Gold: It’s Who’s Buying It That Counts

Image Source: Pixabay

Gold has been on a bit of a losing streak this week, hitting a six-and-a-half-month low. This morning the yellow metal found some (very) modest support in the face of slightly lower Treasury yields, another US government shutdown looming, and concerns regarding the Chinese economy.

However, it’s likely that it will fall further given upcoming announcements and data releases expected before the weekend. Gold has been looking weaker since last week’s FOMC’s announcement that it was still committed to high interest rates.

However, many analysts expect gold will stay strong in the long term. Whilst $1,800 may be the next decisive break, we do still expect to see it head above $2,000 in the not-too-distant future. Consider rising energy prices amongst slowing global growth, for just one reason. It’s a perfect stagflationary environment for the yellow metal to show its…mettle.

One could go as far as to argue that this week has been sale week for gold, an opportunity to snap it up before it heads to new climbs. We’re not the only ones who think this. See Costco (of all places) to back this up.

America’s favourite wholesaler is selling one-ounce gold bars and they are proving to be so popular that they are having to limit sales to two per customer. According to the Costco CEO, the Pamp bars are selling out as soon as they are uploaded onto the site.

What’s going on? Gold is selling out? Not exactly the sign of an economy whose citizens are wholly invested in the vision of the central bank and have faith in the future of the US Dollar.

The truth is, something is a little…off. If you’re feeling confused by what is going on with the gold price then we understand. You’d be forgiven for thinking that because inflation remains relatively high then gold should be breaking new records. Smashing through previous highs. Causing the gold rush of the 21st Century. But it isn’t. As we said earlier – gold has been reaching some notable lows this week.

A Conscious Uncoupling

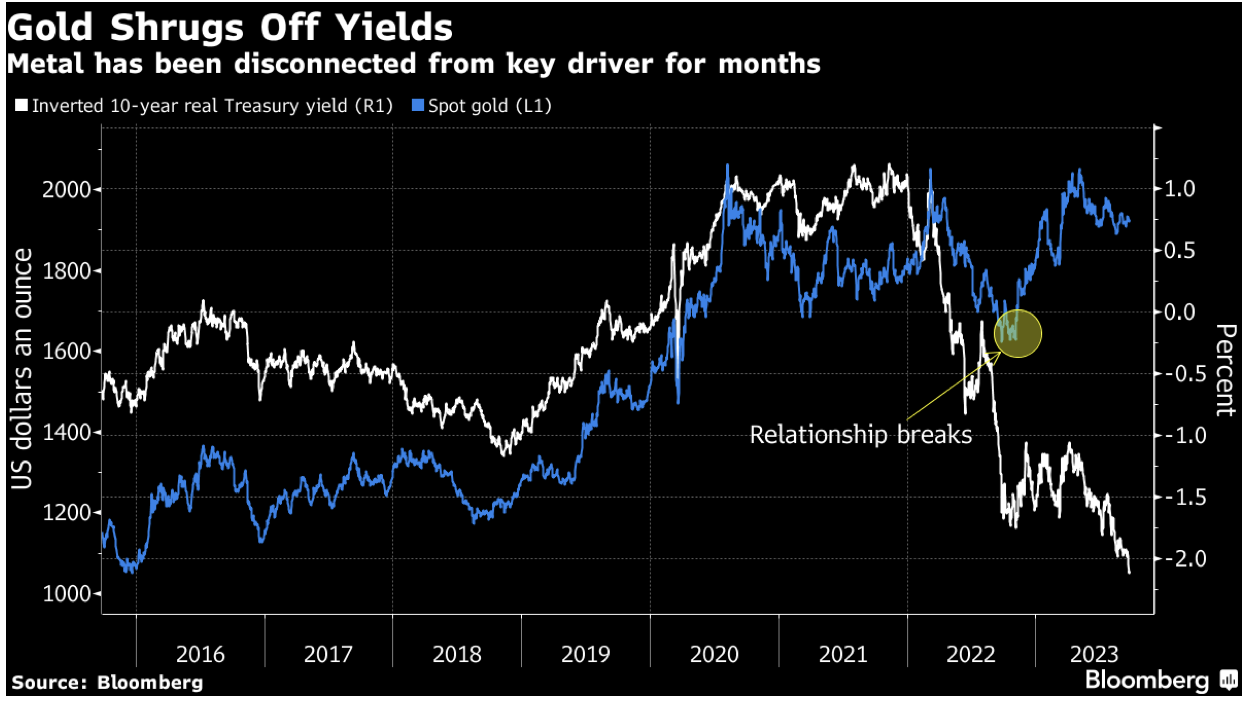

But worry not. Gold has been holding its own. Really, many might argue it should be performing far worse than it actually is. For some time gold has been affected by real interest rates, more than anything else. That is interest rates with inflation considered. But quite recently gold and real rates have been going through what Gwyneth Paltrow might call a ‘conscious uncoupling’.

(Click on image to enlarge)

This phenomenon was explained brilliantly in a Bloomberg piece by Eddie Spence and Yvonne Yue Li. You can see that in the last year or so, there has been a breakdown in what has (until recently) been a solid relationship.

When the relationship is solid the market tells us that when it can generate decent income from a ‘safe’ government bond, then it’s not interested in gold. But, this doesn’t seem to be the case right now.

Certainly gold does seem to be a lot chippier in the face of strong dollar headwinds than it has been in the past. Does this mean that we no longer need to worry about the impact of a strong dollar on the price of gold?

No, not necessarily. It is likely that gold will falter somewhat (see this week, for example). But the headwinds it faces are mere breezes compared to the headwinds the economy and the dollar are facing.

Gold remains in clear buffer territory when it comes to the central bank decisions that are leaving many to question the veracity of monetary policies, the looming recession, and even just the sheer shaky ground that the financial system finds itself in right now. These are not normal times.

The Golden Bull in (the) China (shop)

If you just read mainstream news about markets then it can be tricky sometimes to remember that gold isn’t just priced in US Dollars. It’s not the only gold price we need to pay attention to.

If you swing your head across the map of the world then you’ll see China, and that’s a country whose gold price really is reflective of what we have come to expect from the precious metal. One might even argue that the bullish activity we see there might just about reset the fundamental price assumptions analysts make about the price of gold.

What sparked this reset? The Shanghai Price Premium. This is the premium those buying in China, are paying above that on the world market. This last month we have seen demand for gold surge in China, sending the Shanghai Price Premium to over $100 above the spot.

(Click on image to enlarge)

To put this in perspective, over the last ten years the Shanghai Premium has been at an average of $6 above spot.

Demand is coming from both the central bank and citizens. To be clear this is a country that when it buys gold it is buying physical gold. This is hardcore gold demand, not the fitful buying and selling on the futures market that drives so much of the global spot price. When China buys gold it is making a commitment to own it.

As Charlie Morris stated, gold is a way of keeping your wealth out of the country ‘while still being in the country’. The central bank and locals are keen to shore up their reserves with real money because the economy isn’t looking so healthy. The yuan has really suffered this last year, and the property market is proving to offer little shelter.

This is a clear capital flight into gold – sales of bullion climbed by 30% in the first half of 2023. This is without mentioning the inflows into Chinese gold ETFS and record buying by the central bank.

Is this likely to last? Well, we don’t expect China to suddenly start making headlines about an economic recovery any time soon.

Hang tight

The gold price seems to be in a world of two halves at present. Whilst the recent declines might be somewhat distracting and disheartening we suggest that there are only positives to take away. It seems like demand from the East is finally starting to really impact the global gold price, and that many Western buyers are starting to see through all the rhetoric from the central bankers.

More By This Author:

Gold Slips As Fed Signals More Hikes To ComeWhen The Weight Of Inflation Becomes Too Much

Expect $2,500 – $3,000 Gold In The Next 12 Months

Disclosure: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation ...

more