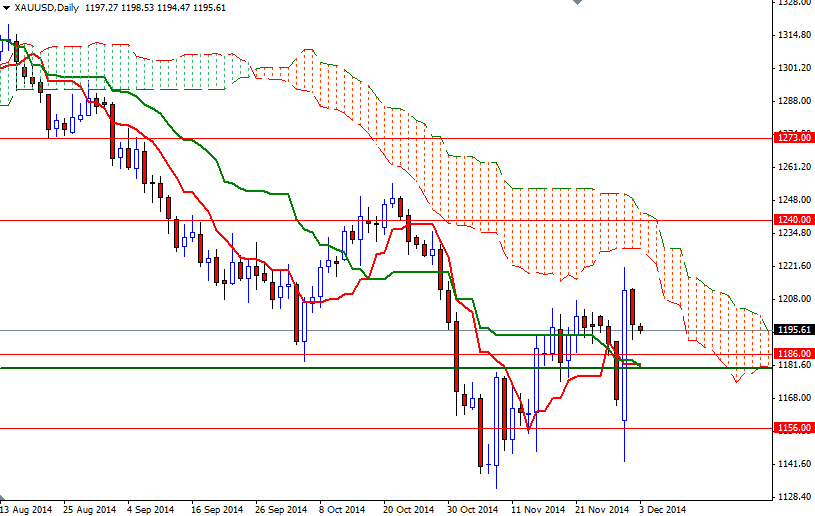

Gold Finds Support At $1191

Gold prices closed lower on Tuesday, giving back a portion of the previous day’s gains but holding ground above $1191 an ounce. Yesterday, the market initially tried to break through the resistance at the 1212 level which was the key for a bullish continuation but sellers stepped in and dragged prices back below the 1202.70 level. As a result the XAU/USD pair retreated towards the 1191 support and since then we remain in a trading range of 1303 to 1193.

For now, the market is caught between an underlying support from demand for physical gold and optimism over the U.S. economic outlook, but going forward, it will mostly be about the economic data, performance of the major stock markets and interest rates. If the greenback continues to be the favored currency, the upside on gold prices will be limited.

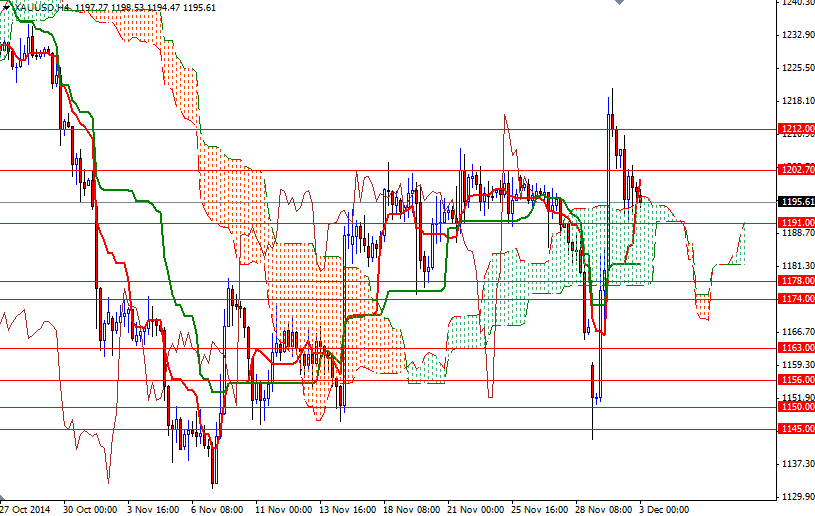

However, despite the pressure on the market, recent price action makes me think that we have seen the low of the year. Currently gold prices are getting support from the Ichimoku cloud on the 4-hour time frame. In addition to that, the Tenkan-Sen (nine-period moving average, red line) and the Kijun-Sen (twenty six-day moving average, green line) lines are positively aligned. From an intra-day perspective, I think the key levels to watch will be 1203 and 1191. If the bulls manage to hold prices above the 1191 support (and of course penetrate the resistance at 1203), we might see the XAU/USD pair heading towards the 1212 level again. Beyond that, the bears will be waiting at 1222 and 1235. If we break below the 1191 support level, then the next stops will be 1186 and 1182.

Disclosure: None.

If there's any truth to the adage that when the stock markets are up, gold is down, then perhaps now is the time to buy gold or gold stocks while prices are relatively low. When the stock market eventually sinks which we all know will happen sooner or later, gold will be on its way up and that way you can hedge. Yesterday (GLD) closed at 115.14 bouncing off its 52 wk low of 109.75 on November 6th.