General Electric Q2 Meets Forecasts, But Its Levered Free Cash Flow Is Terrible

General Electric (GE) reported earnings per share in-line and revenues in-line for its second quarter and sees its fiscal 2014 framework on track, targeting the IPO of its North American Retail Finance business (Synchrony Financial) for the end of July ). The company reported second quarter earnings of $0.39 per share, excluding non-recurring items, the results were in-line with the Capital IQ Consensus Estimate of $0.39. Revenues for the quarter rose 3.3% year over year to $36.23 billion versus the $36.38 billion consensus. Industrial sales of $26.2 billion increased 7% compared to the second quarter of 2013. GECC revenues of $10.2 billion decreased 6% from last year.

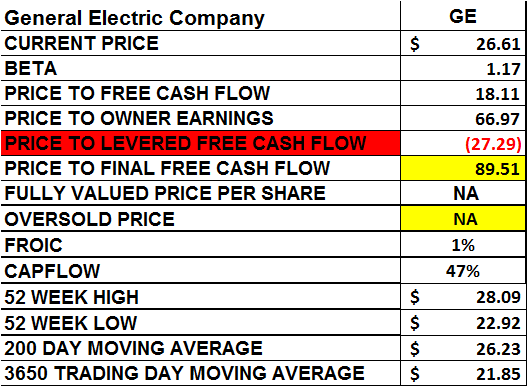

General Electric is trying to reorganize itself by splitting off its various parts to shareholders. The reason it is doing so is because its levered free cash flow numbers are terrible as you can see by my company's free cash flow analysis below.

Because its levered free cash flow is negative, I am thus not able to generate a fully valued price or oversold price for the company. Because GE is only generating a 1% FROIC (Multiple Free Cash Flow Return on Invested Capital) that is the reason you see management making these drastic changes. The company's management is preparing itself for the next market correction, as the stock got slaughtered in 2008-2009, and management obviously never wants to see its shareholders ever repeat that nightmare ever again.

I will close by presenting you with some long term data on GE that you can access by clicking below:

None.