Gold Price Forecast: Real Yields, Weaker U.S. Dollar And Safe Haven Appeal Drive XAU/USD Higher

Image Source: Pixabay

Gold Outlook

- U.S. rates, the U.S. dollar, and geopolitics appear to sustain gold.

- The $1850 level is in focus.

- IG client sentiment: Mixed.

XAU/USD Fundamental Backdrop

Gold is in a great place at the moment with almost all supporting markers favoring the yellow metal. The U.S. 10-year TIPS has plateaued, giving added impetus to gold upside because of the reduced cost of holding gold – traditionally an inverse relationship.

U.S. 10-Year TIPS Breakeven Rate

Source: Refinitiv

From the dollar perspective, we have seen a drop off in the U.S. dollar frenzy of late due to a combination of factors, including a more hawkish ECB, an overstretched dollar, and an easing in the Chinese economy (COVID-19).

Finally, talks around an impending Russian oil embargo may come sooner than expected, according to German Finance Minister Lindner who anticipates a concrete decision by the week’s end. Meanwhile, President Joe Biden’s address regarding intervention should China invade Taiwan has added to bullion's safe haven allure.

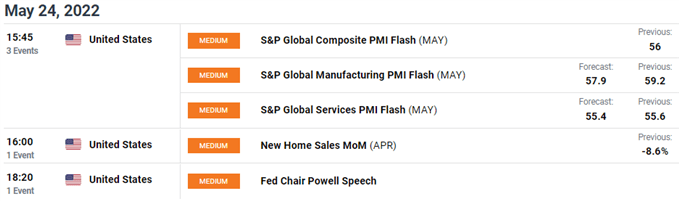

On the economic calendar there are a few dollar-influencing releases today, including PMI’s and housing sales – look out for changes in interest rate markets. Later this evening, we look forward to Fed Chair Jerome Powell’s speech for guidance on the U.S. economy and the Fed’s outlook.

Economic Calendar

Source: DailyFX Economic Calendar

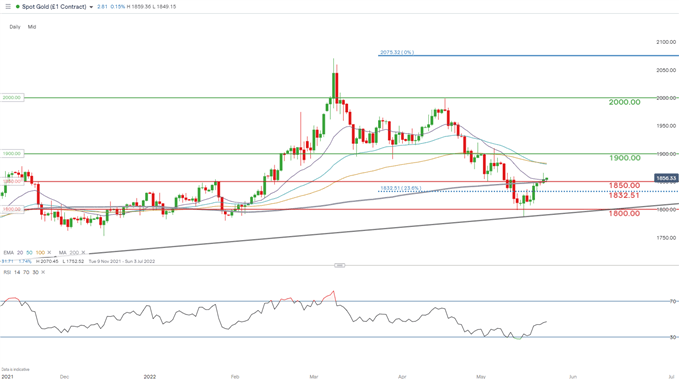

Technical Analysis - Gold Price Daily Chart

Chart prepared by Warren Venketas, IG

Technically, gold price action has confirmed its place above the 1850.00 psychological level after yesterday’s daily candle close above this resistance zone. I would be hesitant to favor a long preference just yet, leaving today’s candle close that much more important. This close coincides with the 200-day SMA (grey), and a strong push higher could establish the indicator as support going forward.

Resistance levels:

Support levels:

- 1850.00/200-day SMA.

- 1832.51 (23.6% Fibonacci).

- 1800.00.

IG Client Sentiment: Cautious

IG client sentiment shows that retail traders are distinctly long on gold currently, with 84% of traders holding long positions, as of this writing. We typically take a contrarian view to crowd sentiment. However, due to recent changes in long and short positioning, we arrive at a mixed disposition.

| CHANGE IN | LONGS | SHORTS | OI |

| DAILY | -5% | 0% | -4% |

| WEEKLY | 13% | 9% | 13% |

Gold Sentiment: Mixed. Data provided by IG. 84% of clients are net long.

Disclosure: See the full disclosure for DailyFX here.