Geopolitical Tensions Extend Broader Market Losses

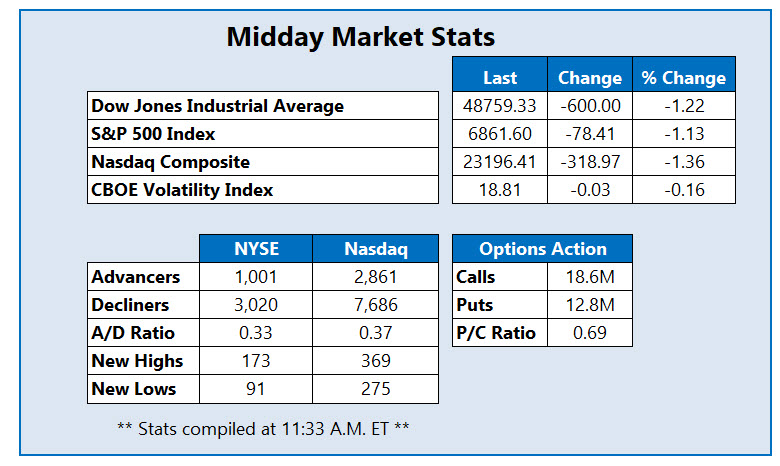

Amid an onslaught of geopolitical tensions triggered by President Donald Trump's demands to overtake Greenland, the Dow Jones Industrial Average (DJI) is extending its early morning losses with a 600 point deficit at midday. Trump threatened to impose tariffs on any European country not supportive of his efforts, including a 10% levy that could start as early as Feb. 1. Major backlash has come from European leaders in response, leaving investors to process a rising 10-year Treasury yield and a rotation out of tech, as traders flock to safe havens.

RAPT Therapeutics Inc (Nasdaq: RAPT) is surging, up 63.9% at $57.52 this afternoon, after news broke that peer GSK (GSK) will buy the drug-maker for $2.2 billion. RAPT is trading at annual highs and seeing an influx of activity in the options pits, albeit amid absolute light volume. So far, 2,167 calls and 1,680 puts have crossed the tape, 37 times the average intraday rate. Most popular are the February 60 call and February 55 put, with new positions being sold-to-open at the former. Over the past nine, months, RAPT has added 775%.

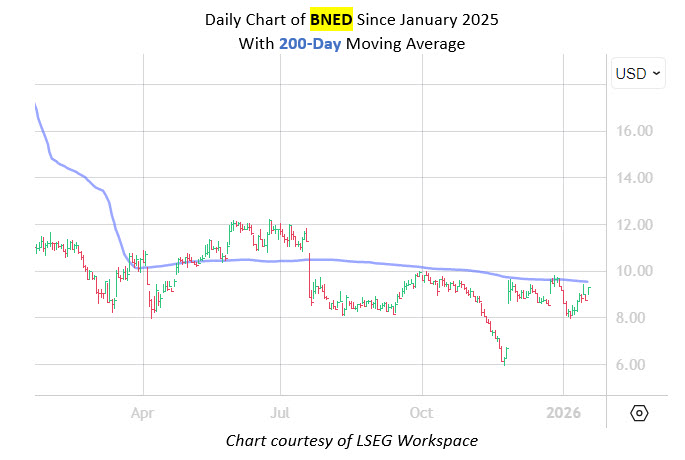

Bookseller Barnes & Noble Education Inc (NYSE: BNED) is near the top of the New York Stock Exchange (NYSE), up 5% at $9.20 at last glance, after the company shared results for the first half of its fiscal 2026. Numbers showed a notable rebound from previous losses, with a reiterated outlook that shifted from $65 million to $75 million. Although BNED has managed to eke out a 6% gain over the past six months, the 200-day moving average sits firmly overhead.

One of the worst NYSE performers this afternoon is JinkoSolar Holding Co (NYSE: JKS), the renewable energy giant shed 10.6%, now trading at $26.36, at last check. The shares are gapping lower with the broader energy sector after the U.S. patent office upheld First Solar's (FSLR) patent validity against its third-party peers. JKS is paring back its 59% nine-month gain, now headed for its worst daily performance since October.

More By This Author:

Stocks Finish Quietly Lower Amid Fed Independence QuestionsStocks Cling To Breakeven As Fed Chair Pick Remains Uncertain

Stocks Finish Higher As Chip, Bank Stocks Drive Optimism