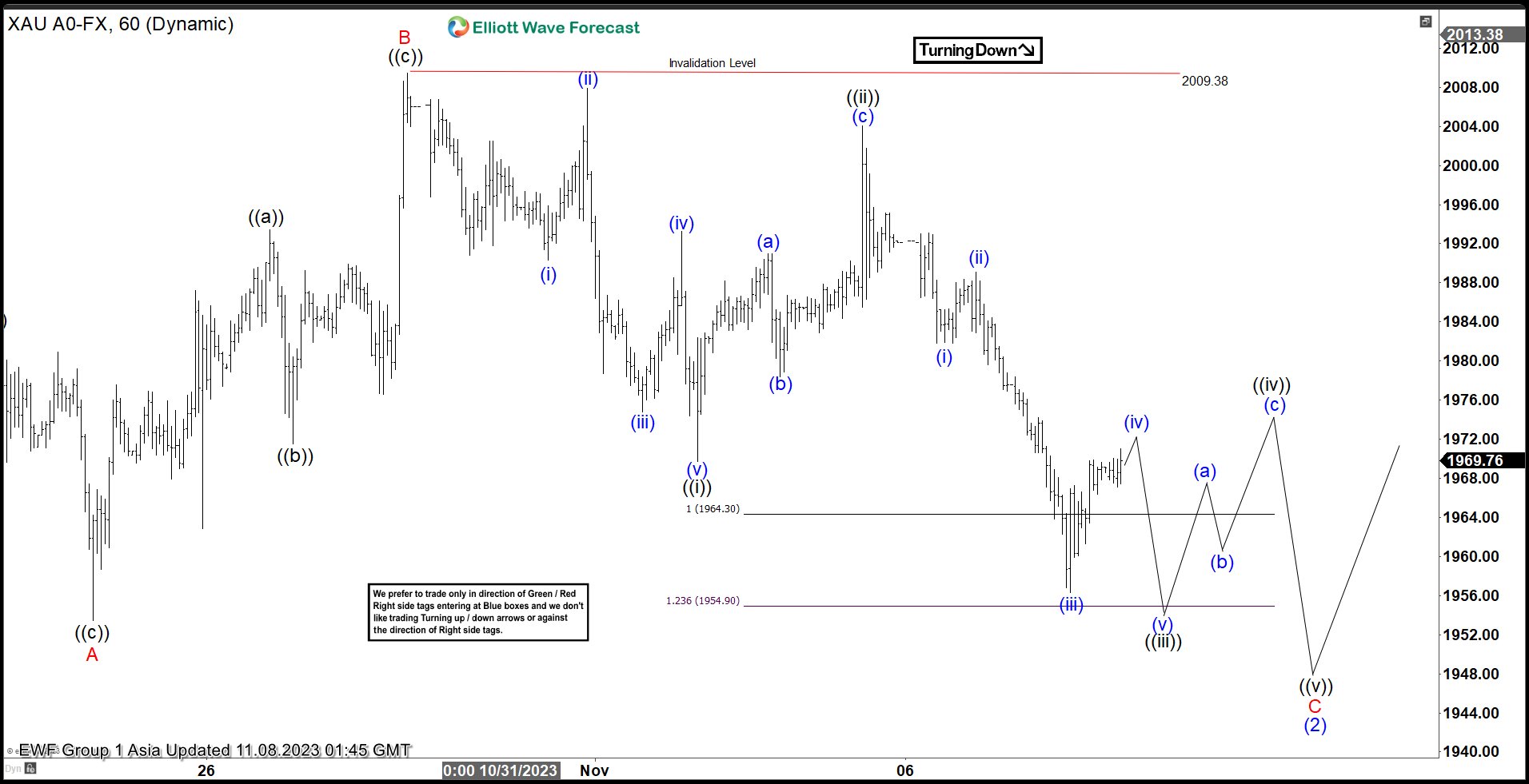

Short Term Elliott Wave in Gold (XAUUSD) suggests that the metal is correcting cycle from 10.6.2023 low. Up from 10.6.2023 low, wave (1) ended at 1997.16. Pullback in wave (2) is in progress as an expanded Flat structure. Down from wave (1), wave A ended at 1953.4 and rally in wave B ended at 2009.38. Internal of wave (B) unfolded as a zigzag in lesser degree as the 1 hour chart below shows. Up from wave A, wave ((a)) ended at 1993.44 and pullback in wave ((b)) ended at 1971.50. Final leg wave ((c)) ended at 2009.38 which completed wave B.

Wave C lower is in progress as a 5 waves diagonal. Down from wave B, wave ((i)) ended at 1969.69 and rally in wave ((ii)) ended at 2004.07. The metal may see another leg lower to end wave ((iii)), then it should rally in wave ((iv)) before turning lower again 1 more time in wave ((v)) to end wave C of (2). Near term, as far as pivot at 2009.38 high stays intact, the metal has scope to extend a bit lower. However, in the higher degree, as long as Gold stays above 10.6.2022 low at 1810.58, the current wave (2) pullback should find support in 3, 7, or 11 swing for further upside.

XAUUSD 60 Minutes Elliott Wave Chart

(Click on image to enlarge)

Gold (XAUUSD) Elliott Wave Video

Video Length: 00:05:10

More By This Author:

Nasdaq Rally Corrective Or Start Of New Bullish Leg?

Shopify Daily Bullish Structure Leading the Way

DAX Doing 3 Wave Corrective Bounce From The Lows

Disclaimer: Futures, options, and over the counter foreign exchange products may involve substantial risk and may not be suitable for all investors. Leverage can work against you as well as for ...

more