Gold Futures: Further Decline Looks Not Favoured

Image Source: Pixabay

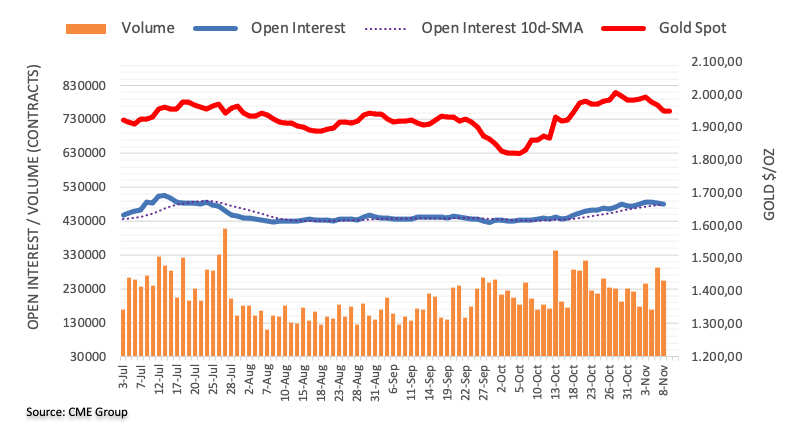

Considering advanced prints from CME Group for gold futures markets, open interest shrank for the second session in a row on Wednesday, this time by around 3.3K contracts. Volume followed suit and went down by around 37.3K contracts amidst the prevailing erratic performance.

Gold: Next on the downside comes the 200-day SMA

Gold prices extended its decline and revisited the key $1950 region on Wednesday. The daily pullback was accompanied by diminishing open interest and volume and warns against the continuation of the ongoing multi-session decline. Further retracements, in the meantime, are expected to meet the next contention around the $1930 area, where the key 200-day SMA sits.

More By This Author:

EUR/USD Price Analysis: Further Weakness Could Revisit 1.0500EUR/JPY Price Analysis: Rally Looks Unabated So Far

USD Index Extends Its Recover And Targets 106.00, Focus On Powell

Disclosure: Information on this article contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes ...

more