Global Stocks Race Higher On Trade Deal, Rate Cut Hopes As Yuan Tumbles, UK Economy Implodes

June's euphoric rebound from the May slump continued on Monday, as European shares followed Asian stocks higher on Monday after the United States ended plans to impose tariffs on Mexico (at least until the proposal is voted down by Mexico's legislative body) and as investors anticipated lower U.S. interest rates when the Federal Reserve meets next week on the back of poor jobs data.

The biggest overnight mover was the Mexican peso which soared more than 2% on Monday, its biggest gain in over a year, as investors bought the currency in a relief rally after fretting for the past week that opening up another trade conflict, while still battling with China, could push the United States and other major economies into recession.

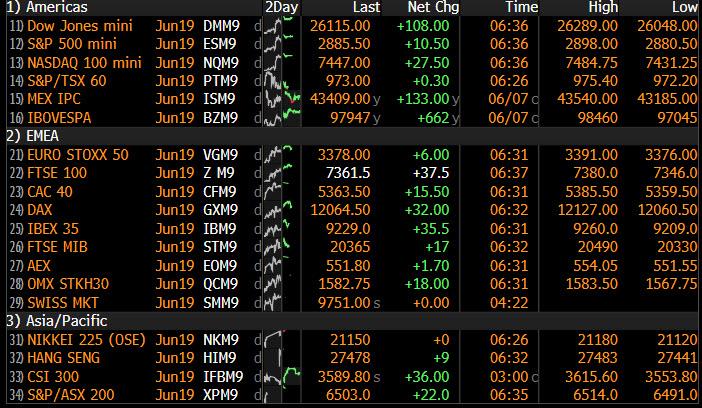

Futures on the S&P 500, Dow Jones Industrial Average and Nasdaq 100 all climbed, as one would expect, but much of the overnight rally fizzled as the real threat to the global economy - the trade war with China - showed no signs of relenting.

All Asian markets advanced on Monday in celebration another trade war front had been averted, for now, led by Hong Kong and Japan. Hong Kong’s Hang Seng Index closed 2.3% higher, extending its gains into the third day, while China’s Shanghai Composite Index jumped 0.9%. Japan’s Topix Index gained 1.3% to a three-week high and the Nikkei rose 1.2%, with Nippon View Hotel Co. and Denki Kogyo Co. contributing most of the index’s gains. India’s S&P BSE Sensex Index rose 0.2%.

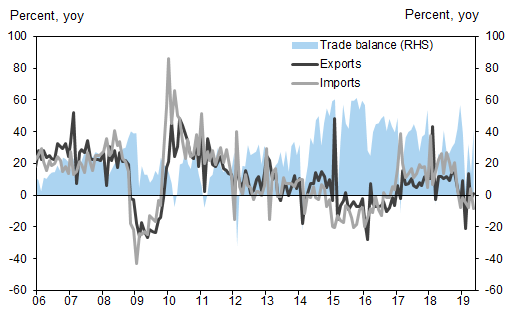

Investors also focused on Chinese trade data reported overnight, which showed imports in May tumbled 8.5% from a year earlier, a much worse than expected outcome that signaled weak domestic consumption. Exports, however, unexpectedly rose 1.1% last month, though this was once again due to front-loading of shipments by firms to avoid higher U.S. tariffs. The frontloading may continue in June, according to Goldman, due to the concerns of possible tariff for the $300bn of China exports to US (late June or early July at the earliest if implemented), which could support exports momentum in the near term. However, with the fading of this effect, exports momentum may turn notably weaker, especially amid moderate global economic growth, which would call for easier domestic policy to maintain growth stability.

Further commenting on the report, Goldman said that growth of imports for major commodities went down broadly. In value terms, crude oil imports slowed to +5.5% yoy in May (vs. +15.5% yoy in April); steel products imports continued to decline by 22.5% yoy in May (vs. -12.7% yoy in April); iron ore imports increased +24.0% yoy in May (vs. +23.1% yoy in April). In volume terms, crude oil imports decelerated to +3.0% yoy in May (vs. +10.8% yoy in April); steel products imports resumed the contraction by 13.1% yoy in May (vs. -3.8% yoy in April); iron ore imports decreased by 11.0% yoy in May (vs. -2.6% yoy in April), all indicating an economy that has hidden a sudden and profound air pocket.

China's trade also happens to be the core issue depressing global sentiment today: “Mexico is not China and investors will want to see some clear signs of improvement in U.S.-China relations before increasing exposure to risk assets. Before then the market is left focusing on poor Chinese import figures for May.....as speculation builds over whether the PBOC [the People’s Bank of China] allows yuan to trade through 7 per dollar,” said Chris Turner head of FX strategy at ING Bank.

Over the weekend, we learned that China will implement export controls on sensitive sectors to prevent and resolve national security risks, while there were also reports that Chinese authorities reportedly warned several tech companies not to reduce exposure to China more than what was necessary due to trade restrictions or there would be consequences.

European shares followed Asian stocks higher on Monday on the "No Mexican Tariffs" relief rally, and as investors anticipated lower U.S. interest rates when the Federal Reserve meets next week on the back of poor jobs data. The European auto sector was boosted by signs that Fiat Chrysler Automobiles NV and Renault SA were looking for ways to revive their collapsed merger plan and secure the approval of Nissan Motor Co. Fiat Chrysler jumped 3%, while Renault’s shares were up 1%. In London, Thomas Cook’s shares rose 20% after a report that Hong Kong-listed Fosun Tourism was in talks to buy its tour operating business as the British group faces breakup after issuing three profit warnings in the past year.

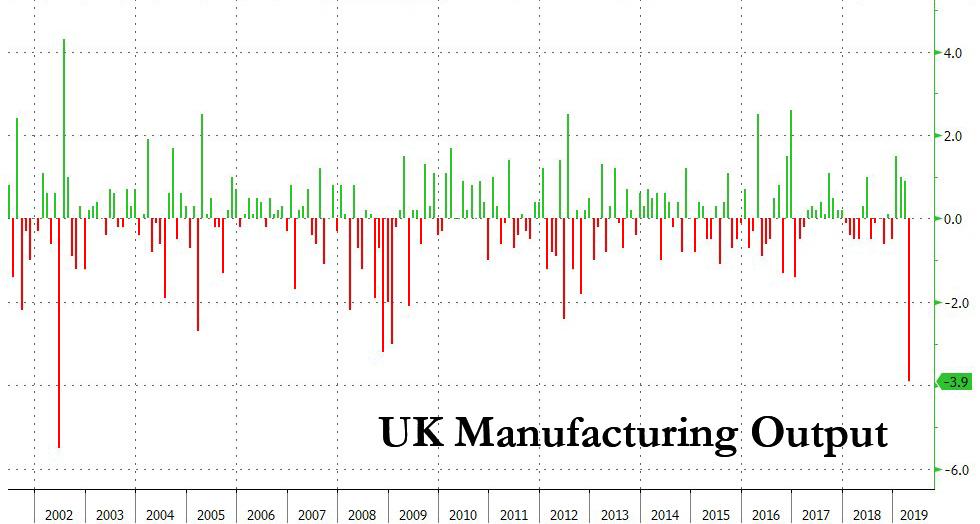

And speaking of the UK, the country was the center, or rather centre, of an "economic shock" today as a twofer of dismal economic data hit: U.K. Manufacturing output tumbled -3.9%, far below the -1.0% expected, the biggest drop in almost 17 years in April, or since June 2002, as the boost from Brexit stockpiling evaporated and car producers went ahead with planned shutdowns.

At the same time, GDP data “was a bit of a shocker even factoring in domestic politics,” according to Neil Jones, head of hedge-fund currency sales at Mizuho. The pound slumped as much as 0.4% to $1.2685 as GDP comes in at -0.4% m/m versus estimated -0.1%.

“The GDP estimate was downbeat anyway and we came in even lower”: said Jones, noting that the Pound was likely to slide further as “weekend politics does not look encouraging, this morning data is very downbeat and we’re in a market with only a small short at best”

In the United States, expectations the Fed will cut rates boosted stocks on Friday, with the buying continuing on Monday after weak jobs report from the U.S. Labor Department. Fed funds rate futures prices, down on Monday after the Mexico deal, are still pricing in more than two 25-basis point rate cuts by the end of this year, with one almost fully priced in by July. The Federal Reserve’s next policy meeting is set for next week, on June 18-19.

Still, not everyone was rushing to buy stocks just inches away from all-time highs: “We remain a bit skeptical about the rally since last week, which is again due to expectations for easier monetary policy and easing trade tensions,” said Goldman strategist Christian Mueller-Glissmann. "Equity valuations remain high and global growth is still weak, which suggests draw-down risk remains elevated. As a result, we are reluctant to buy the dip."

In rates, European government bond yields remained close to all-time lows. Core bond yields in the bloc were still at all-time lows, despite the two basis point move higher in the German bund in early trade to -0.24%, as expectations of easier monetary policy fuel bond buying. US Treasurys were near session highs, rising to 2.1414% after dipping below 2.06% after Friday's payrolls report.

In FX, the dollar gained versus all G10 peers as Treasuries dropped; antipodeans came under pressure amid a drop in China’s imports, while the yen also felt the heat from the possibility of further BOJ monetary stimulus. The euro briefly fell below $1.13, sliding 0.3%, as leveraged names unwound short-term dollar shorts, even if near a 2-1/2-month high of $1.1347 touched on Friday. Meanwhile, in China, the onshore yuan fell to its weakest level since November as trading resumed after a holiday, following comments from China’s central bank governor in which he hinted there was no line in the sand for the currency. Monday’s decline followed the offshore yuan’s tumble to its weakest level since November on Friday, as People’s Bank of China Governor Yi Gang signaled that he was not wedded to defending the nation’s currency at a particular level. Financial markets in China and Hong Kong were closed Friday

In commodities, oil prices rose on Monday after Saudi Arabia said producer club OPEC and Russia should restrict supplies to current levels, with front-month Brent crude futures at $63.61, 0.5%, above Friday’s close. Gold slipped almost 1%, having hit a 14-month high of $1,348.1 per ounce on Friday, near a major resistance around $1,350.

Market Snapshot

- S&P 500 futures up 0.3% to 2,883.50

- STOXX Europe 600 up 0.2% to 378.26

- MXAP up 0.9% to 155.69

- MXAPJ up 1% to 508.27

- Nikkei up 1.2% to 21,134.42

- Topix up 1.3% to 1,552.94

- Hang Seng Index up 2.3% to 27,578.64

- Shanghai Composite up 0.9% to 2,852.13

- Sensex up 0.06% to 39,640.72

- Australia S&P/ASX 200 up 1% to 6,443.89

- Kospi up 1.3% to 2,099.49

- German 10Y yield rose 2.3 bps to -0.234%

- Brent Futures up 0.2% to $63.39/bbl

- Italian 10Y yield fell 12.7 bps to 1.991%

- Spanish 10Y yield rose 4.2 bps to 0.595%

- Brent futures down 0.2% to $63.19/bbl

- Gold spot down 0.9% to $1,328.61

- U.S. Dollar Index up 0.3% to 96.87

Top Headline News from Bloomberg

- President Trump pushed Mexico -- and his own party -- to the brink when he threatened massive new tariffs over illegal immigration. And he now has a cross-border deal to show for it

- China’s export growth unexpectedly rebounded in May and imports dropped, as the trade standoff with the U.S. intensifies and both countries show no signs of de-escalating tensions

- Bank of Japan can deliver more big monetary stimulus if necessary, but needs to take care with its side effects on the financial system, Governor Haruhiko Kuroda said

- U.K. manufacturing output fell the most in almost 17 years in April as the boost from Brexit stockpiling evaporated and car producers went ahead with planned shutdowns. The 3.9% decline, the most since June 2002, saw the economy as a whole shrink for a second straight month. Vehicle production plunged by a quarter

- Hong Kong’s leader pledged to press ahead with Beijing- backed legislation easing extraditions to China despite one of the city’s largest protests since the former British colony’s return more than two decades ago

- Fears are mounting at the European Central Bank that investors are losing faith in the inflation outlook, in a self-reinforcing spiral that could force the institution to dig deeper into its stimulus toolkit. Staff at the euro area’s national central banks are worried that inflation expectations are becoming “deanchored,” according to officials familiar with the matter

- The Bank of Japan can deliver more big monetary stimulus if necessary, but needs to take care with its side effects on the financial system, Governor Haruhiko Kuroda said

- Boris Johnson, the front- runner to succeed Theresa May as U.K. prime minister, promised to take Britain out of the EU in October with or without a deal as he hardened his rhetoric on Brexit and unveiled a tax-cut plan as the other leading candidates prepared to start their campaigns on Monday

- U.S. Treasury Secretary Steven Mnuchin said he had a "constructive" talk on trade with PBOC Governor Yi Gang. Mnuchin said “if they want to come back to the table and have a real agreement we will negotiate”

- China extended its gold- buying spree as the trade war with the U.S. damps growth expectations and boosts demand for a portfolio diversifier

- Hong Kong’s leader pledged to press ahead with Beijing-backed legislation easing extraditions to China despite one of Hong Kong’s largest protests since the former British colony’s return more than two decades ago

Asian equity markets began the week higher with sentiment underpinned after US and Mexico reached an agreement to avert tariffs which were set to kick in today, while the region also took impetus from the last Friday’s gains on Wall St. where disappointing Non-Farm Payrolls data spurred Fed rate cut hopes. Nikkei 225 (+1.2%) was lifted by favorable currency flows and following an upward revision to Q1 GDP, with automakers also underpinned by the tariff-related relief as well as news Fiat and Renault Chairmen discussed reviving their merger plan. Elsewhere, Australia remains closed for holiday, while Hang Seng (+2.2%) and Shanghai Comp. (+0.9%) were positive but with initial weakness seen in the mainland following a net liquidity drain by the PBoC and mixed Chinese Trade data in which Trade Balance and Exports topped estimates although a contraction in Imports highlighted subdued domestic demand. Finally, 10yr JGBs were initially pressured on safe-haven outflows but then staged an aggressive comeback as the declining yield narrative persisted and with the BoJ also in the market for JPY 775bln of JGBs.

Top Asian News

- Chinese Imports Drop as Growing Tensions With U.S. Cloud Trade

- Kuroda Says BOJ Has Enough Ammunition, Wary of Side Effects

- China Trust Shares Plunge as $1.7 Billion Products Face Default

- Hong Kong Stocks Lead Catch-Up Rally Amid Policy Easing Signals

European equities are marginally higher [Stoxx 600 +0.2%] following on from a positive Asia-Pac handover, with sentiment underpinned by the US-Mexico trade agreement, albeit with the positive momentum fading as Washington’s trade spat with China remains a grey cloud over the market. UK’s FTSE 100 (+0.5%) marginally outperforms its peers as exporters in the index benefit from a weaker domestic currency, whilst German, Swiss, Austrian and Norwegian cash markets are closed due to Whit Monday. Sectors largely reflect a “risk-on” mood as defensive sectors such as Utilities, Healthcare and Consumer Staples lag their peers. In terms of individual movers, BAE Systems (+1.2%) shares are supported in light of a mammoth merger between US listed Raytheon (RTN) and United Technologies (UTX), which some say point to renewed demand in the sector; the merger of equals will result in the new Co. having an annual revenue of around USD 74bln. Elsewhere, Fiat Chrysler (+2.2%) shares spiked higher amid reports of potential renewed talks with Renault (+2.1%), with the former also potentially buoyed by the US-Mexico trade agreement as it is one of 8 automakers with plants in the South American country. Finally, Thomas Cook (+14.5%) shares were bolstered by acquisition chatter as Forsun (18% shareholder) is reportedly planning a potential offer for Co’s tour arm which generates sales of GBP 7.4bln.

Top European News

- Russia U-Turn on Wealth Fund May Cause Dutch Disease, S&P Warns

- Some ECB Officials Fear Markets Losing Faith in Inflation Goal

- Ocado Invests in Indoor Farming in Step Beyond Grocery Tech

- Italy’s Conte Sets Warning to Populists on Talks With Brussels

In FX, the USD has extended its recovery from Friday’s lows, albeit in part due to renewed weakness in rival currencies and despite outperformance in certain EMs on fundamental and technical factors. The DXY just topped out a fraction below 97.000 having declined to sub-96.500 in wake of a weak BLS report that raised already lofty market expectations for Fed easing, with the focus now switching to upcoming CPI data to add more justification for the FOMC to deliver a cut.

- GBP - Not the biggest G10 loser, but Sterling has been one of the weakest majors in early EU trade on the back of monthly GDP for April showing a faster than forecast contraction in the UK economy as ip, manufacturing and construction output all slumped more than anticipated. The ONS assigned much of the blame to planned shutdowns and Brexit uncertainty that led to a record decline in car production, while transport equipment tanked the most since 1974. Cable duly retreated through 1.2700 in response and Eur/Gbp breached 0.8900 to post 5 month+ peaks.

- NZD/AUD - The main victims of a slump in Chinese imports, but somewhat perversely it is the Kiwi that is feeling the brunt of the data that exacerbates US-China trade tensions rather than the Aussie and perhaps due to Australia’s national holiday. Nzd/Usd is hovering just above 0.6600 vs Aud/Usd holding around last Friday’s low and several key technical support levels either side of 0.6950, like 10 and 21 DMA convergence circa 0.6955 and a Fib at 0.6945, while the Aud/Nzd cross is hugging the upper end of a 1.0525-00 range.

- JPY/CHF/EUR - The US-Mexican trade accord has seen the Yen and Franc lose safe-haven appeal and retreat vs the Buck to 108.50+ and 0.9900+ respectively, but Usd/Jpy faces some upside hurdles in the form of 1.1 bn option expiries at the 109.00 strike and then trend-line resistance at 109.15, while Usd/Chf and Eur/Chf (latter pivoting 1.1200) will be conscious that Thursday’s SNB quarterly policy review is looming. Elsewhere, Eur/Usd is testing 1.1300 and bids below the big figure after a brief and minor breach of Fib/30 DMA support at 1.1293 amidst more bleak Italian data that was only partly attributed to calendar distortions due to a national holiday, per ISTAT. Note also, decent expiry interest at 1.1300 in 1.1 bn.

- CAD - The Loonie remains relatively bid after Canada’s healthy jobs release in contrast to the US and with some extra encouragement via contagion from the aforementioned US-Mexican agreement that bodes well for USMCA prospects. Usd/Cad off lows but still well under 1.3300 in a 1.3278-25 band and near multi-month lows ahead of Canadian housing starts and building permits.

- EM - As noted above, several regional currencies outpacing the Dollar and none more so than the Peso in relief that Mexico will avoid US tariffs – Usd/Mxn sub-19.2000 and down through 19.1400 at one stage. Meanwhile, the Rand and Lira are also doing well, albeit in corrective moves after hefty losses of late on a steep deceleration in SA GDP/SARB mandate uncertainty, and ongoing US-Turkey strains, as attention turns to the upcoming CBRT policy meeting. Usd/Zar has reversed from 15.0000+ to around 14.8500 and Usd/Try down towards 5.8000, but conversely, Usd/Cnh remains close to recent 6.9600+ peaks on the drop in Chinese imports.

Commodities are mixed as the energy complex continues to consolidate following its recent sell-off, with the benchmarks somewhat underpinned by the risk appetite around the market after US President Trump called off tariffs on Mexico which were due to be imposed today. WTI and Brent futures currently hover just above USD 54.00/bbl (ahead of its 200 DMA at 52.60) and USD 63.00/bbl respectively. Turning to OPEC, Saudi’s Energy Minister echoed some comments from the back-end of last week in which he stated that Russian is the only country still undecided on an OPEC+ deal extension, and subsequently, Russia’s Finance Minister noted that Brent prices could potentially fall to USD 40/bbl if the deal is not extended. Elsewhere, amid the possible ramifications of the US-Sino trade war on the global economy, Barclays revised its 2019 oil demand forecast lower by 300K BPD to 1.3mln BPD (in-line with IEA’s 2019 forecast of 1.3mln BPD and marginally higher compared to OPEC’s forecast of around 1.21mln). In terms of precious metals, a firmer risk tone and a stronger Greenback have shaved off some gains in gold (-1.0%) and silver (-1.5%), whilst copper (+0.7%) prices benefit from the risk appetite after Washington struck a deal with Mexico. Finally, iron ore futures are marginally firmer as a firmer Buck caps gains in the base metal, despite China’s iron ore imports rebounding from an 18-month-low last month, against the backdrop of tight supply amidst the recent production disruptions including Vale’s shipment cuts and China’s smog alerts.

US Event Calendar

- 10am: JOLTS Job Openings, est. 7,496, prior 7,488

DB's Jim Reid concludes the overnight wrap

I hope you all had a good weekend. I’ve woken up with paint still splattered on me after a Sunday of arts and crafts and also smelling of fairy liquid. My brother bought the kids an industrial sized, battery operated bubble machine and given it’s size it required a big glug of washing up liquid. A very messy afternoon which ended with Maisie in agony and hysterics as fairy liquid ended up being rubbed into her eyes. I was in the doghouse for letting it happen on my watch !!

Markets are blowing small celebratory bubbles this morning as late on Friday the US announced a deal with Mexico to ensure that tariffs don’t get imposed today as planned. However, there was some subsequent confusion as Mr. Trump tweeted that Mexico has agreed to buy “large” amounts of agricultural products from the US as part of the deal. This didn’t seem to be anywhere in the accord released and sources close to the negotiations suggested on Bloomberg that there weren’t any additional side deals planned. So a bit puzzling but there will be relief that the tariffs have been avoided and perhaps some might believe it shows Trump’s propensity to strike deals after brinkmanship. As such there may be those thinking that a similar thing might happen with the China trade situation. That might eventually be true but it’s not clear this is imminent and as such high uncertainty will continue. As a result of the deal, the Mexican peso is up +2.04% this morning, the highest single-day gain since July 2018.

Most other markets in Asia have started the week on a firmer footing taking as a result of the news. The Nikkei (+1.09%), Hang Seng (+2.00%), CSI (+1.43%), Shanghai Comp (+0.98%) and Kospi (+0.86%) are all up. China’s onshore yuan is trading down -0.35% at 6.9338, the weakest level of the year, with all the G-10 currencies also trading softer against the dollar. Elsewhere, futures on the S&P 500 are up +0.23% and the yield on 10y USTs is up +3.5bps while that on 2y USTs is up +4bps bringing the 2s10s spread down to +22.7bps. Gold prices are -0.85% this morning while WTI crude prices are up +0.56%.

This morning in China, we’ve seen trade data for May with the balance standing at $41.65bn (vs. $22.30bn expected) as exports jumped more than expected (at +1.1% yoy vs. -3.9% yoy) while imports saw a sharp slide (at -8.5% yoy vs. -3.5% yoy expected). In terms of trade with the US, exports declined -4.2% yoy (vs. -13.1% yoy last month) while the decline in imports was sharper at -26.8% yoy (vs. -25.8% yoy last month). Meanwhile, China’s May foreign reserves surprised on the upside at $3.101tn (vs. $3.090tn expected and $3.095tn last month). Our China strategists suggest this could either be due to lumpy coupon payments on their holdings or early signs that the Chinese are diversifying away from dollar holdings. You only mark to market when you sell so reserves could go up on this sort of event. We’ll wait for the latest Treasury holdings data to see.In terms of other data releases, Japan’s final Q1 GDP came in one tenth above the preliminary read at +0.6% qoq.

Moving on to this week, China data will take centre stage. After the trade data released earlier we have May CPI and PPI data tomorrow and then the full May activity indicators on Friday. At some stage during the week we should also get the May credit data, which is expected to show an increase in aggregate financing versus the month prior.

As we go into Fed blackout period, in the US the main highlights are May PPI tomorrow, CPI on Wednesday, the May retail sales report on Friday alongside the industrial production print and the preliminary University of Michigan consumer sentiment survey for June. In Europe, we’re due to get final May CPI revisions over the week including data for Spain on Wednesday, Germany on Thursday and France and Italy on Friday. The April industrial production print for the Euro Area is also due on Thursday. In the UK we get the April GDP and industrial production data today and April/May employment data on Tuesday.

As for last week, global equity markets performed well, with the S&P 500 snapping a streak of four consecutive weekly losses to advance +4.41% (+1.06% on Friday), its best week since November. Other indexes performed similarly well, with the NASDAQ and DOW gaining +3.88% and +4.71% (1.66% and +1.02% Friday) respectively. There were two key drivers for the strength: increased confidence that the Fed will ease policy this year and firmer expectations that tariffs on Mexico would be avoided before today’s deadline. This was clearly what happened late on Friday night.

May’s nonfarm payrolls report showed that the US economy added only 75,000 jobs last month, minus another -75,000 in net revisions to the prior months. Average hourly earnings were also a touch softer than expected at +0.2% mom and 3.1% yoy. Futures markets moved to completely price in a Fed rate cut at the July meeting, plus an additional 62 basis points of cuts over the subsequent year. Bond yields fell sharply, with 10-year yields down -4.4bps on the week (-3.6bps Friday), but yet again the bigger moves were in the front-end, where 2-year yields fell -7.5bps (-3.1bps Friday).

European equities lagged the US, as the ECB’s meeting proved disappointing last Thursday. President Draghi barely changed the economic outlook or the balance of risks and was reluctant to signal further easing. The market reaction was negative, with equities falling, especially bank shares, the euro strengthening, and bond yields falling. Ultimately, the STOXXX 600 ended +2.28% (+0.93% Friday), though an index of bank stocks ended -0.29% on the week (-0.10% Friday). Bond yields fell across the continent, with bunds down -5.5ps (-1.8bps Friday) to -0.257% and a fresh all-time low. OATs also reached a record low of 0.085% after falling -12.5bps (-3.0 Friday), while BTPs outperformed, falling -31.2ps (-13.0bps Friday) even as the EU stepped up their fight over Italy’s debt. The mix of central bank easing expectations and soft data provided the impetus for the rally, but Italy was also boosted by positive rhetoric from the leaders of its two governing parties, Di Maio of the Five Star Movement and Salvini of the Northern League. They issued a joint statement on Thursday night that said “the government must move forward” on implementing “a constructive dialog with Europe,” helping to alleviate some of the concerns around a potential confrontation with Brussels.

Disclosure: Copyright ©2009-2019 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

moreComments

No Thumbs up yet!

No Thumbs up yet!