Gold Price Forecast: XAU/USD Shined As US Yields Dropped Amid An Upbeat Market Mood

Image Source: Pixabay

- Gold prices saw a recovery on Friday, achieving gains of 0.25%. This was driven by a reversal in US bond yields, with the 10-year note coupon dropping from a 16-year high of 4.51% to 4.44%.

- Federal Reserve officials expressed a cautious stance, emphasizing the need for patience despite the necessity for further rate hikes to control inflation.

- The US Dollar Index (DXY) continued to print modest gains, as it was seen sitting at around 105.56.

- Next week, US data includes Consumer Confidence, Durable Goods Orders, and Initial Jobless Claims.

The gold price recovered some ground on Friday after hitting a weekly low of $1913.99, though it remained shy of breaking solid resistance at around the 50-day moving average (DMA) at $1929.79. Factors like dropping US T-bond yields and an upbeat market sentiment drove XAU/USD’s price toward the $1924.56 mark, achieving gains of 0.25%.

Gold Price Nudged Upwards Despite a Firm US Dollar

XAU/USD prices were being driven up by the reversal in US bond yields. The US 10-year benchmark note coupon reversed from a 16-year high of 4.51% towards 4.44%. Consequently, US real yields were seen edging lower from 2.11% to 2.06%.

In the meantime, Federal Reserve officials had turned cautiously, led by Boston and San Francisco Fed Presidents Susan Collins and Mary Daly, stressing that although inflation is cooling down and further rate hikes would be needed, the Fed must be patient. Fed Governor Michelle Bowman commented that more increases are needed to control inflation.

Data-wise, S&P Global announced the final PMI readings in the United States. Manufacturing PMI improved to 48.9, but still stood in recessionary territory. Contrarily, Services and Composite PMI showed signs of losing steam, though it expanded and continued to aim towards the 50 expansion/contraction threshold.

Meanwhile, the US Dollar Index printed modest gains of 0.17%, stalling the yellow metal's rally. The DXY was seen sitting at around 105.56, printing solid gains for the tenth straight week.

On the US front, Consumer Confidence, Durable Goods Orders, Initial Jobless Claims, and the Fed’s preferred gauge for inflation, the core PCE, are to be released next week.

XAU/USD Price Analysis: Technical Outlook

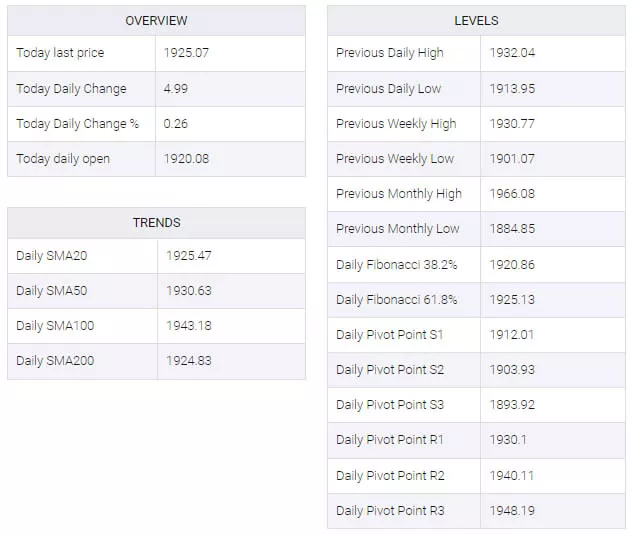

From a technical standpoint, the XAU/USD appeared set to continue to trade sideways within the $1913-$1948 range, with most daily moving averages (DMAs) seen hovering around the recent exchange rate. However, as the yellow metal remained below the 200-DMA at $1926.24, the path of least resistance tilted to the downside.

The first area of support would be found at the Sept. 21 low of $1913.99, followed by the Sept. 14 swing low of $1901.11. Conversely, if the metal was able to surpass the 100-DMA at $1941.86, a challenge of the $1950 mark could be expected.

(Click on image to enlarge)

XAU/USD Technical Levels

More By This Author:

AUD/USD Rallies Despite A Firm US Dollar, On Risk-On Mood And Falling US YieldsUSD/JPY Heading Topside For Friday, Aiming For 148.50

USD/JPY Looks To Approach 148.50 On BoJ’s Decision To Keep Interest Rates Unchanged

Disclaimer: Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only ...

more