Glad About Gold

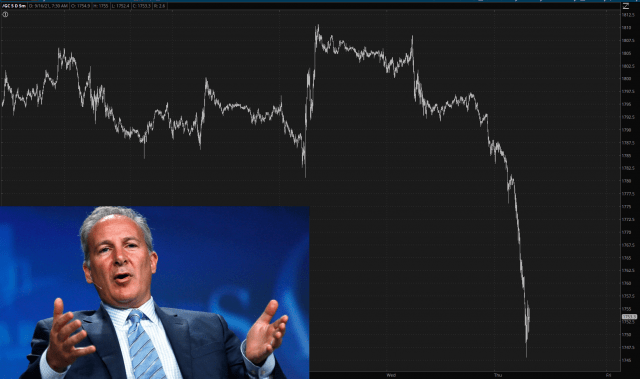

After years of resisting, what finally pushed me over the edge and into crypto was my disgust at gold’s behavior. Precious metals should be thriving right now. Precious should be where the smart money goes. But, nope, it has sucked out loud for months, and this morning is no exception. I‘m glad to have nothing to do with it anymore. Although you can reliably count on Schiff having a put-everything-in-gold post every other day on ZH.

As a chartist, I was convinced of gold’s lameness recently because of the failed trendline. This line is resistance now.

(Click on image to enlarge)

It’s even worse with silver. Even when I was still trying to make a go of it with gold, I thought silver stunk. It has a mountain of overhead supply. It’s comic that the WSB crowd actually thought they could “squeeze” the silver market to the heavens earlier this year. This metal is even worse garbage than gold itself.

(Click on image to enlarge)

Not to say that all hope it lost. The long-term (and I mean long-term) picture for gold isn’t ruined yet. Years from now, it could absolutely be $5,000 per ounce. For now, however, I prefer to trade profitably, which is why I’ve thrown caution to the wind and am purely into digital assets that do not exist in any physical sense.

(Click on image to enlarge)

Certainly this article is entertaining, although that was probably not the intent. The fact is that gold remains a good hedge against inflation, and inflation is certainly upon us, no matter how much the lies are repeated.