Gold Price Gains Ground Ahead Of US PPI Data, Fed’s Powell Speech

Image Source: Pixabay

- Gold price trades on a stronger note on Tuesday.

- Any signs of sticky inflation might further diminish expectations of US interest rate cuts this year, pressuring yellow metal.

- The US PPI report for April and Fed Chair Jerome Powell's speech will be in the spotlight on Tuesday.

The gold price (XAU/USD) rebounds despite the consolidation of the US Dollar (USD) on Tuesday. The upside of yellow metal might be limited as traders might wait on the sidelines ahead of key US inflation data this week. The higher-for-longer US rate mantra has exerted some selling pressure on the XAU/USD in recent sessions. However, the safe-haven flows due to escalating Middle East tensions might boost the gold price for the time being.

Investors will closely watch the key US economic data this week. The US Producer Price Index (PPI) for April is due on Tuesday, along with Fed Chair Jerome Powell's speech. The attention will shift to the US Consumer Price Index (CPI), due on Wednesday. These reports could offer insights into the timing of the Fed's initial rate adjustment. The hotter-than-expected inflation figures might dampen the prospect of a Fed rate cut, weighing on the precious metal. Higher interest rates may reduce overall investment demand for gold as they increase the opportunity cost associated with holding gold.

Daily Digest Market Movers: Gold price holds positive ground, all eyes are on the crucial US key inflation data

- Fed vice chair Philip Jefferson called for holding interest rates at current levels until inflation shows more signs of easing, adding that he will continue to look for additional evidence that inflation is going to return to the 2% target.

- The Fed is likely to cut the Fed funds rate by 25 basis points (bps) in September, said 70 of 108 economists, while cutting rates by 50 bps in 2024, said 65 of 108 economists, according to the Reuters poll.

- On Monday, Israeli soldiers moved deep into the ruins of Gaza's northern frontier to retake an area from Hamas rebels, while tanks and troops pushed a highway into Rafah, forcing Palestinian residents to flee, per Reuters.

- The US Producer Price Index (PPI) for April is expected to show an increase of 2.2% YoY, while the Core PPI figure is estimated to show an increase of 2.4% YoY in the same period.

- The US Consumer Price Index (CPI) inflation is forecast to ease to 3.4% YoY in April from 3.5% prior. Core CPI inflation is projected to drop to 3.6% YoY in April from 3.8% in March.

Technical Analysis: Gold price maintains a positive outlook

The gold price edges higher on the day. The yellow metal keeps the bullish vibe unchanged as XAU/USD remains above the key 100-day Exponential Moving Average (EMA) on the four-hour chart. The upward momentum is reinforced by the 14-day Relative Strength Index (RSI), which is in the bullish zone at 52.70, indicating the support level is likely to hold rather than break.

A high of May 10 at $2,378 acts as an immediate resistance level for the precious metal. Extended gains will pave the way to the $2,400 psychological level. A break above this level will see a rally to an all-time high near $2,432, en route to the $2,500 round figure.

On the other hand, the crucial support level will emerge around the $2,325–$2,340 zone, portraying the confluence of the resistance-turned-support level and the 100-period EMA. The breach of this level will expose a low of May 2 at $2,281.

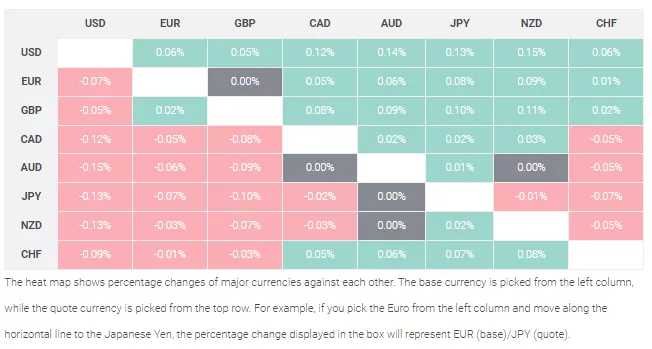

US Dollar price today

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the weakest against the Pound Sterling.

More By This Author:

EUR/USD Price Analysis: The Crucial Resistance Level Will Emerge At The 1.0790–1.0800 RegionGold Price Extends The Rally Despite Hawkish Fedspeak

USD/CHF Trades On A Positive Note Above 0.9050, Focus On Fed’s Daly’s Speech

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not ...

more