Global Markets Roar Higher After Powell Spikes The Koolaid

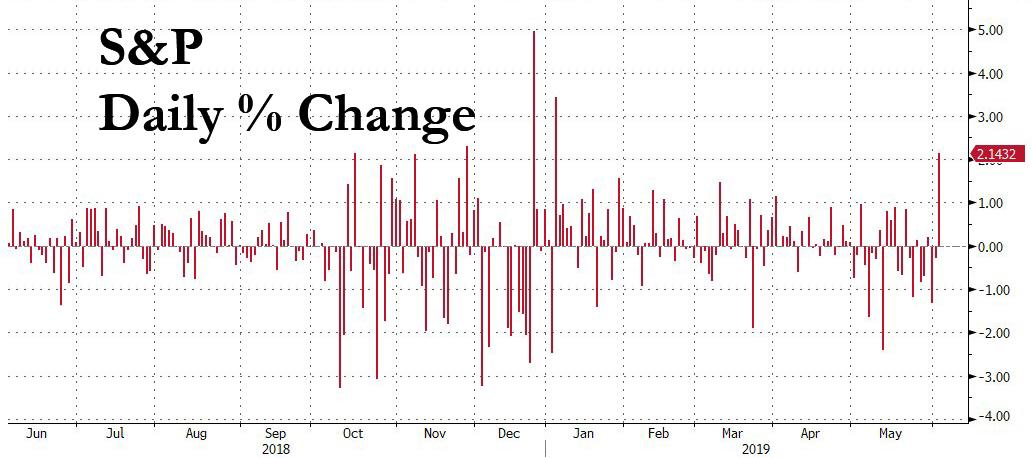

After the second best day for the S&P in 2019, which saw the US stock market surge by 2.14%...

... global stocks gained for a third straight day on Wednesday, paradoxically bolstered by growing hopes that the global economy is deteriorating fast enough so that the Fed will cut interest rates this year - perhaps as soon as this month - to avert a recession, while the dollar languished near seven-week lows.

"The market is sending out invitations for a rate cut party, and waiting for the Fed to turn-up," said Greg Gibbs, director and founder of Amplifying Global FX. Powell “gave just enough hint that he might turn up, but he is still reluctant to acknowledge that risks to growth have increased.”

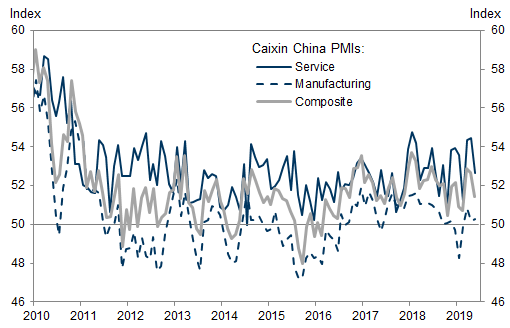

And while Powell made 'terrible news great again', as observed late last night when the China Caixin Services PMI dropped again by 1.8 to 52.7 in May, below consensus expectations (the sub-indexes suggest slow down in the growth of services exports orders, new business and employment, though inflationary pressures were reduced slightly in the services sector)...

... in turn, sending futures even higher, the overnight rally has cooled somewhat amid lingering trade-war concerns.

Global equities and US index futures advanced and the yen fell after Fed Chairman Jerome Powell said the central bank is monitoring the trade war’s impact and would act appropriately to sustain the U.S. expansion, opening the door to possible interest-rate cuts. Powell's comments come a day after St. Louis Federal Reserve President James Bullard said in a speech that a rate cut may be needed "soon."

Stock markets responded positively to Powell’s comments, with U.S. stocks registering their biggest one-day gains in five months. The optimism rolled over into markets on Wednesday, with the MSCI All-Country World Index up 0.4% after the start of European trading, adding further to a 1.4% gain on Tuesday.

"Whilst the markets are giddy on central bank support, the effects could be short-lived," said London Capital Group's Jasper Lawler. “Let’s not forget the other half of the equation is the escalating trade war on multiple fronts. Today the markets are happy to focus on Fed support, but with the U.S. Commerce Department promising retaliation in the event of China’s rare earth’s threat, this trade war looks set to get worse before it gets better.”

Technology shares led the advance in Europe's Stoxx 600 index as software companies including SAP and Micro Focus jumped after a positive sales forecast by U.S. peer Salesforce.com. Sectors are somewhat mixed, with the Tech sector the notable outperformer, despite yesterday’s FAANG driven underperformance in tech names; where the sector lagged heavily for much of the session. Separately, TSMC Chairman Liu stated that the US’s move to ban US companies from doing business with Huawei is to have a short-term impact on TSMC, though the Co’s outlook remains unchanged, which may have provided some impetus to the European IT names.

Asian stocks gained, led by industrials and IT sectors. Japan and Hong Kong led the rally, while markets in Singapore, India, Philippines, Malaysia and Indonesia were shut today for public holidays. Japan’s Topix Index closed 2.1% higher. Hong Kong’s Hang Seng Index snapped its five-day losing streak, with Techtronic Industries Co. and WH Group Ltd. contributing most of the gains. Australia’s S&P/ASX 200 Index rose 0.4% after its central bank chief strongly suggested he could follow up Tuesday’s interest-rate cut with another reduction.

Overnight, the IMF cut its 2019 economic growth forecast for China to 6.2% on heightened uncertainty around trade frictions, saying that more monetary policy easing would be warranted if the Sino-U.S. trade war escalates.

Ten-year Treasuries were little changed and EU government bonds were mixed, while the euro strengthened to a seven-week high. Italy’s yields rose after the EU started a disciplinary process against the country over its debt. Germany’s 10-year bond yield reached a record low and Italian debt held on to this week’s gains as investors ramped up their bets on a generous loan package for banks in the euro zone as well as a U.S. rate cut. Germany’s 10-year bond yield reached a record low, following a spike in Japanese bonds which surged on speculation of more easing from the BOJ.

In FX, the dollar steadied after a four-day decline on short-term positioning as Treasuries edged up alongside most euro-area bonds. Global equities advanced and the yen fell after Fed Chairman Jerome Powell opened the door to possible interest-rate cuts. The kiwi led gains in Group-of-10 currencies after RBNZ’s Christian Hawkesby surprised traders with relatively hawkish comments. The euro climbed for a fourth day. The loonie and the Norwegian krone extended recent gains as oil prices consolidated, while sterling advanced on stronger-than-expected U.K. services data, and as Theresa May prepared to step down on Friday.

“Given the extent of the dovish re-pricing of the Fed outlook and the collapse in U.S. Treasury yields in recent weeks, the dollar losses appear fairly muted in this context,” said Chris Turner, head of FX strategy at ING in London.

In the escalating feud between the US and Mexico, Trump stated that US Senate Minority leader Schumer gave Mexico bad advice in his suggestion that the tariffs on Mexico is a bluff, while Trump added it is 'no bluff!'. Elsewhere, US Senate Majority leader McConnell said there is "not much support" from Republicans for tariffs on Mexico and hopes they can be avoided via talks with the Mexican delegation, while a US administration official said US-Mexico talks will be held at the White House later today.

In the latest Brexit news, former UK Foreign Secretary Boris Johnson warned Conservative MPs that a Brexit delay means defeat and that the Conservative Party faces “extinction” if Britain is not out of the EU by October 31st. Meanwhile, Trump backtracked regarding the NHS being part of a future US-UK trade deal and stated that he doesn’t see it being on the table as the health service was something that would not be considered part of a trade, which was in contrast to a prior suggestion of including the NHS in trade discussions.

In commodity markets, oil prices resumed their slide, dragged down by a surprise gain in U.S. inventories and comments from the head of Russian state oil producer Rosneft questioning the point of a deal with OPEC to withhold supplies. In European trade, U.S. crude retreated 0.85% to $53.03 a barrel and Brent crude futures dropped 0.6% to $61.58 per barrel.[

Expected data include mortgage applications and employment change. Brown-Forman and Campbell Soup are among companies reporting earnings

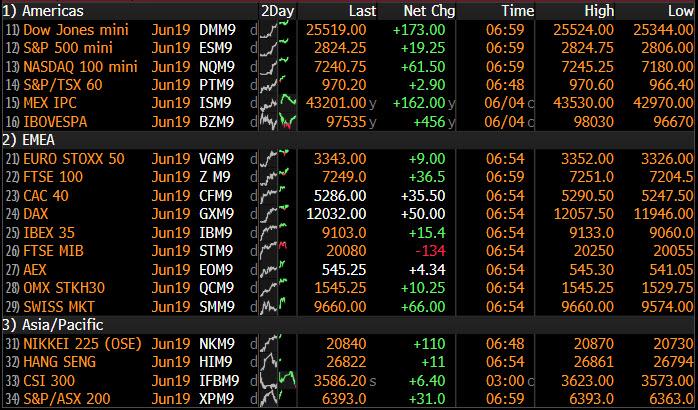

Market Snapshot

- S&P 500 futures up 0.4% to 2,816.00

- STOXX Europe 600 up 0.5% to 374.39

- MXAP up 1% to 153.95

- MXAPJ up 0.4% to 502.83

- Nikkei up 1.8% to 20,776.10

- Topix up 2.1% to 1,530.08

- Hang Seng Index up 0.5% to 26,895.44

- Shanghai Composite down 0.03% to 2,861.42

- Sensex down 0.5% to 40,083.54

- Australia S&P/ASX 200 up 0.4% to 6,358.52

- Kospi up 0.1% to 2,069.11

- German 10Y yield unchanged at -0.206%

- Euro up 0.2% to $1.1273

- Italian 10Y yield fell 4.4 bps to 2.145%

- Spanish 10Y yield fell 2.6 bps to 0.639%

- Brent futures down 0.2% to $61.83/bbl

- Gold spot up 0.8% to $1,336.43

- U.S. Dollar Index down 0.2% to 96.93

Top Overnight News from Bloomberg

- In separate comments Tuesday, Fed Chair Jerome Powell and his No. 2, Richard Clarida, reassured nervous investors they’re watching closely for signs that disputes between the U.S. and its trading partners are denting the outlook for the world’s largest economy

- Treasury Secretary Steven Mnuchin will meet with the People’s Bank of China chief during the Group of 20 gatherings of finance ministers and central bankers in Japan over the weekend, the Treasury Department said on Tuesday

- Democratic presidential candidate Elizabeth Warren called for “actively managing” the dollar to bolster U.S. jobs and growth, a move that would break from a longstanding currency policy agreement among the world’s 20 major economies

- Boris Johnson, the front-runner to replace Theresa May as U.K. prime minister, warned Conservative Party colleagues that they face “extinction” if they don’t deliver Brexit by the current deadline of Oct. 31

- The U.K. economy was ‘close to stagnation’ according to IHS Markit. Stronger-than-expected growth in Britain’s dominant services sector isn’t enough to make up for a poor performance in the rest of the economy, with data showing contractions in construction and manufacturing

- Strength among service providers helped economic activity in the euro area expand at a modest pace in May, though signs of a broader rebound continue to be elusive. A composite Purchasing Managers’ Index came in at 51.8, above the 51.6 initial estimate and higher than April’s reading

- It’s Japanese government bonds’ turn to take the lead in the global fixed-income melt-up as bets climb for the Bank of Japan to add to its stimulus. Japan’s two- year yield is on course for its biggest daily drop since January and swaps indicate that traders have priced in a full 10-basis point reduction in rates by next April

- Central banks are resuming their first-responder role as the world economy runs into trouble. Traders are betting the Fed will lower rates before year-end, Australia’s central bank cut rates Tuesday and India’s may follow this week while the ECB is bound to stay dovish

- Australia’s economy expanded slightly slower than forecast in the first three months of the year, as a housing downturn continued to weigh on growth

- Oil resumed declines as an industry report signaling a surprise jump in U.S. crude inventories stirred fears of a supply glut at a time when trade wars are jeopardizing the global demand outlook

Asian equity markets were higher as the region took impetus from the strength in the US where sentiment was buoyed after comments from Fed Chair Powell spurred hopes of a rate cut. This saw Wall St notch its biggest gain since early-January with the Nasdaq the frontrunner as tech outperformed, while all sectors in the S&P 500 closed in the green and the DJIA rallied by over 500 points. ASX 200 (+0.4%) gained in which tech led the upside and with risk appetite supported by the recent rate cut by the RBA, as well its openness to further reductions. Nikkei 225 (+1.8%) surged as Japanese exporters cheered a weaker currency and with SoftBank shares boosted as it expects to book a profit of around JPY 1.2tln on the partial sale of its Alibaba stake. Hang Seng (+0.5%) and Shanghai Comp. (U/C) conformed to the positive global risk tone but with gains capped by disappointing Chinese Caixin PMI data and a substantial liquidity drain of CNY 210bln by the PBoC, while trade concerns lingered after China issued a warning against traveling to the US and held a meeting on rare earths where experts recommended greater controls on exports of the metals. Finally, 10yr JGBs were higher with prices underpinned on the back of Fed Chair Powell’s dovishness and as Japanese 10yr yields slipped to their lowest in around 3 years.

Top Asian News

- Chinese Auto Group Calls for Stimulus to Help Spur Car Sales

- Diokno Says Rate Cut Inevitable as Faster May CPI Isn’t a Trend

- China Nominates Occupy-Era Hong Kong Police Chief for UN Post

- IMF Cuts China Growth Forecast, Citing Downside Trade War Risks

Major European indices [Euro Stoxx 50 +0.2%] are firmer, although somewhat more subdued than their Asia-Pac counterparts, which were boosted by Wall Street printing its largest daily gain since early-January. Sectors are somewhat mixed, with the Tech sector the notable outperformer, despite yesterday’s FAANG driven underperformance in tech names; where the sector lagged heavily for much of the session. Separately, but potentially of note for Tech names; TSMC Chairman Liu stated that the US’s move to ban US companies from doing business with Huawei is to have a short-term impact on TSMC, though the Co’s outlook remains unchanged, which may have provided some impetus to the European IT names. This morning’s most notable move is Provident Financial (+16.4%) on the back of Non-Standard Finance (-2.7%) stating that they are not going ahead with the hostile takeover. Also, in the green and towards the top of the Stoxx 600 are Norsk Hydro (+3.6%) after posting stronger than expected earnings; however, the Co. state that they expect to see payments relating to the cyber-attack in their Q3 earnings. Meanwhile, Saipem (+4.8%) shares spiked higher after announcing a new EPC contract for Anadarko Mozambique project, in which the Co. will have a share of around USD 6bln. Finally, Hikma Pharmaceuticals (-0.8%) are in negative territory as they are set to be removed from the FTSE 100.

Top European News

- Italy Commits to EU3.5b Annual Savings in Response to EU: Stampa

- Deutsche Bank’s DWS to Focus on Costs as Deals Prove Difficult

- Euro-Area Economy Extends Modest Growth With Help From Services

- Romanian Central Bank Mulls New Tools Amid Fastest EU Inflation

In FX, some divergence down under as RBNZ Deputy Governor Hawkesby intimates that rates may remain on hold for a while if not considerably longer in contrast to RBA Governor Lowe who inferred that more easing could be in the offing in addition to Tuesday’s 25 bp OCR cut. Hence, the Aud/Nzd cross has recoiled further from circa 1.0600 and through 1.0550, while the Kiwi is leading G10 gains vs a soggy Greenback after Fed chair Powell promised to support the US economy against a more pronounced slowdown yesterday. Nzd/Usd has tested resistance and offers around 0.6950, as Aud/Usd continues its rebound from pre-RBA lows to just over 0.7000 and into a heavy option expiry zone spanning 0.7005 to 0.7025 (1.7 bn). Note also, the Aussie needs to clear Fib resistance at 0.6995 convincingly and faces congested technical resistance between 0.7033-35 in the form of the 55 DMA and another Fib.

- USD - The aforementioned Dollar weakness has pushed the DXY back down below 97.000 and sub-the 100 DMA at 96.980 to a fresh 96.915 low amidst widespread losses vs major currency counterparts and EMs, bar the Yen and Rand. Technically, 96.745 is the next support level and fundamentally the focus switches to ADP ahead of Friday’s NFP, services surveys (Markit PMI and ISM) and more Fed speak.

- EUR/GBP/CAD/CHF - As noted above, all beneficiaries of the Buck’s demise, but with the single currency and Pound also gleaning some traction via better than expected services PMIs, on balance. Indeed, Eur/Usd has now surpassed the 100 DMA (1.1276) having narrowly missed the equivalent level on Tuesday and is eyeing 1.1300, while Cable seems more assured on the 1.2700 handle, albeit still lagging in Eur/Gbp cross terms within a 0.8855-80 range. Elsewhere, the Loonie has overcome 1.3400 and is filling hefty buying interest layered from 1.3370 to 1.3360, with the 100 DMA sitting just under 1.3350 at 1.3348, and the Franc has rebounded towards 0.9900 but underperforming vs the Euro in broad 1.1300-1.1250 parameters.

- JPY - In contrast to its major peers, the Yen has been undermined by the ongoing recovery in broad risk sentiment and is retesting recent 108.30+ lows vs the Dollar with decent expiries also within close proximity at 108.20-30 (1 bn) and 108.50-55 (1.1 bn).

- EM - While most of the region takes advantage of the Dollar’s downturn, more downbeat SA macro developments have hit the Rand and propped up Usd/Zar within 14.8240-6260 boundaries. The bad news kicked off with a sub-50 services PMI and continued via weaker business sentiment, while the ANC party’s ally has joined forces to back a wider SARB policy mandate prompting a dismissive response from the Bank itself.

In commodities, WTI (-0.7%) and Brent (-0.6%) prices are back on the decline as a surprise build in last night’s API exacerbated the recent downside seen amidst demand concerns. Stockpiles last week increased by 3.5mln barrels vs. an expected decline of 800k barrels. On the OPEC front, Russian Energy Minister Novak will be meeting his Saudi counterpart, Al-Falih, on June 10th to potentially discuss a date for the OPEC/OPEC+ meeting with no confirmation as of yet to whether it will take place at the end of June or early July. News-flow has been light for the complex thus far, with traders now eyeing the release of the weekly DoE crude stocks data in which the headline is expected to draw by 849k barrels. Elsewhere, Gold (+0.9%) is holding onto a bulk of its recent gains amid the weaker post-Powell USD whilst copper is set to notch a third straight day of gains on the back of a receding Buck, whilst alumina prices declined due to a demand halt as traders paused on spot purchases amid high prices.

US Event Calendar

- 8:15am: ADP Employment Change, est. 185,000, prior 275,000

- 9:45am: Markit US Services PMI, est. 50.9, prior 50.9; Composite PMI, prior 50.9

- 10am: ISM Non-Manufacturing Index, est. 55.4, prior 55.5

- 2pm: U.S. Federal Reserve Releases Beige Book

DB's Jim Reid concludes the overnight wrap

I am still trying to get over the powerful conclusion to “Chernobyl” that aired in the UK last night. I’ve no idea if your country has the rights to it but if not move to somewhere that does. TV drama doesn’t get much better. It’s ironic that this great show ended the day after the new series of “Love Island” started. If your country hasn’t had an international version count yourself lucky! Back to Chernobyl and the only thing left to do is spend some time reading up on how much of it was true and how much of it was a dramatized version. I did this for the excellent “The Crown” and walked away feeling slightly cheated when I realized not all of it happened so it’s always a danger with stories based on real life.

How much truth there was in the big rally for markets yesterday and how much was dramatized is open for question. Indeed, the last 24 hours has seen a marked change in sentiment and although it’s hard to completely attribute the move to Powell’s comments at the Fed conference yesterday, the fact that the Chair seemingly didn’t push back on very dovish market pricing did at least fill investors with a bit more confidence. Indeed the +2.14% return for the S&P 500 was, in fact, the biggest since January while the recently battered NASDAQ rose +2.65% and FANGS +3.92% which at least helped to plaster over some of the recent damage to the sector.

In truth Powell didn’t provide a huge amount for the market to feed off however he did say in relation to “trade negotiations and other matters” that “we are closely monitoring the implications of these developments for the US economic outlook and, as always, we will act as appropriate to sustain the expansion, with a strong labor market and inflation near our symmetric 2% objective”. The reference to being prepared to “act as appropriate” was probably the most significant insofar as not pushing back on market pricing. The rest of Powell’s speech focused on longer-term issues which our US economists summarised as being balanced in the assessment of ‘make-up’ inflation policies. He did not talk about new policy tools, e.g. negative rates, and he downplayed the significance of the dot plots.

Treasury yields were already higher prior to Powell speaking and finished the day slightly higher still, despite a brief knee-jerk drop lower as his comments hit the wires. Ten-year yields ended at 2.131% and +5.9bps on the day. At the short-end, 2y yields sold off +5.2bps and the most since April 1, making the 2s10s curve marginally steeper. It’s a bit puzzling that front-end rates rose despite the dovish tilt to Powell’s comments, but after parsing the price action, it turns out that the market is now pricing even higher odds of a cut by September, now at 93%. Powell’s willingness not to push back against this pricing and his dovish comments have likely raised expectations that the Fed will act promptly, which perversely lowers the odds that they need to cut rates even more steeply later in 2020. So two-year yields rising, in this case, may actually be completely consistent with the market’s perception of Powell being dovish. Well, that’s the only way we can explain the price action and the narrative together.

The USD (-0.07%) was little changed despite the Fed noise and some new political headlines, which goes to show how much is already priced in. Democratic Presidential Candidate Elizabeth Warren released a plan aimed at “more actively managing our currency value” in an effort to boost American manufacturing. This drew some attention but did not move markets given the early stage of the primary campaign. Still, it seems like the political consensus for a weaker dollar is growing in a bipartisan way.

In Europe Bund yields stubbornly failed to take part in the bond sell-off with 10y yields actually edging -0.7bps lower in yield to a fresh closing low (-0.210%) covering all of human existence and probably through the lives of the dinosaurs and beyond too. Indeed the divergence in moves between treasuries and bunds was its sharpest of the year, for both 10- and 30-year paper. Elsewhere in Europe, BTPs rallied -4.4bps as risk-on dominated, with sentiment also boosted by constructive comments from Deputy PM Di Maio, who downplayed the recent stories about disagreements within the coalition by saying he is open to the Northern League’s proposed flat tax and devolution measures. Staying with Italy, the risk of the Commission recommending an Excessive Deficit Procedure as soon as today has increased significantly of late but our economists continue to believe it is more likely in Q4 after the 2020 draft budget, as they highlight in their report here. In any case, it’s one to watch.

Back to the risk-on. It wasn’t just Powell’s comments yesterday which seemed to help. Mexico’s Foreign Minister said that there’s an 80% chance that Mexico and the USA will find common ground – which helped the Mexican Peso to strengthen +1.08% - while the Senate leadership from both parties pushed back against the tariffs. Majority Leader McConnell said that there is “not much support” for the new duties among Republican lawmakers, and Democratic Leader Schumer added that Trump “likely won’t follow through.” Auto stocks led gains in both Europe and the US, rallying +3.09% and +4.65%, respectively. Overnight, however, President Trump doubled down, saying his plan was “no bluff,” which caused the peso to give back about 0.35% of its gains. In addition, China’s Commerce Ministry put out a statement saying that China hopes the US will meet China halfway. As always with these headlines, it’s hard to know how much weight was behind them but it at least acted as a temporary circuit breaker, especially given that China had also issued a warning to citizens traveling to the US which wasn’t a good sign.

Staying with trade, overnight the US Treasury Department confirmed that Treasury Secretary Mnuchin will meet Chinese central bank Governor Yi Gang during a gathering of G-20 finance ministers from this Friday to Sunday in Japan, which should add as the next focal point for markets. This comes as reports also hit that China has fined Ford’s main China venture for antitrust violations. Elsewhere, Chinese President Xi Jinping gave a reasonably good assessment of the country’s economy in an interview with Russian media including Tass saying, while the global economy and trade have slowed down, China’s economy has stayed in a reasonable range in 2019, with stable growth, increasing employment, rising incomes, and stable prices. He also said China has “sufficient conditions, ability and confidence” to cope with various risks.

Markets in Asia are following Wall Street’s lead this morning with the Nikkei (+1.76%), Hang Seng (+0.72%), Shanghai Comp (+0.63%) and Kospi (+0.31%) all up. The more modest gains in China, however, may partly reflect the Caixin services PMI which printed at 52.7 (vs. 54.0 expected) and the lowest since February 2019. As you’ll see in the day ahead the remaining global services PMIs are due out today.

Moving on. Prior to Powell, the Chicago Fed’s Evans had sounded fairly balanced, saying that the economy is “doing well” and “the consumer is solid” but also that he was “nervous” about “inflation underrunning 2%”. On the current very dovish market pricing, Evans also responded by saying that “it suggests the market sees something that I haven’t yet seen in the national data”. So no endorsing of cutting rates yet but suggesting that he will need to see the impact in the data to lean towards justifying easing. After Powell, Vice Chair Clarida largely repeated the same message, saying the economy is in a good place but that tariff uncertainty will need to be taken into account. He said that if the Fed senses growth slowing, they will respond appropriately and cited the 1995 and 1998 “insurance cut” episodes as a possible roadmap. He also responded to a question about the yield curve by saying “if the yield curve inverts as it has and if it persists for some time, that’s obviously something I would definitely take seriously.”

It’s worth making the point that there is still a fairly steady stream of Fed speakers this week – including Clarida again today - however, that will be the final chance for the market to digest officials’ latest views before the Fed hits their blackout period from next week before the Fed meeting outcome on the 19th.

Meanwhile, in Europe, there was more disappointment in the latest inflation data which showed that May core CPI was 0.8% yoy, and one-tenth below consensus. Our economists forecast core CPI to hover around 0.8-0.9% for the next few months before rising back towards 1.0% at the end of the summer. Finally, in the UK the May construction PMI followed the manufacturing reading in slumping last month, to 48.6 (vs. 50.6 expected) and nearly 2pts lower than April. That puts both readings in contractionary territory and puts the focus on today’s services reading.

Finally, in other news, the World Bank cut its global growth forecast to 2.6% this year (vs. 2.9% previously) and 2.7% next year. The World Bank President David Malpass said in a call with reporters that “there’s been a tumble in business confidence, a deepening slowdown in global trade and sluggish investment in emerging and developing economies,” while adding, “momentum remains fragile.”

Looking at the day ahead, this morning the focus will be on those remaining services and composite PMIs in Europe with a first look also at the data for the non-core and UK. Not long after we get the April PPI and retail sales reports for the Euro Area. This afternoon in the US we’ve got the May ADP employment change reading, PMIs and May non-manufacturing ISM. The Fed’s Beige Book is also due out tonight while the scheduled Fed speakers include Clarida, Bowman and Bosic. The BoE’s Ramsden is also due to speak this morning. Away from that China’s Xi Jinping departs for a two-day visit to Russia while President Trump is due to meet Irish PM Varadkar.

Disclosure: Copyright ©2009-2018 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more