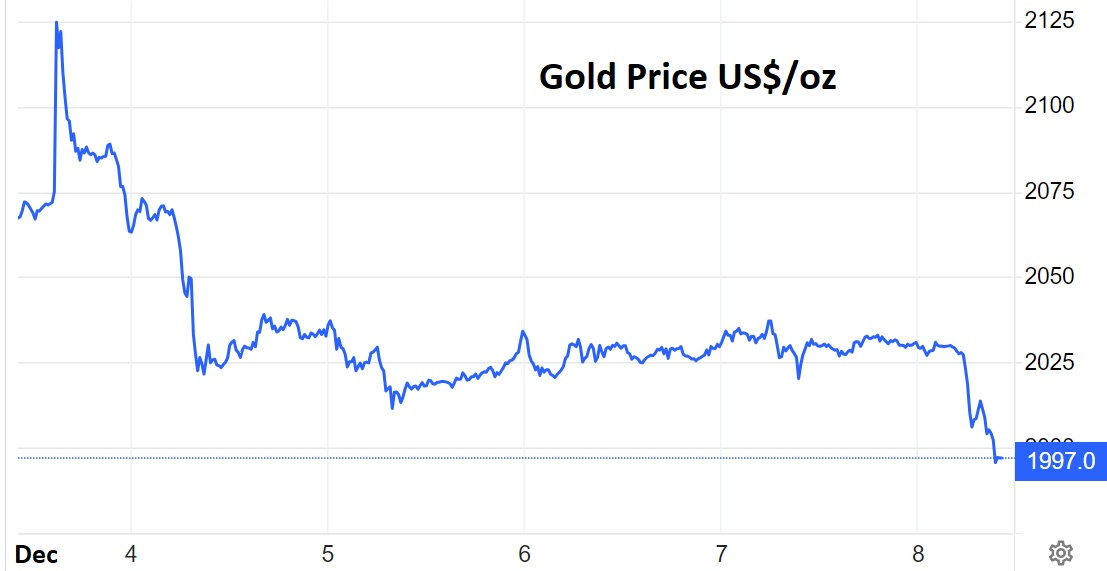

Gold: $2000 Might Still Be Resistance

One of the fun things about bull markets is watching resistance levels turn into support. Gold, for instance, spent three years banging into $2000/oz and recently broke through, touching $2125 on December 1.

Then the selling started, pushing the price down to, as this is written, $1997.

(Click on image to enlarge)

If the “$2000 is now support” thesis holds, buyers will enter at this level and stop the carnage. If not, then gold is still rangebound, the past week was just a head fake, and the battle for $2000 continues.

For stackers, this is of course irrelevant because gold and silver aren’t for trading. They’re insurance to be held for generations. And as Rick Rule likes to say, when something you want goes down, that’s good because you can buy it on sale.

New Incrementum Charts

On a related note, Incrementum just released another batch of charts that put the financial world in context. Some highlights:

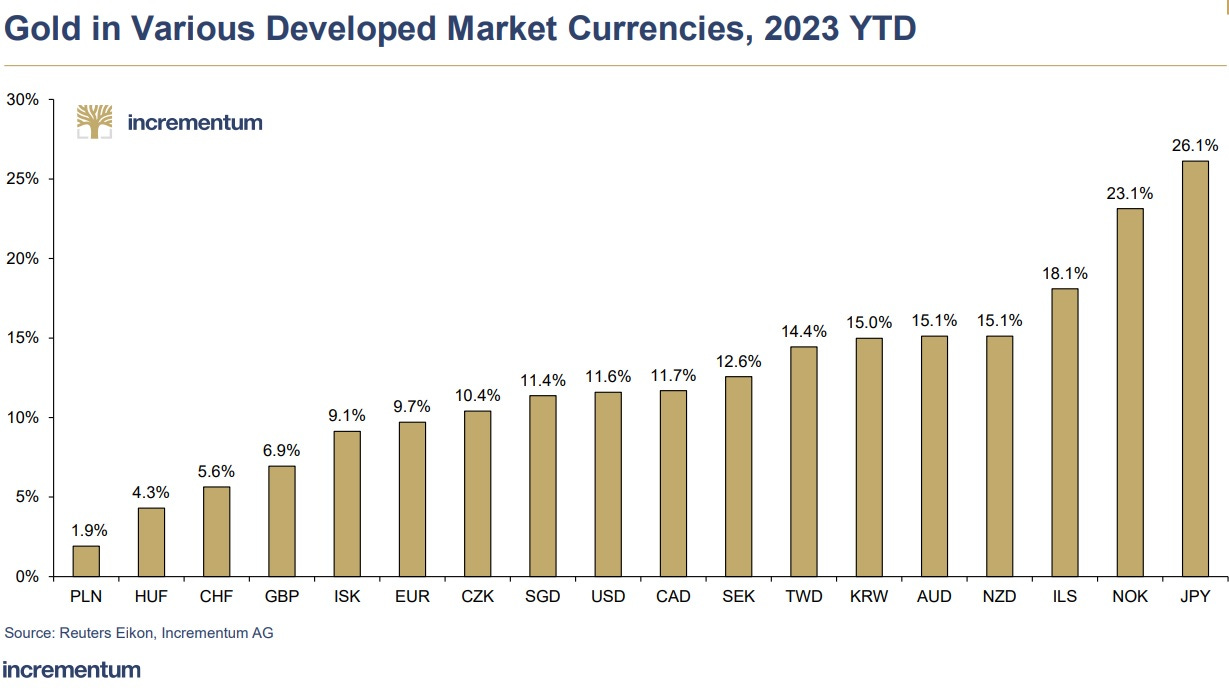

Despite today’s downer, gold is having a good year in most developed countries.

(Click on image to enlarge)

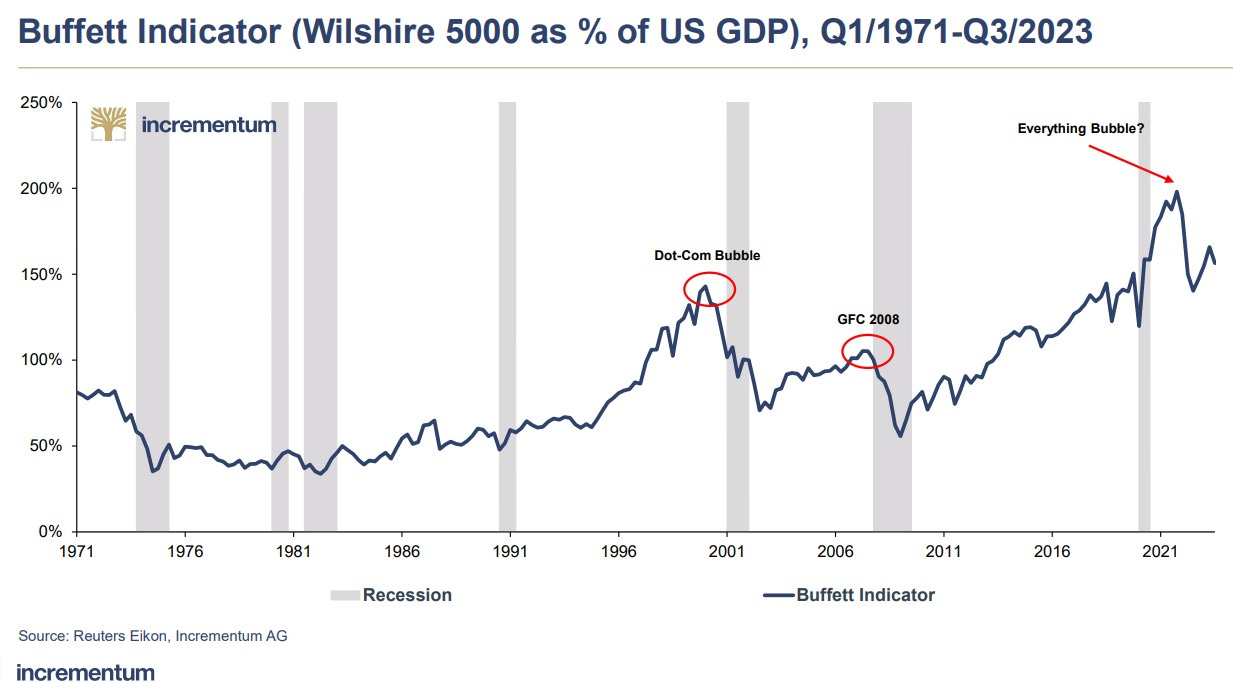

The overall stock market is wildly overvalued according to Warren Buffett’s supposed favorite indicator, which compares equity market capitalization to GDP:

(Click on image to enlarge)

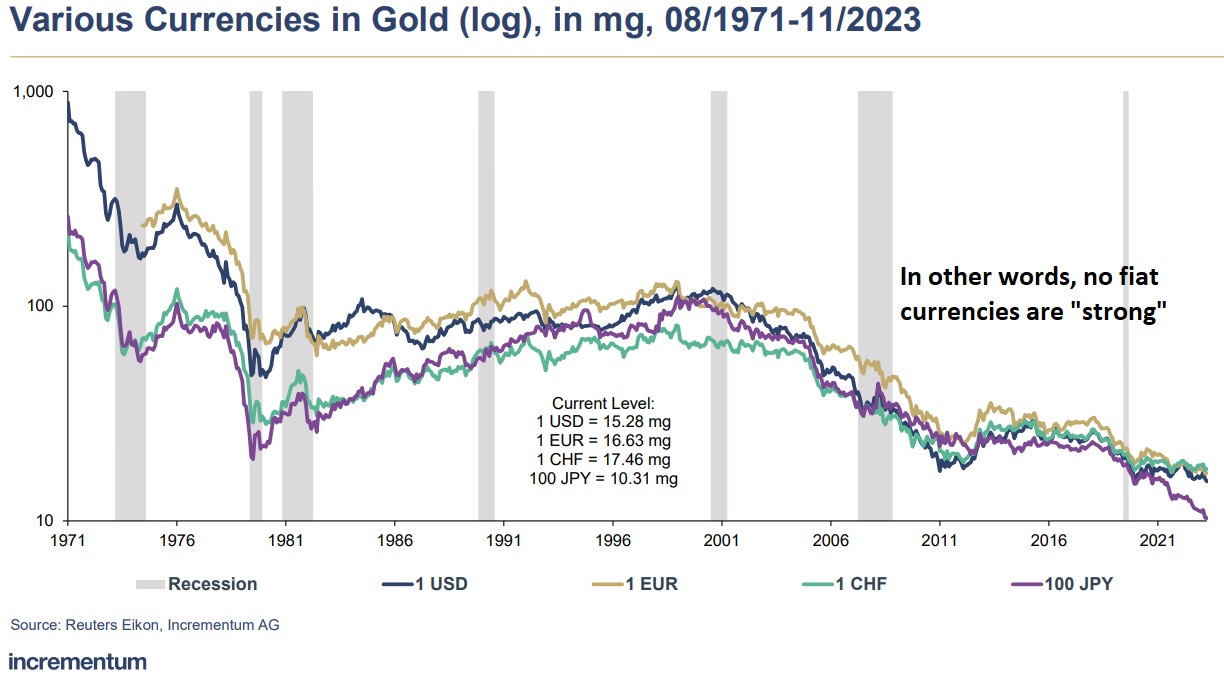

“Strong” fiat currencies are a myth. When priced in gold, they’re all falling. But lately, the Japanese yen has been leading the march into the abyss.

(Click on image to enlarge)

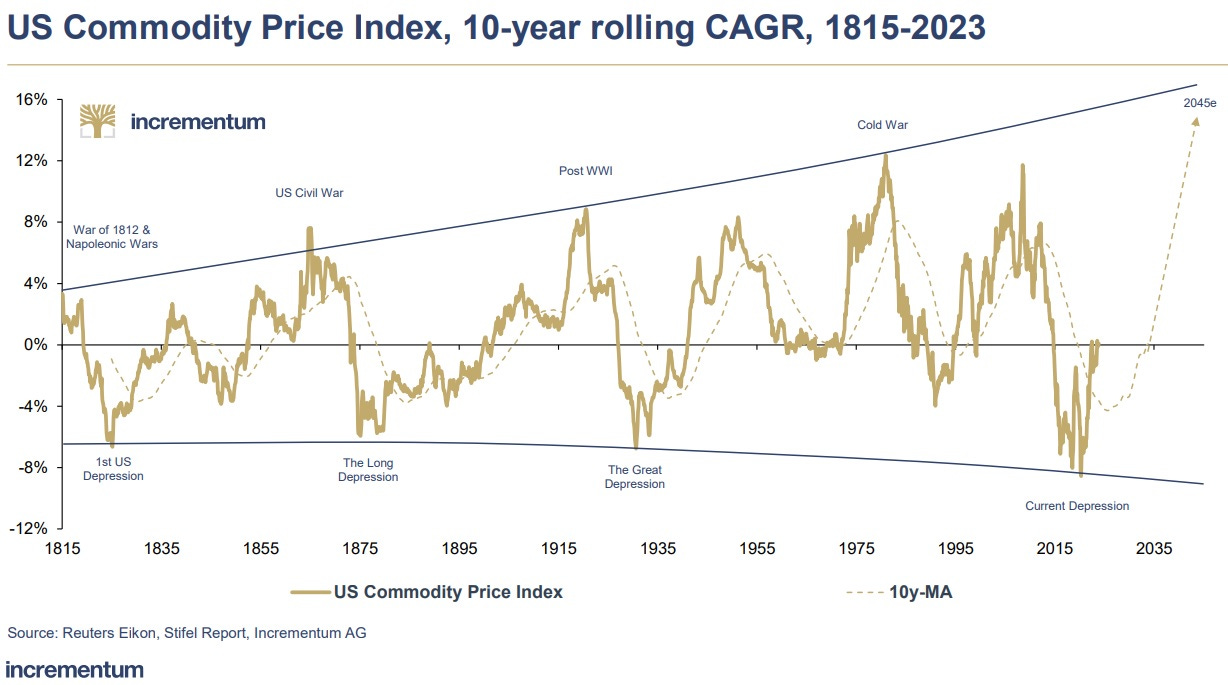

A lot of advisors now recommend commodities, and the next chart illustrates why. Supplies of uranium, copper, silver, etc., are inadequate for future demand while prices are barely above their depression-level lows. Future shortages = higher prices.

(Click on image to enlarge)

More By This Author:

Is This Gold Breakout For Real? De-Dollarization May Be The Key Factor.Someday This Will Happen To Silver

On Sustainable Cluster Bombs