Gold Hits New High As Federal Reserve Turns Super Dovish To Set Stage For Coming Bubble Bust

Image Source: Pexels

Last week, the Federal Reserve turned super dovish with its FOMC statement and Jerome Powell’s subsequent press conference. Coming into this year, the Federal Reserve predicted that it would lower interest rates three times in 2024. As the months went by, though, inflation data did not improve, and so they could not lower rates in February or March.

Coming into the recent meeting last week, there was some expectation that they might lower their forecast to two cuts instead of three, because, looking at the economic data that has come out this year, there has been no justifiable reason to even lower interest rates at all.

At the Fed’s meeting this past week, they, in fact, raised their estimates for 2024 GDP growth and even the inflation rate. It was an admission of the state of things, and, despite it, they stuck to their three rate cuts projection. In other words, they have totally abandoned their inflation fight that they started two years ago.

No surprise – stocks rallied on that news, and gold went up to a new all-time high.

The Federal Reserve is saying that they are going to do what they did in 1998 – and that is to lower rates when there was no reason in the economic data to do so. That generated a massive frenzy into speculative, fictitious capital investing in 1999 that led to the bubble bust of 2000, which led to a bear market that lasted for almost three years.

Back then, the speculative capital in the financial markets was best represented by the mania that developed in internet stocks for companies that made no money and would go bankrupt in a few years. Today, it is typified by the speculation now taking place in virtual crypto coins, that represent ownership in nothing, but one could argue that it is also driving the stock market up to nosebleed valuations.

You can see this in terms of the CAPE ratio for the S&P 500, closing last week at its fourth highest reading in history, too.

Why did the Federal Reserve turn too dovish in 1998? A giant hedge fund connected to JP Morgan and other major Wall Street banks was going under, so they lowered rates to try to stabilize it.

Well, why are they turning super dovish now? Maybe they want to make stock market investors and crypto players happy going into the election. Or, maybe they are scared that if things slow down before the election, they will get blamed.

Another line of thought, is that they feel like they need to do anything they can to lower future interest rate payments on the debt, because its growth is accelerating and new funding needs are coming in the second half of the year, with a lot of Treasury debt being rolled over then.

Whatever the reason, they are now doing this, and it’s going to make the bubble grow and then set the stage for a super bubble bust, probably starting next year.

When a financial markets turns into a speculative bubble and starts to disintegrate, people sell and then move money into the most stable instruments they can – that is, money that is most closely linked to real world commodities and physical wealth. And that’s gold and silver, because it has served as that since the beginning of recorded history.

People often look for less volatile instruments to buy. From 1980 till 2022, investors flocked in US Treasury bonds during stock market bear markets, but bonds ended their secular bull market in 2020, when interest rates went to zero to form a secular all-time low, and then fell in 2022 when the stock market fell, making gold even more important the next time a bear market hits in force.

And crypto crashed in 2022 when stocks did. Crypto will never replace gold and silver as the source of stability in times of crisis, because it is too volatile and unstable to do so. It also represents ownership in nothing – unlike bonds, it pays no interest, and unlike gold, it has no connection to anything. What crypto does is serve as the most perfect form of speculative, fictional capital, because it represents ownership in nothing tangible in the real world.

That is why this is now crypto’s moment – and why people can just fantasize about any price tag they want to put on to it. Since it represents ownership in nothing, it has no fundamental value. If a house cost $100,000 to build, it would be absurd to claim it is worth $1,000,000, but since crypto is simply virtual, people can throw out any number they want at it.

It is why many are now obsessed with it, but the market cap for the entire crypto market has now surpassed that of the internet stock bubble in March of 2000.

Crypto enthusiasts tell people that they are in a new paradigm. They tell them things like nothing has ever gone up as quickly as Bitcoin. But in real financial history, tulips actually went up faster than Bitcoin did in a five-year period during the 1600’s.

The problem is the Bitcoin gurus and crypto enthusiasts will never tell people when to sell, so they will be left holding the bag when things turn down again, just like they did two years ago.

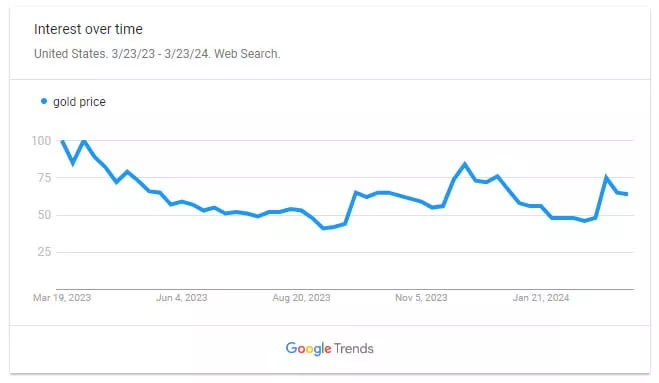

At the same time, the mass interest in gold is actually lower than it was in the fourth quarter of last year, and about 25% less than it was in terms of search traffic as it was a year ago, despite the move to new all-time highs we have seen occur twice so far this year.

The stock market may be overvalued by historic standards, but at least stocks represent shares of ownership in a company that exists in the real world. The problem with the internet stocks in 1999 is that most of the companies those shares represented made no money and ended up going bankrupt.

I’m not sure when this stock market rally, which really started as a cyclical bull market at the end of 2022, will come to an end. I see no signs in the charts of it ending in the next few weeks. It could happen this summer, or maybe not until next year.

I’m just taking things one week at a time to analyze them, to hopefully see the signs when they come over the horizon.

A sign that the end is here will happen when the yield curve inversion goes from negative to positive. This will happen when the yield on the 2-year bond goes lower than the 10-year – or vice versa, if it’s fueled by the selling of longer-term debt issues.

This last happened in August of 2007, and then in the Fall of 2000. That tells you how rare it happens, and this seems to suggest it will be a historic event again the next time it occurs. I’ll be watching to see if it happens in the second half of this year or next year.

In the Fall of 2000, gold made an important secular turn and outperformed the stock market for the next twelve years, doing it through 2007 and 2008 up to the end of 2011. Here is the gold/SPX ratio, so you can see this relative strength plot.

As for the gold price now, it broke out to new highs again last week before pulling back on Thursday and Friday. It looks like it is going to pause this week to form a new higher support level, perhaps somewhere above $2100.

I wouldn’t be shocked if gold manages to reach and hold on to the $2150 level. We’ll see. Meanwhile, silver got close to that key $26 resistance level, which has held it down for a year now, before the grey metal ended the week right below the $25.00 mark.

As I wrote last week, I believe the recent breakout in gold is the signal for the start of a new commodity bull market, which is only in its first inning. Meanwhile, the stock market is in the ninth inning of its bull market, but the game isn’t over yet.

People who want to buy something right now have a choice – they can invest in something in a bullish trend that is likely to continue to go up in the years to come, or speculate in the red, hot thing of the moment and try to get out before the bubble busts.

More By This Author:

The Federal Reserve Interest Rate Projections Are Not Working Like People ThinkThe Gold Breakout Signals Start Of A New Commodity Bull Market, And Silver Prices Are Going To Explode

Bitcoin Will Crash One Day, So Silver Is The Way To Go