Gold Price Slid As Powell Warned About Tariff-Driven Inflation

Image Source: Pixabay

- The XAU/USD currency pair was pressured by the Fed’s hawkish tone and a liquidity crunch on Friday.

- Powell signaled tariffs could reaccelerate inflation, which cooled rate cut bets and hammered gold prices.

- The Financial Times reported that hedge funds have faced the largest margin calls since the height of the COVID-19 pandemic, which sparked the forced liquidation of assets.

The price of gold extended its losses on Friday and plunged to a seven-day low of $3,015 before the yellow metal recovered some ground after a speech by Federal Reserve Chair Jerome Powell. His speech indicated that inflation could reaccelerate due to tariffs. The XAU/USD currency cross was seen trading at around $3,029, down approximately 2.70%.

The turmoil seen in the financial markets continued amid the escalation of the trade war between the United States and China. Alongside that, Powell poured cold water on Fed easing bets, as he commented that tariffs are likely to have an impact on the US economy, including slower growth and higher inflation.

A recent article in the Financial Times revealed that hedge funds were hit by the most significant margin calls seen since the height of the COVID-19 pandemic, following Trump’s Liberation Day.

Suki Cooper, an analyst at Standard Chartered, said, “We tend to see gold as a liquid asset being used to meet margin calls elsewhere, so it's not unusual for gold to sell off after a risk event given the role that it can play in a portfolio.”

Data-wise, the US economic docket featured a strong jobs report, which highlighted that private companies hired over 200,000 people in March. The Unemployment Rate edged a tenth up, but Bloomberg stated that “it was mostly a rounding error.”

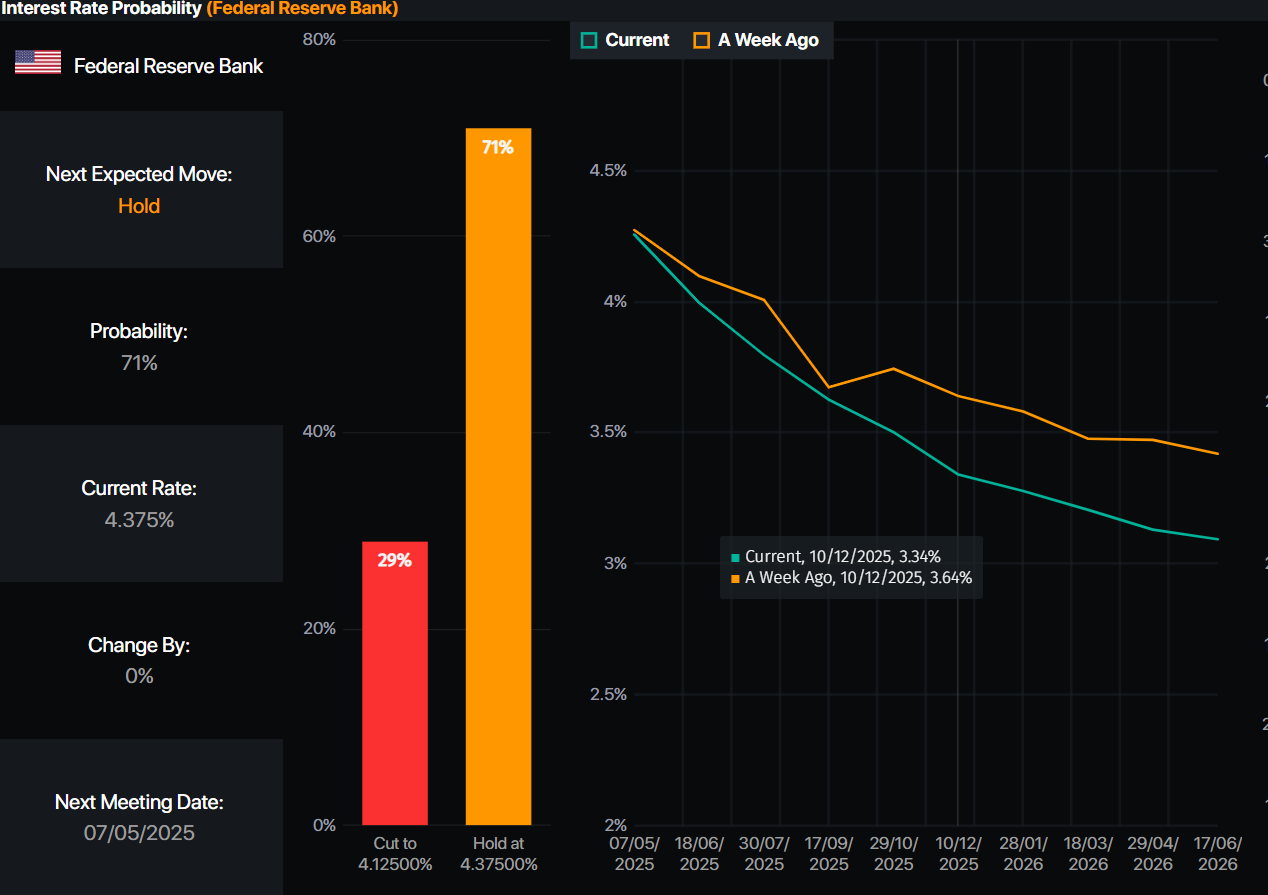

Money market traders had priced in over 1% of Fed easing by 2025, according to the data provided by Prime Market Terminal.

(Click on image to enlarge)

Image Source: Prime Market Terminal

Recession fears ignited, as depicted by the US10s to 3 months yield curve inversion, with the latter seen paying 25 bps more than the US 10-year yield.

Next week, the US economic docket will feature Fed speakers, the latest Federal Open Market Committee (FOMC) minutes, and the release of inflation data on both the consumer and producer side.

Market Movers: The Gold Price Tanked, Weighed by US Dollar Strength

- The US 10-year Treasury-note yield dropped three basis points to 4.00%. US real yields edged down four bps to 1.718%, according to US 10-year Treasury Inflation-Protected Securities (TIPS) yields.

- The US Dollar Index (DXY), which tracks the performance of the greenback against a basket of six currencies, rallied over 1.14% to the 103.09 mark, as it exerted pressure on bullion prices.

- Jerome Powell commented that monetary policy is appropriate as they wait for clarity before considering interest rate adjustments. He said, “Tariffs are likely to raise inflation in the coming quarters; more persistent effects are possible.”

- Powell added that the economic outlook appears highly uncertain and that despite the economy being in a good place, downside risks have increased.

- March’s Nonfarm Payrolls exceeded forecasts of 135,000 and rose by 228,000, significantly surpassing February’s reading of 151,000. The US Unemployment Rate edged up from 4.1% to 4.2%.

XAU/USD Technical Outlook: Gold Price Tumbled Below $3,050

At the time of writing, gold was seen puking as sellers continued to push prices lower. It seemed that sellers eyed the $3,000 mark as a challenge. The Relative Strength Index (RSI), despite its bullishness, appeared ready to cross below its neutral level. This seemed to signal that gold could be poised for a pullback in the coming days.

If gold was to print a daily close below the $3,000 level, the next support would be the 50-day Simple Moving Average (SMA) at the $2,937 mark, followed by the $2,900 figure. On the other hand, if the XAU/USD currency cross could edge further up, buyers would need to reclaim $3,100 to regain control.

(Click on image to enlarge)

More By This Author:

Gold Price Crashed Over 2.8% As Powell Turns Hawkish On Tariffs And Inflation

Gold Price Seesaws Above $3,100 As Trump Announces Tariffs On China

Gold Holds Near All-Time High, Eyes On Trump’s Tariff Reveal

Disclaimer: Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only ...

more