Gold Price Forecast: Soft US Inflation Data Has XAU/USD Eyeing Less Hawkish Fed

Photo by Dmitry Demidko on Unsplash

Gold Fundamental Forecast: Slightly Bullish

- Gold prices soared the most since March 2020 last week.

- Soft US inflation data saw traders eye a less hawkish Fed.

- Keep an eye on Fedspeak, US PPI, and retail sales ahead.

Gold prices soared in the immediate aftermath of October’s US inflation report last week. By the end of Friday, the yellow metal was up about 5.1% for the week. That was the best performance since March 2020. The XAU/USD pair is very sensitive to the combined trajectory of the US dollar and Treasury yields. Both of the latter fell hard after the inflation report - as shown in the chart below.

US CPI unexpectedly surprised softer, with the headline rate dropping to 7.7% year-over-year versus 7.9% anticipated. The core rate also softened, weakening to 6.3% from 6.6% prior. A softening in food and energy prices contributed to the outcome. Interestingly, the gap between core and headline inflation narrowed further as housing-related costs still surged.

Gold Reaction to US CPI Data

Chart Created in TradingView

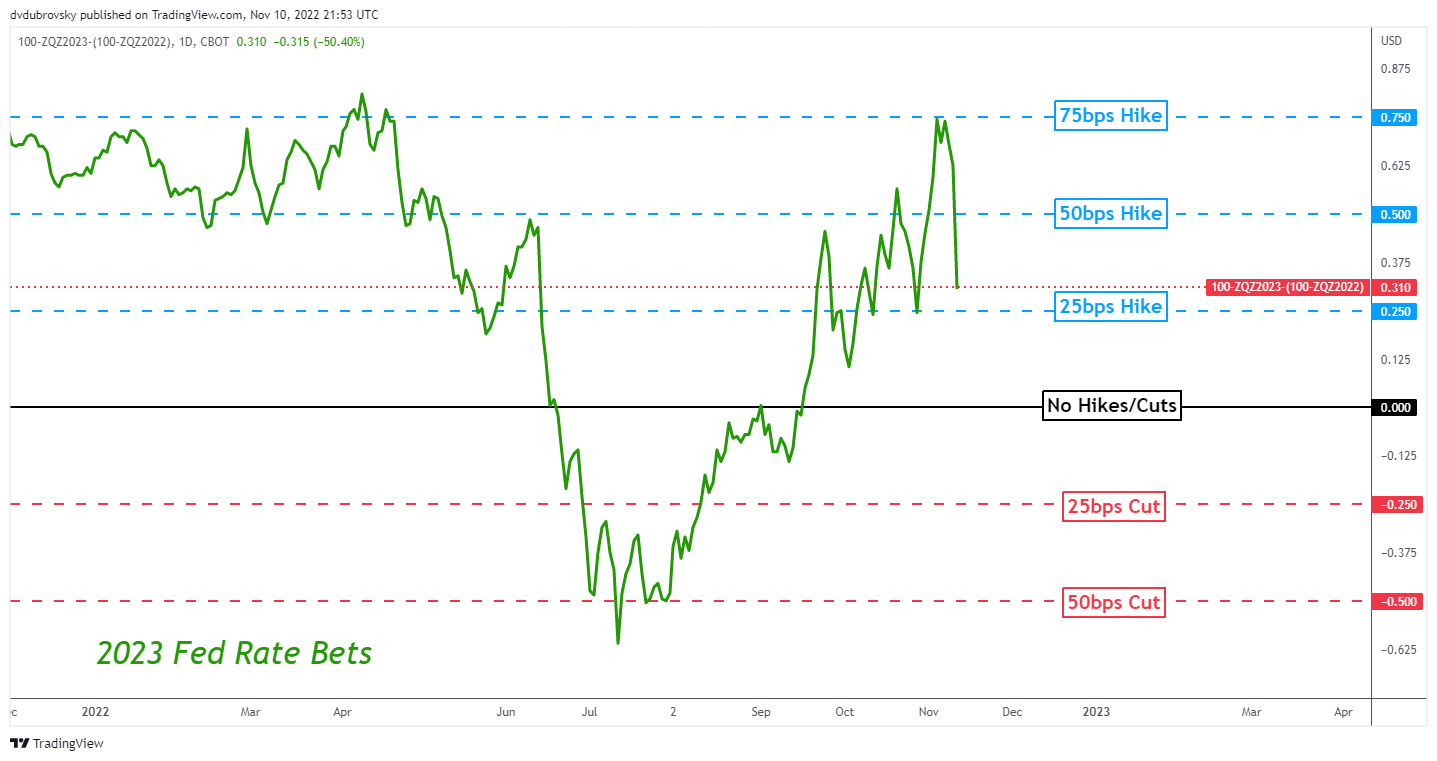

Why did gold rally so strongly? Just look at the chart below. Markets heavily trimmed how hawkish the Federal Reserve might be in 2023. In fact, about 50-basis points were taken off the table. Thus, it should come as no surprise as to why the US dollar sank alongside government bond yields. Markets are clearly pricing in an aggressively less-hawkish central bank. That ended up pushing gold higher.

With that in mind, a 75-basis point rate hike for December is almost surely off the table. Traders are eyeing a 50-basis point move instead. In terms of Fedspeak, certain policymakers remained cautious in the aftermath of the inflation report. But the language seems to be shifting toward the pace of tightening and just how high rates may have to go.

In terms of US economic event risk in the week ahead, PPI data will be released on Tuesday to gauge wholesale inflation. Retail sales will then cross the wires on Wednesday. Do not forget that markets are still in a volatile landscape. Still-strong economic data in the coming days could underscore that the markets may have over-corrected to the inflation data.

Gold traders will also continue paying attention to Fedspeak to gauge how commentary may change in the aftermath of the inflation report. We will get John Williams, Christopher Waller, James Bullard, and more scattered throughout the week. Check out the DailyFX Economic Calendar to stay in the loop with Fedspeak. With that in mind, more familiar cautious language in the week ahead may benefit gold.

2023 Fed Rate Bets

Chart Created in TradingView

More By This Author:

US Dollar Outlook Turns Bearish As Slowing Inflation May Further Weigh On YieldsEUR/USD Latest: EURUSD Prints Largest Single Day Rise Since 2020

Nasdaq 100, S&P 500, Dow Rally As US Inflation Surprises To The Downside