Gold Bearish Outlook: Everything Goes According To Plan

We might see a plunge in gold prices quite soon. History repeats itself to a huge degree at the moment – let’s see what it has to offer.

Today’s technical analysis will be very similar to what I provided to you yesterday because the markets pretty much moved exactly as I had expected. As you may recall, I wrote about the analogy between now and early August in the following way (I’m putting the key part in bold):

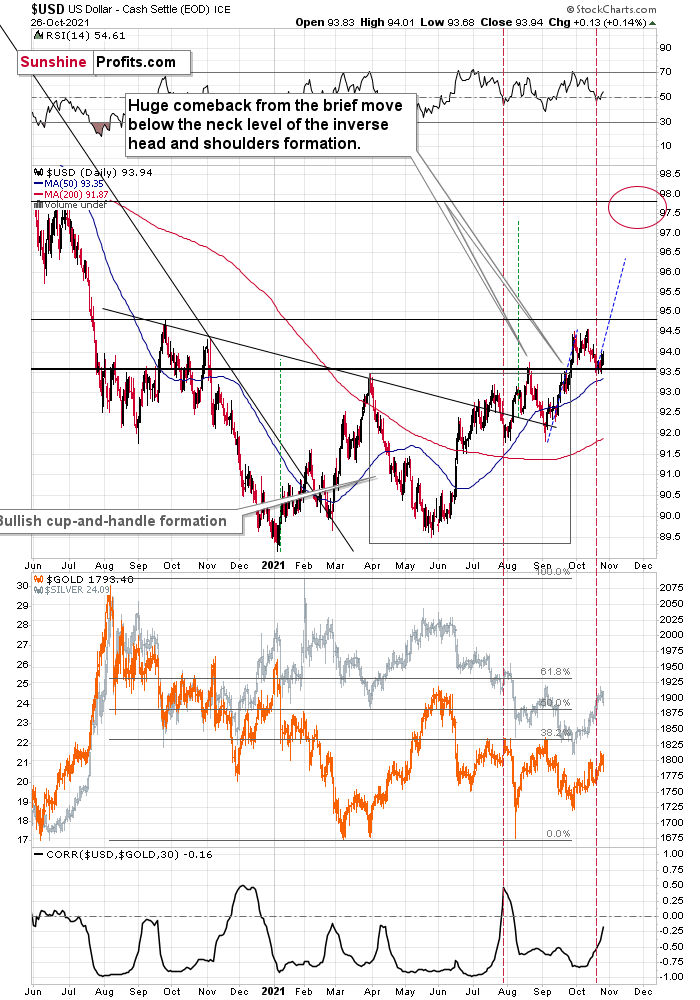

The situation now appears to be the same as it was at the beginning of August, where the bottom also took several days to form, but when the USD Index finally moved higher once again, gold plunged. To be precise, back then, the bottom formed over 5 trading days, and yesterday was the fifth trading day of the current bottom. On the sixth day – back then – the USDX did very little and gold declined modestly, and it was the seventh day when the action really started. And… the short-term decline was over on the very next day. It was not easy to catch this decline if one wanted to wait for a big confirmation that it was indeed taking place. It seems that the same – patient – approach is justified in the current situation.

The RSI indicator (upper part of the chart) continues to confirm this similarity.

Yesterday, the USD Index ended the session 0.13 higher, so – just as in early August – it moved very little. Gold declined modestly back then, and, well, it moved lower by $13.40 yesterday, so it seems that it fits well. Gold is down by $6 in today’s pre-market trading (at the moment of writing these words), so it seems that history might repeat itself to a very big degree.

If it repeated itself to the letter, we would have a $100+ decline in gold this week. But since history rhymes more than it repeats, I think it’s more realistic to simply expect gold to fall substantially soon, without giving the decline just 2 days to materialize.

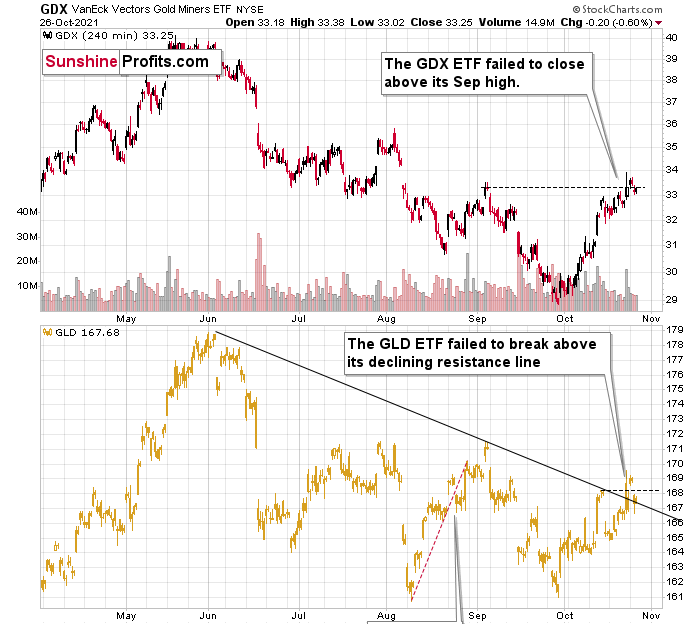

Yesterday, I described the above chart as “another attempt”. Mining stocks (GDX ETF) once again failed to hold the move above their September highs, which is – of course – bearish. GLD failed to hold above its previous October highs as well. It did manage to close above the declining resistance line based on the previous highs, but given today’s pre-market rally, it’s doubtful if GLD will be able to hold this level for long.

There are different rules for confirming a breakout or breakdown, but in the precious metals sector, based on almost two decades of experience in it, I prefer to see three closes above or below a certain level to view the breakout or breakdown as confirmed. Gold / GLD hasn’t confirmed its breakout just yet, and it seems to me that it won’t confirm it soon. Instead, another – big – downswing seems to be just around the corner.

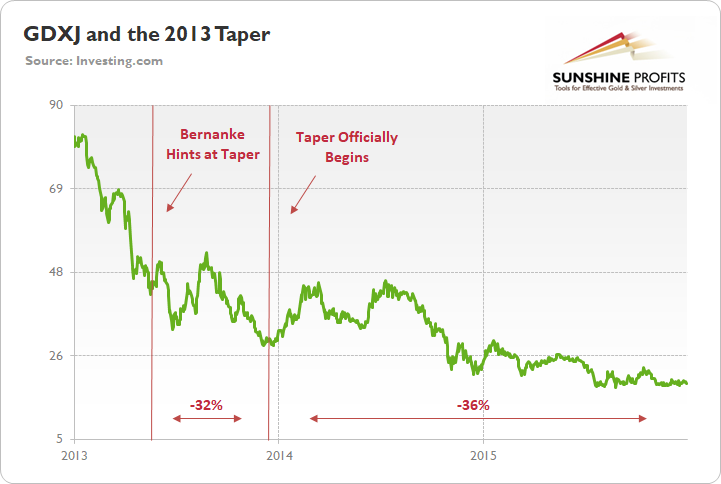

Also, let’s keep in mind how mining stocks (seniors and juniors) reacted to the previous tapering announcement. They moved higher only very initially, but then fell substantially.

To explain, the green line above tracks the GDXJ ETF from the beginning of 2013 to the end of 2015. If you analyze the left side of the chart, you can see that when Fed Chairman Ben Bernanke hinted at tapering on May 22, 2013, the GDXJ ETF declined by 32% from May 22 until the taper began on Dec. 18.

Moreover, the onslaught didn’t end there. Once the taper officially began, the GDXJ ETF enjoyed a relief rally (similar to what we’re witnessing now) as long-term interest rates declined, and the PMs assumed that the worst was in the rearview.

All in all, the technical picture for the precious metals sector looks bearish, even though the recent short-term corrective upswing might make one think otherwise.

Disclaimer: All essays, research and information found on the Website represent the analyses and opinions of Mr. Radomski and Sunshine Profits' associates only. As such, it may prove wrong ...

more

Bullion Cartel algos push paper and silver contracts to new near-term lows, what a buying opportunity to load up physical. Physical buying alerts set off around the world as these cartels allow a load up on the real thing.