Gold Price Forecast: XAU/USD Hit A Five-Month Peak, Dipped To $1980s On Safe-Haven Flows

Image Source: Unsplash

- The price of gold hit a five-month high at $1997.16 per troy ounce after bouncing back from the daily lows of $1972.12 on Friday.

- The escalating conflict in the Middle East and attacks on US military bases in Iraq and Syria heightened investors' anxiety.

- Dovish comments from Fed Chair Jerome Powell sparked gold’s ascent towards the end of the week.

The price of gold was shy of testing the $2000 barrier on Friday amidst increasing geopolitical risks, as the conflict between Israel and Hamas appeared to be spreading toward more countries in the region. At the time of writing, XAU/USD was seen trading at around $1980.20 after the yellow metal bounced from the daily lows of $1972.12.

XAU/USD Climbed, Fueled by Middle East Conflicts and a Weakening US Dollar

A potential escalation in the conflict in the Middle East kept investors on their toes as Bloomberg reported, “The US said its military bases in Iraq and Syria are increasingly under attack.”

That, along with dovish comments by Federal Reserve Chair Jerome Powell, weighed on US Treasuries -- particularly the 10-year benchmark note, which fell seven basis points. This move was a tailwind for XAU/USD prices. The US Dollar Index (DXY), which tracks the performance of the US dollar vs. a basket of six currencies, pared its earlier gains, as it turned red at 106.17 and fell by approximately 0.07%.

The Fed parade continued on Friday, as Atlanta Fed President Raphael Bostic indicated the possibility of a rate cut in 2024, suggesting a potential shift in monetary policy if economic conditions warrant it.

Meanwhile, Cleveland Fed President Loretta Mester expressed that the Federal Reserve may be at or near the peak of its rate hike cycle. She emphasized that the central bank will closely depend on incoming data in its decision-making process for the next monetary policy meeting.

Aside from this, next week’s economic calendar will feature US flash PMI data, the release of Q3 Gross Domestic Product (GDP) on its preliminary reading, Durable Goods Orders, unemployment claims, and the Fed’s preferred gauge for inflation, the core PCE.

XAU/USD Price Analysis: Technical Outlook

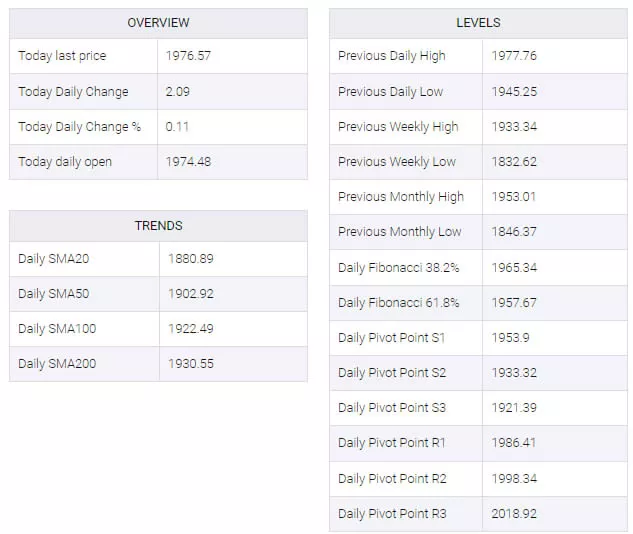

If gold were to extend its gains past the $2000 level, the metal's next resistance would be found at the May 10 daily high of $2048.15, followed by last year’s high of $2075.14, before it could challenge the all-time high at $2081.82. If XAU/USD cannot stay above the $2000 mark, the first support would be the July 20 high at $1987.42, followed by the Sept. 1 high-turned-support at $1952.95.

(Click on image to enlarge)

XAU/USD Technical Levels

More By This Author:

US Dollar Sets Sail Towards Negative Weekly Close

WTI Extends Gains Near $89.10 On SPR Refill Plans, Escalating Tensions In Middle-East

S&P 500 Declines To $4,278 As U.S. Treasury Yields Surge Once More

Disclosure: Information on this article contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes ...

more